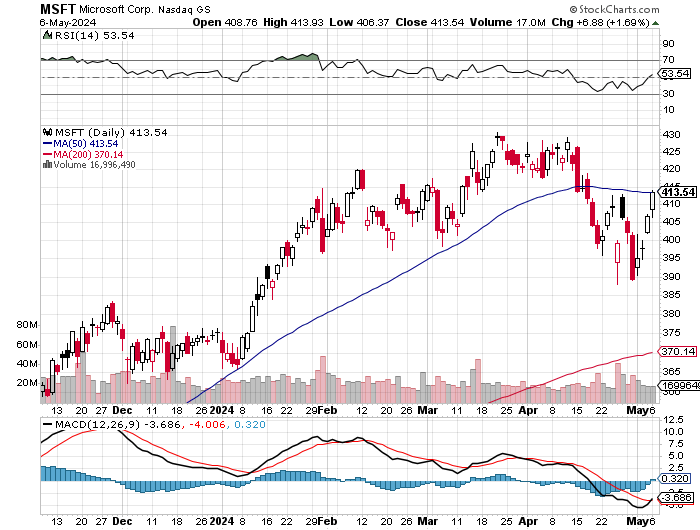

Microsoft Corporation (NASDAQ: MSFT) had been enjoying a stellar run in 2024 with a 15% gain up to its near-term peak in March and April. But as the stock approached $430 per share it kept running out of gas. It’s still up about 11% year-to-date after its earnings report. Still, the stock has traded in a choppy pattern since its earnings. That should spook some of the investors who only want to see positive earnings reactions.

It turns out that most analysts on Wall Street have maintained their bullish stance on Microsoft as a stock investment. Actually, the analysts stayed bullish and then some!

Microsoft is worth a whopping $3 trillion in market cap. Satya Nadella’s “cloud first” strategy a decade ago proved to be the right call. All the way. The Microsoft of the 2020s doesn’t rely on any new release dates for Windows as some older investors remember. It’s all cloud efforts. Office 365, Azure Cloud, Intelligent Cloud, AI, Bing search, storage, Xbox, Teams, LinkedIn and so on. Definitely more than what your parents and grandparents remember from the 1990s.

Microsoft’s consensus analyst target price was right at $432.00 ahead of earnings. After earnings — that consensus target is now closer $470.00, but you might think it was even higher based on some of the key price target hikes. As a reminder, most analyst price targets are generally implied as 12-month outlooks.

BIG PRICE TARGET HIKES

Many analysts reiterated their Buy, Outperform and Overweight ratings AND also raised their price targets after earnings. Individual report summaries were not included because there are just so many analyst calls as is.

Goldman Sachs (Buy) raised its target to $515 from $450.

Citigroup (Buy) raised its target to $495 from $475

Piper Sandler (Buy) raised its target to $465 from $455.

Raymond James (Outperform) raised its target to $480 from $450.

Stifel (Buy) raised its target to $475 from $455.

JPMorgan (Overweight) raised its target to $470 from $440.

Bernstein (Outperform) raised its target to $489 from $465.

Deutsche Bank (Buy) raised its target to $475 from $450.

Wells Fargo (Overweight) raised its target to $500 from $480.

Evercore ISI (Outperform) raised its target to $485 from $475.

AND SOME ONLY STAYED STRONG AS WELL

Wedbush reiterated its Outperform rating and it has a $500 price target.

Morgan Stanley reiterated its Overweight rating and it has a $520 price target.

Argus reiterated its Buy rating and its $475 price target.

BofA reiterated its Buy and Top Pick ratings along with its $480 price objective.

CFRA reiterated its Strong Buy rating and its $475 price target.

TACTICAL BULL OR PERMA-BULL?

To say that the analyst community has had a tactical stance would be an understatement. Many of the firms and analysts mentioned above have maintained Buy, Outperform or Overweight ratings for years now on Microsoft. Even a $3 trillion market capitalization is not slowing down that calls for more upside ahead.

The chart below is from StockCharts.com.

Categories: Investing