Infinity Natural Resources, Inc. (NYSE: INR) has seen its post-IPO quiet period come to an end. The oil and natural gas exploration and production company sold 13.25 million shares at $20.00 per share. The total stock offering was more than 15 million shares as the overallotment option of 1,987,500 shares was also exercised y the underwriting group.

Despite analysts issuing more aggressive upside than most exploration and production companies, this stock has slid down to nearly $18.00 after an initially positive offering as it became public.

Tactical investors appear to have a solid case for looking into Infinity Natural Resources. At least that is what the verdict is from Wall Street analysts. Of the available reports seen so far, the analyst community thinks this stock is going higher.

Tactical Bulls always reminds investors that no single analyst report should ever be the sole reason for investors to buy or sell a stock. Some analysts get their thesis wrong, and sometimes the fundamentals of the companies or the sector can change rapidly.

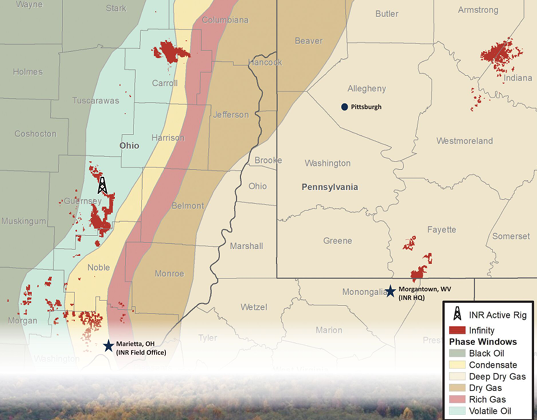

Infinity Natural Resources has a concentrated map of exploration and production with Appalachia.

Infinity Natural Resources held above its $20 per share IPO price initially, rising to as high as $23.00. Since that time the stock has slid lower and it most recently closed at $18.14 after a 3% drop on Thursday.

The analyst ratings and price targets are from each of the firms named. Tactical Bulls does not maintain any formal ratings or price target on Infinity Natural Resources.

BofA started it with a Buy rating and a $30 price objective.

CapitalOne issued a new Overweight rating and a $23 price target.

Citigroup start it as Buy with a $27 price target.

KeyBanc Capital Markets started it as Overweight with a $26 price target.

Raymond James issued a Strong Buy and $30 price target.

RBC Capital markets started coverage as Outperform with a $30 price target,

Stephens issued a new Overweight rating and a $30 price target.

Trust Securities issued a Buy rating with a $26 price target.

ALSO READ: BP JUST WANTS TO BE AN OIL & GAS COMPANY AGAIN!

Of the underwriting syndicates, this was the breakdown of the underwriter positions in the IPO press release:

- Joint book-running managers were listed as Citigroup, Raymond James and RBC Capital Markets.

- BofA Securities, Capital One Securities and Truist Securities were also acting as joint book-running managers.

- KeyBanc Capital Markets and Stephens were listed as senior co-managers.

- Comerica Securities, Fifth Third Securities, First Citizens Capital Securities and BTIG were also listed as co-managers.

- BOK Financial Securities and Zions Capital Markets were listed as junior co-managers.

Infinity’s only trading day with over 1 million shares trading hands was its January 31 IPO with more than 5.8 million shares trading hands. Most trading days are now seeing less than 500,000 shares trade hands, although with a float of barely 15 million shares that should not be very surprising.

Infinity Natural Resources is focused on the Marcellus and Utica shale plays in Appalachia with a 55%/45% inventory split between Ohio and Pennsylvania.

BofA noted that this company is the smallest U.S. exploration and production company in its stock coverage, but the firm also noted that it uniquely positions them for organic growth.

Again, all price targets and ratings were issued by each firm named.

Categories: Investing