Momentum investors are generally polar opposites of value investors. While the value buyers may be looking for diamonds in the rough, momentum buys only want to buy the stocks that are already working. Many of the momentum investors do not even care about current or future valuations at all. Just buy what’s already going up!

Tactical Bulls is featuring the best and worst of the S&P 500 stocks so far in 2024 as this is the first trading day of the second half of the year. While this identifies the top gainers, perhaps the biggest notion is how much of a surprise there is among the top winners. A brief explanation has been provided of what is going on now rather than just what happened in the first half of 2024.

On top of year-to-date (YTD) gains, an additional view has been shown for how the stocks have gained versus a year ago. The screens come directly from FinViz screening data and have been ranked in the order of the gains from tenth to top-dog. No investment views have been included. How each investor views each of these stocks is solely up to them and no directional opinions have been offered by Tactical Bulls.

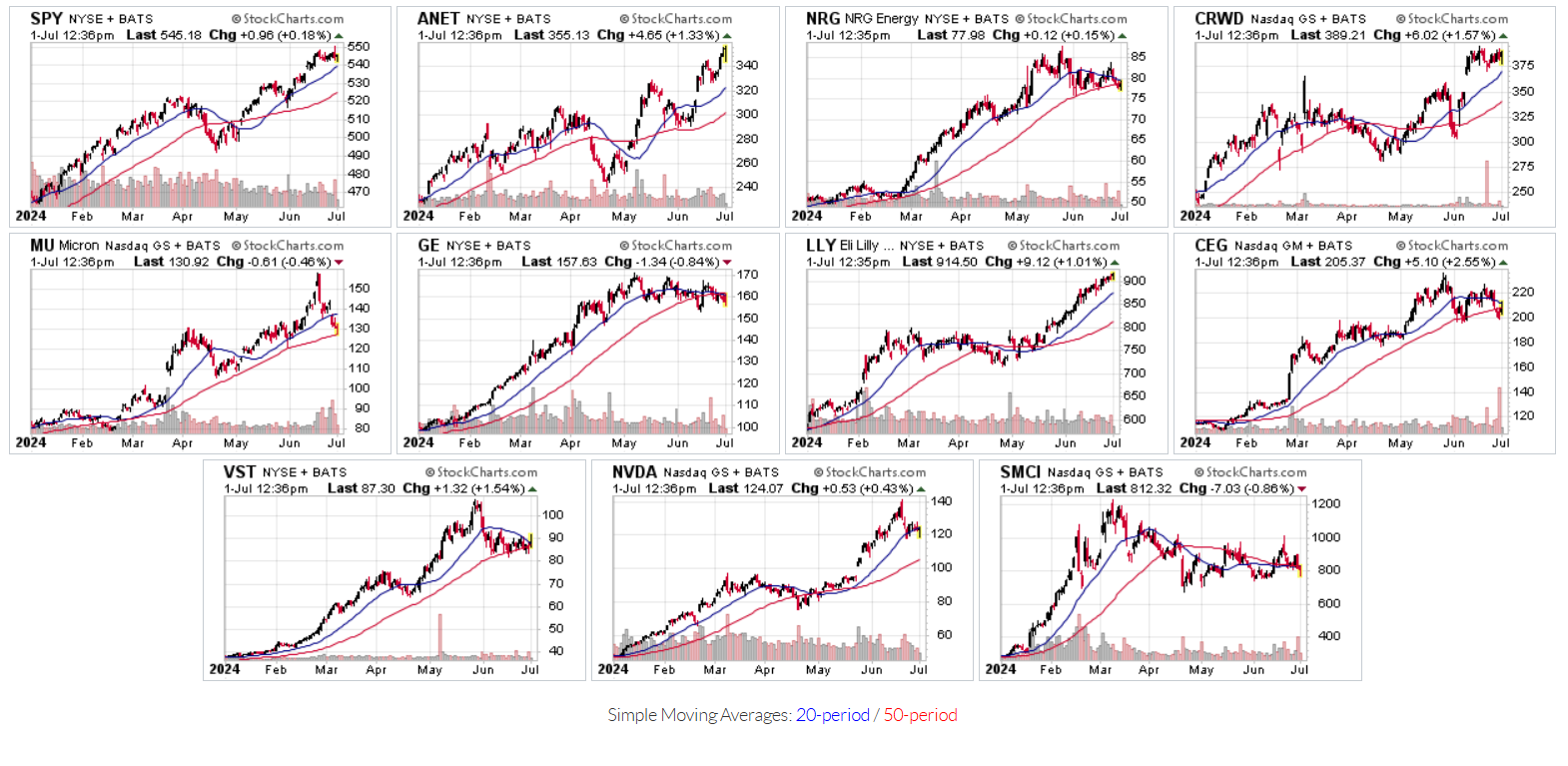

Charts of each S&P 500 winner and the S&P 500 itself have been included at the end.

AND THE TOP 10 ARE…

Arista Networks, Inc. (NYSE: ANET) has ridden the cloud and A.I. trends higher as the 10th best S&P 500 stock so far in 2024. Its YTD gain is 50.3%, but its gain over the last year is a more impressive 122%. And as the stock launches into the second half of 2024 it was challenging highs and it now has a $110 billion market cap.

NRG Energy, Inc. (NYSE: NRG) is a surprise winner in electricity and natural gas as most stocks tied to utilities are not frequently the top winners of a broader-based index. NRG isn’t even alone in the top 10 winners coming at #9. NRG is up 50.6% coming into the second half, but the stock is up an even more impressive 109% over the last year.

CrowdStrike Holdings, Inc. (NASDAQ: CRWD) may seem unsurprising in cybersecurity as the 8th best gainer in the S&P 500 YTD. The 51.6% gain YTD is one thing, but it’s up an even more impressive 168% over the last year. The stock is still within about 2% of its all-time high.

ALSO READ: Is There ANY Value in the S&P 500’s Top 10 YTD Losers???

Micron Technology, Inc. (NASDAQ: MU) was the 7th best member of the S&P 500 as of the first trading day of July. What should stand out here is that its gains and ranking would be even higher had a “sell the news” reaction not been seen after earnings the prior week. Micron’s gain is 53% YTD, but that is up 103% from a year ago. Imagine how strong this DRAM and flash memory leader would look if it held on to the recent peak of $157.54 rather than pulling back to $131.53 for a 16.6% short-term pullback.

GE Aerospace (NYSE: GE) is the dominant player left over after the break-up of General Electric and its stock has surged as the 6th best stock in the S&P 500. Analysts are also still quite positive ahead. GE Aerospace posted a gain of 54.3% YTD, and that’s up almost 83% from a year ago.

Eli Lilly & Co. (NYSE: LLY) may be an unsurprising winner because of weight-loss drugs, but now it is even getting help with OpenAI to target new drugs and new categories in pharma. The one issue which may puzzle holders is its $867 billion market cap. Eli Lilly shares ranked 5th best in the S&P 500 with 56.9% gains YTD. Eli Lilly is even up a more impressive 97% over the last year.

Constellation Energy Corporation (NYSE: CEG) is another electricity and natural gas giant that seems surprising in a world where so many tech stocks have risen so much. Constellation Energy’s stock was the 4th best gainer in the S&P 500 with a 76.2% YTD. The gain is an even more impressive 126% versus a year ago.

Vistra Corp. (NYSE: VST) may not even known by name to many investors as an integrated retail electricity and power generation company. Vistra is quite diversified in operations and it is the third-base stock of 2024 from the S&P 500 with a gain of 127.3% YTD. Perhaps more impressive is a 236% gain versus a year ago.

NVIDIA Corp. (NASDAQ: NVDA) needs no introduction as the leader of the A.I. boom, but its recent pullback made it the second-base stock in the S&P 500 so far in 2024. NVIDIA shares were last seen up 150% YTD, but that’s even after a 12% pullback from the recent post-split high. NVIDIA shares are still up 203% from a year ago.

Super Micro Computer, Inc. (NASDAQ: SMCI) was the #1 gainer in the S&P 500 according to the FinViz screener despite pulling back by one-third from its all-time high during Q1-2024. Super Micro was last seen up 186.7% YTD. Its gain also outpaces NVIDIA for the last year with a 245% gain. And despite those gains, it’s market cap of $47 billion may seem small to some A.I. focused investors.

CHARTS GALORE

The top ten stock charts have been provided by StockCharts.com. The S&P 500 (via the SPY) has been included as well.

Courtesy of StockCharts.com

Categories: Investing