It is no secret that the stock market has lost some of its luster in 2025. Economic reports are coming in slower than had been expected. Corporate earnings and guidance are also not offering support. Tariffs are also not offering much support. Investors have now seen all of the “Trump Bump” gains erased since November.

There may actually be some help on the way — Federal Reserve rate cuts may be back on the table. There is even a growing possibility that Fed Funds could be back down to 3% (or under) by the of 2026.

Tactical Bulls has noted that the United States has had an unfair global disadvantage as the U.S. Treasury has to pay significantly higher interest rates than most other major economic powers. The concern has been endless deficit spending, and “tariffs turning into trade wars” only add to the uncertainty.

As economies slow, their central banks generally use interest rates as the first line of defense in monetary policy. It was not that long ago that the market was bracing for perhaps only one more meager rate cut from Jerome Powell and the FOMC.

Fed Chairman Jerome Powell and most voting members of the FOMC have been less than positive about being aggressive with interest rate cuts. After all, the Fed’s 2.0% to 2.5% inflation target has been elusive and tariffs are not expected to help prices at all.

Investors have to keep in mind that central bankers do not like to pivot around each and every economic report and corporate earnings report. That doesn’t mean that the markets have to keep that same stance as central bankers.

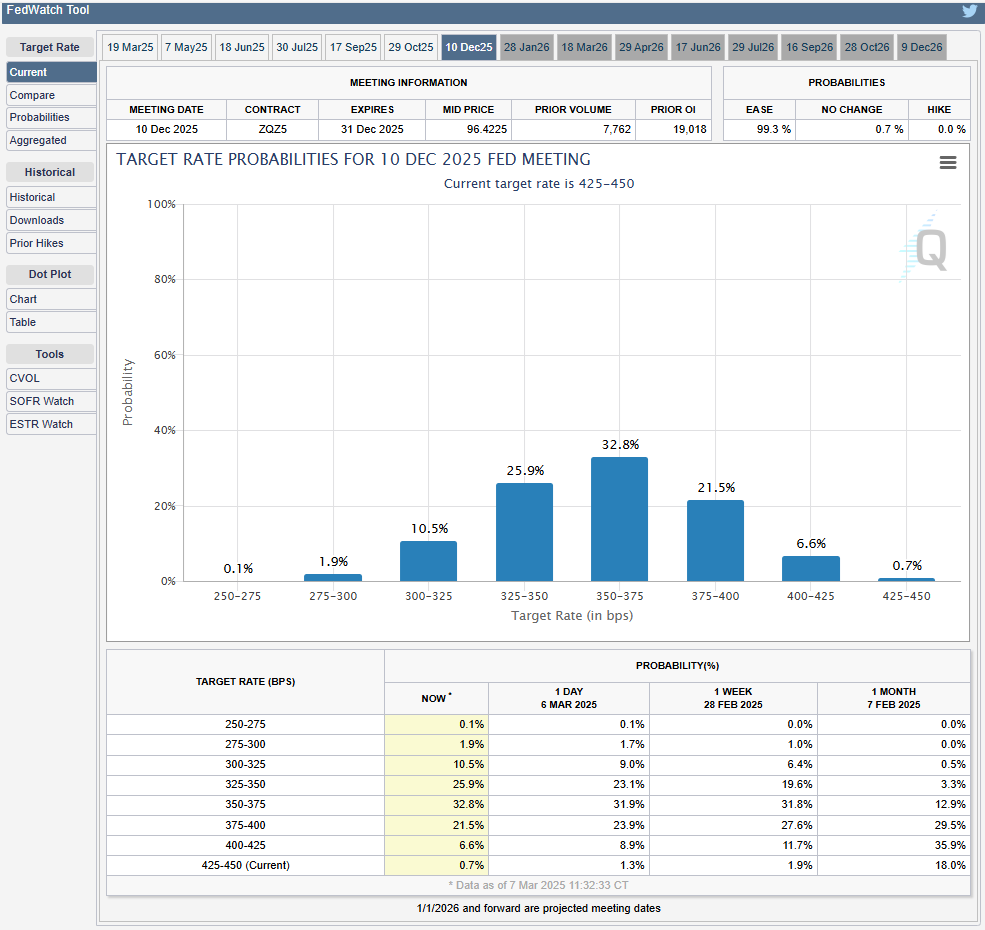

The current 4.25% to 4.50% range of Fed Funds could be down 50 to 75 basis points by the end of 2025. That’s using the CME FedWatch Tool rather than just opinion. There are of course no assurances that Powell will play along, but it is real-world money that has been bet on Fed Fund Futures contracts. As of Friday, here are the new live odds of rate cuts to potential Fed Fund ranges by the end of 2025:

- 4.25-4.50 (Current)… only 0.7%

- 4.00-4.25… 6.6%

- 3.75-4.00… 21.4%

- 3.50-3.75… 32.9%

- 3.25-3.50… 26.1%

- 3.00-3.25… 10.4%

- 2.75-3.00… 1.8%

Source (https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html)

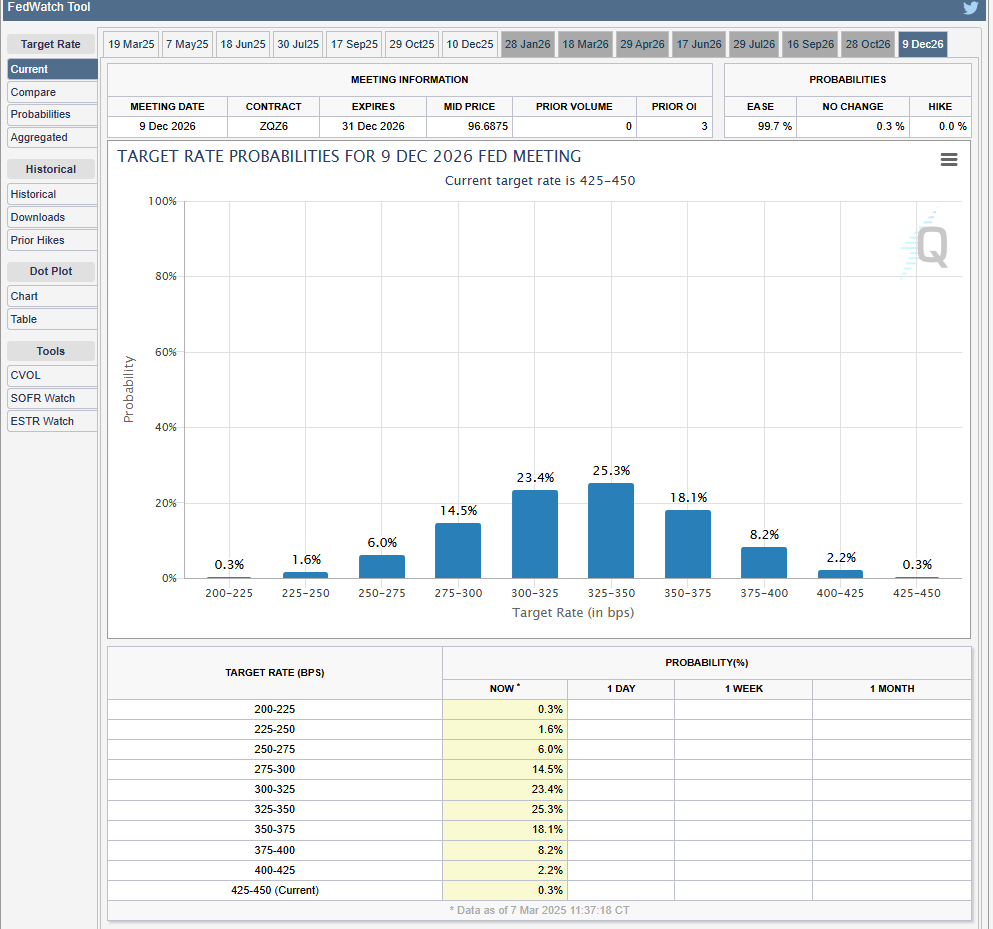

The CME FedWatch Tool now also goes out to December-2026 as well. This longer-term view is also based on actual dollars using Fed Funds futures, and this even begins to assign some lower probabilities that the current Fed Funds rate of 4.25% to 4.50% could drop back to under 3% by the end of 2026. Here are those current odds:

- 4.25-4.50 (Current)… 0.2%

- 4.00-4.25 … 1.8%

- 3.75-4.00… 7.1%

- 3.50-3.75… 16.8%

- 3.25-3.50… 24.8%

- 3.00-3.25… 24.0%

- 2.75-3.00… 15.6%

- 2.50-2.75… 7.0%

- 2.25-2.50… 2.1%

- 2.00-2.25… 0.4%

- 1.75-2.00… 0.1%

Categories: Economy, Investing, Personal Finance