There are still many internet browsers for internet users to choose from. It’s not just about Google, Microsoft and Apple. Then again, fighting for even a 1% share in search is no easy task against such behemoths. One browser which may have some appeal is the Opera browser — and it may have something to offer tactical investors looking for upside in some of the lesser-known stocks.

…

Piper Sandler has initiated coverage of Opera with an Overweight rating. The firm’s new $25.00 price target implies nearly 40% upside from the $18.00 closing price if Piper Sandler’s thesis proves to be true.

…

Before getting into this call, Tactical Bulls would remind investors that no single analyst call should ever be used as the sole basis to buy or sell a stock.….

Opera is said to be in a unique position as a browser because of growth in higher average revenue per user segments and in Western Markets. Piper Sandler is also positive over Opera’s ramp of new internal advertising efforts and from its third-party advertising products that can bring additional revenues into the company. According to the research report, the digital advertising backdrop is strong and is also gaining share in focus verticals.

…

Piper Sandler sees multiple catalysts for the shares in 2025 — one key issue being the Alphabet Inc. (NASDAQ: GOOGL) regulatory matter taking place with the U.S. antitrust case and with additional Google regulatory matters in the United Kingdom and in Europe. An additional scaling of its iOS app presence and a search agreement renewal are also expected to be catalysts for growth in 2025.

…

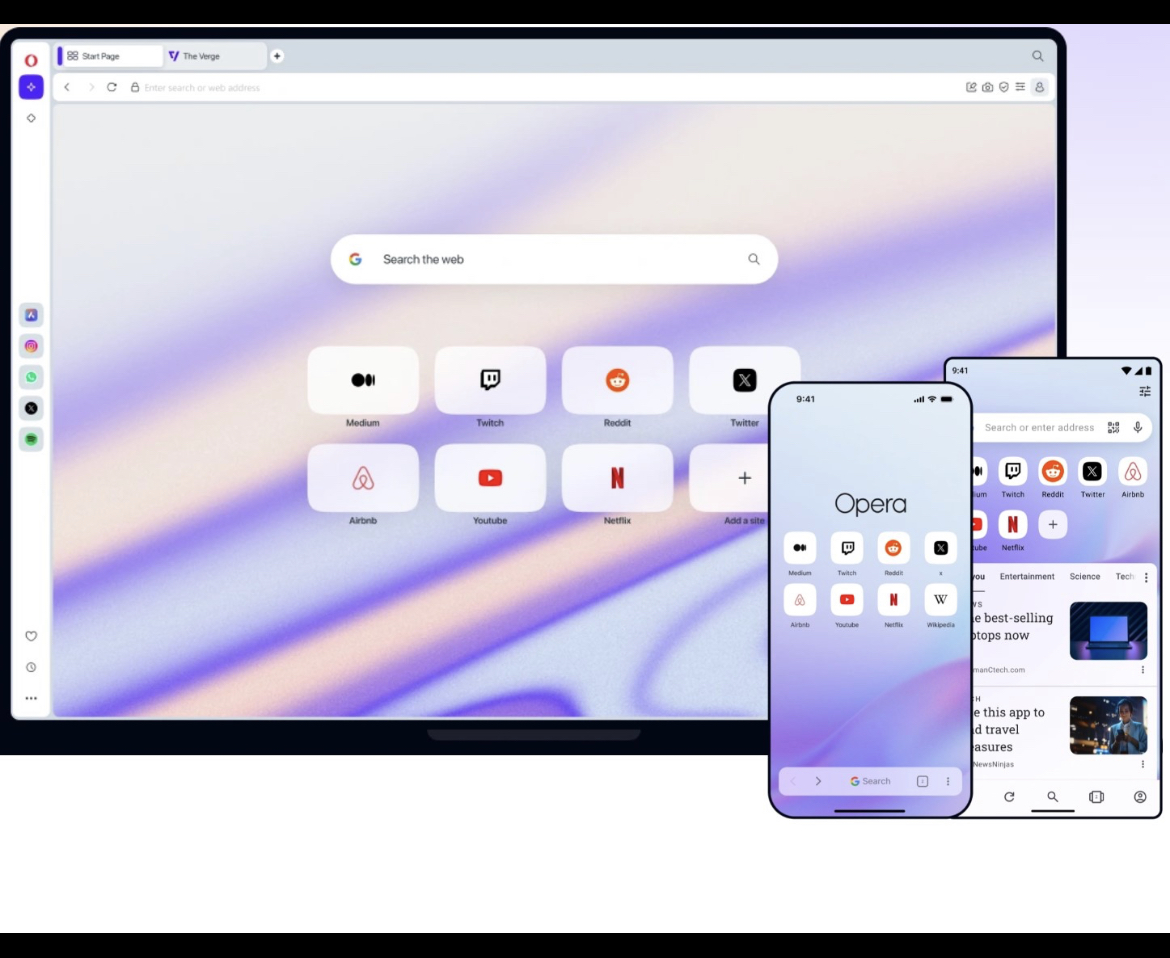

Opera is still a small company based in Norway with just a few hundred employees. It seems like a David and Goliath story in some ways because it is actually one of the oldest browsers (dating back to 1994) that is still in operation, but the company was acquired by a Chinese consortium in 2016. The company is not as new as many technology users and investors might think. It came public in a 2018 IPO at $12 per share that was valued at just $115 million in capital raised at the time.

…

Opera also recently released its Opera Air browser. It was said to be built around the concept of mindfulness. The company designed Opera Air to make its users feel better while they browse the web. It said:

…

The new browser integrates mindfulness tools such as breathing exercises, meditation, binaural beats, stretching, and positive quotes directly into the browsing experience. Users also get to enjoy a minimalist Scandinavian design and frosted glass UI.

…

Opera’s shares closed at $18.00 on Tuesday and the stock was indicated up 8% at $19.40 in early trading on Wednesday. Its 52-week range is $10.11 to $20.70 and its market cap is about $1.7 billion.

Categories: Investing