Many types of investors want to own gold. Central banks are adding to their gold reserves. Gold is often considered an inflation hedge or a way to avoid currency devaluation. Gold is often considered the ultimate flight to safety in times of turmoil. And gold is often not correlated to equity and bond market returns.

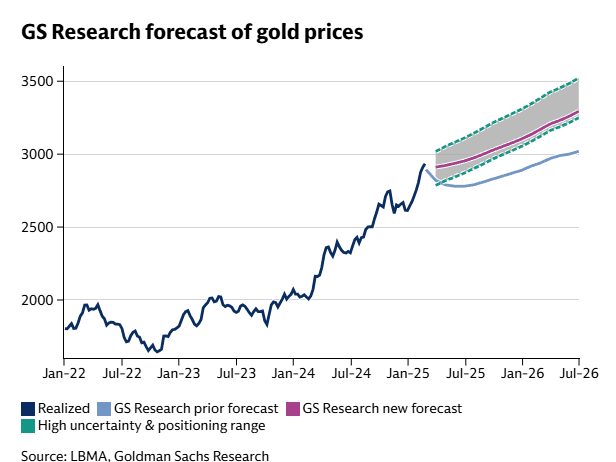

The price of gold has risen by over 40% since the start of 2024. While the price of gold kept hitting new highs and briefly hit $2,950 during February (2025), Goldman Sachs’ Lina Thomas has a forecast that the price of gold will rise as high as $3,100 per ounce by the end of 2025 — up from a prior $2,890 forecast. There is even a case made for as much as $3,300!

Tactical Bulls always reminds investors never to use a single analyst report as the sole basis to buy or sell any stocks or investments. That would hold true here as well. One issue to consider in favor of Goldman Sachs is that they only cater to institutions and high net worth investors — when they speak they are advising the world’s wealthiest investors what to do.

One reason that Tactical Bulls is focused on gold is because tactical investors frequently rotate into (and out of) gold as economic and geopolitical uncertainties rise and fall. Gold may be one of the core focal points for many tactical investors, but for many other reasons as well.

ALSO READ: BEWARE PRICE TARGET CUTS IN POULAR STOCKS

The higher forecast from Goldman Sachs (from a prior $2,890/ounce forecast) first points out “higher-than-expected demand for gold from central banks.” According to the report:

Central banks have been increasing their reserves of the commodity since the freezing of Russian central bank assets in 2022, following Russia’s invasion of Ukraine. Before then, the average monthly institutional demand on the London over-the-counter gold market stood at 17 tonnes. In December last year, that figure hit 108 tonnes.

It may take more than just central bank demand to drive gold to this higher forecast. On top of strong demand from central banks, Goldman Sachs expects gold prices to rise because of stronger purchases of gold ETFs as declining interest rates make gold a more attractive investment.

There are some cross currents that should be considered in this bullish call. Goldman Sachs sees the strengths being partially offset by speculators cutting their net long positions on gold in the futures markets. This may even drag gold prices down due to profit taking. The report noted:

Speculators’ net long positions are high because of demand for gold as a safe haven asset — a phenomenon that could be short-lived if markets become more confident about the economic and political environment.

As for the case for $3,300 per ounce, that is based on policy uncertainty. This includes tariff fears, geopolitical risk and even fears about high government borrowing. Goldman Sachs is also still anticipating two interest rate cuts from the Federal Reserve in 2025, and lower interest rates are generally positive for gold.

The gold chart below noted that the shaded area shows gold price outcomes based on uncertainty levels. The report noted that higher uncertainty keeps speculative positioning elevated to the top of the range, while normalization lowers it to the bottom of the range.

Goldman Sachs sees gold rising further in 2025. This is how high its forecasts are predicting.

Categories: Investing