“Tactical Buys” issued by analysts on Wall Street are generally considered to be “Buy” or equivalent ratings with something additionally happening to compound gains on top of normal expected gains. Wells Fargo has two well-known stocks on its Tactical Ideas List for the third quarter of 2024.

KROGER – GROCERIES

The Kroger Co. (NYSE: KR) is a top pick from the Tactical Ideas List from Wells Fargo. This firm is far from the only positive ideas ahead because Kroger can win with or without its multi-billion buyout of Albertson’s. Wells Fargo’s Edward Kelly sees a positive set-up in Kroger’s valuation for the near-term based on a $49.93 recent close.

Kelly sees a strong potential for a “beat and raise” report in the coming weeks while much of Wall Street has a lot to worry about in the broader grocery segment. The analyst also sees the Albertsons overhang likely ending in September and this could bring further upside to the valuation story with an attractive risk/reward profile.

Wells Fargo’s rating is Overweight and its $65 price target is nearly $7.00 above the consensus analyst target price.

OMNICOM -ADS/MARKETING

Omnicom Group Inc. (NYSE: OMC) is one of the advertising kings with more than a $17 billion market cap. Wells Fargo’s Steven Cahall just added Omnicom to the Tactical Ideas List for the third quarter of 2024 after the shares have sold off handily since mid-May. In the last six weeks or so, Omnicom fell from about $98 at the peak down to $98.70 for its Q2-ending closing price.

Wells Fargo’s positive setup for a stronger near-term performance is that recent momentum in its advertising and marketing accounts should allow Omnicom to raise its full-year organic growth guidance. Cahall also sees Omnicom raising some targets for 2025 as well. If this occurs, a re-rating of should occur in Omnicom’s shares.

Omnicom’s rating is Overweight at Wells Fargo and the $106 target price is actually in-line with the $108.10 consensus analyst price target.

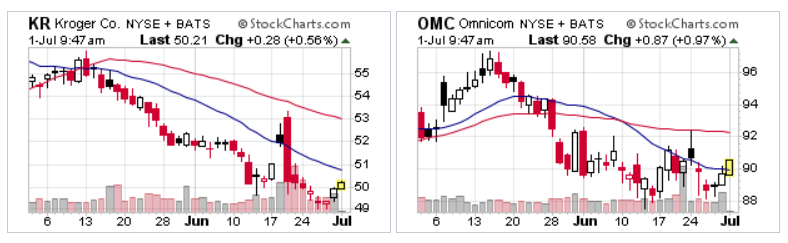

THEIR STOCK CHARTS

The following 60-day charts are courtesy of StockCharts.com.

KR OMC charts courtesy of StockCharts.com

Categories: Investing