2024 was a great year for stocks. That said, even with a 23% annual gain in the S&P 500, year-end performance was not very good. That expected Santa Rally morphed into a 2.4% loss for the month. The problem isn’t as much the economy as it is interest rates. Wall Street forecasters are predicting a return of more than 12% for the S&P 500 in 2025. Is that strong bull market already in jeopardy?

Tactical Bulls warned investors ahead of the December FOMC meeting that the expected 0.25% rate cut in Fed Funds would likely be followed with a lower-than-expected projection for additional rate cuts in 2025. And, presto… Somehow the stock market was surprised about fewer rate cuts being likely ahead.

The driving force here at the onset of 2025 for the stock market and for interest rates is that the Federal Reserve’s longer inflation target of 2.0% remains quite elusive. Inflation is currently running well under 3.0%. Many market participants and borrowers alike would wish that the Federal Reserve would just keep lowering interest rates. After all, sub-3% inflation is much lower than the 7% inflation in 2021 and the 6.5% inflation of 2022. The cumulative and compounded effects of inflation came to a total of over 21% higher prices on average from 2021 through the end of 2024. That’s perhaps the key reason the Fed remains so fixed on getting inflation even lower.

And then there is the growing Treasury deficit that is being ballooned by the dual effects of 1) government deficit spending along with 2) a debt servicing cost that is becoming unacceptable. The Treasury’s debt servicing cost has moved from a statistically insignificant number a decade ago to one of the highest budgetary items. All of these issues will be outlined below.

The reality is that these issues pose serious caveats for bullish investors — even those of us who consider ourselves to be tactical bulls!

So where will the stock market and bond market focus as January kicks off?

ODDS WEAKENING FOR MANY MORE RATE CUTS

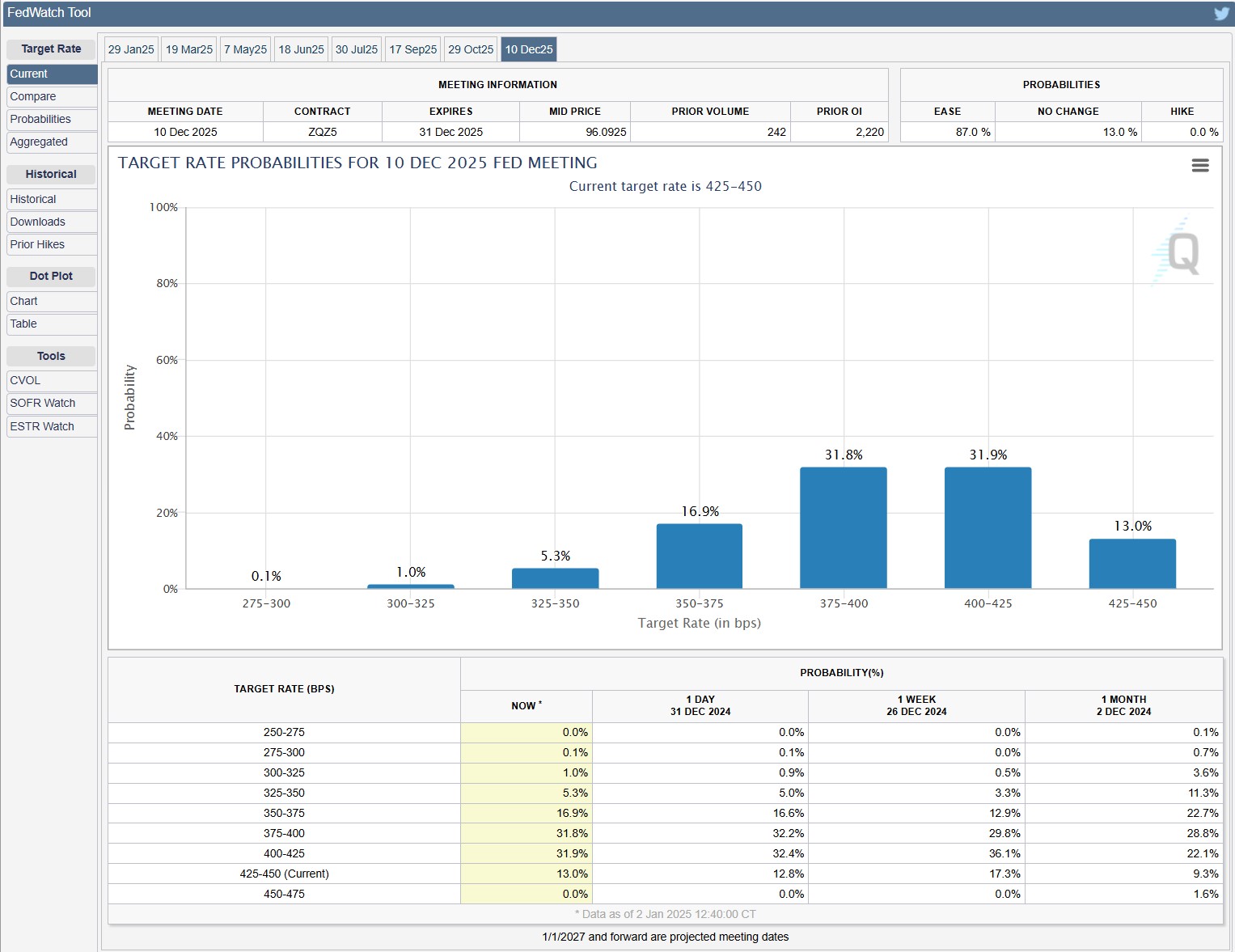

What is unfortunate at the start of 2025 is that the CME FedWatch Tool, which uses based on Fed Funds futures contract prices on a real-time basis, is now signaling that perhaps only one or two more rate cuts of 0.25% are in store for 2025. The problem is that this may even be worse.

The Fed Funds rate is currently in a 4.25% to 4.50% range. The CME FedWatch Tool still shows a 12.6% chance that Fed Funds will remain at the 4.25% to 4.50% range. This shows almost a statistical equal chance of Fed Funds ending in December 2025 at 4.00%-4.25% (31.9%) and 3.75%-4.00% (31.8%). That is currently just a 16.9% chance of rates being lowered to 3.50%-3.75%.

If the current pricing of Fed Fund Futures is accurate, this leaves a statistical odd that Fed Funds will end in December 2025 in a 3.875%-4.125% range. That statistical median is not likely possible considering that the FOMC rate cuts and hikes are almost always in 0.25% increments. Where this gets even murkier is that the Fed Funds probabilities are all worse than they were at the start of December. The FedWatch Tool’s table (see below) had the following probabilities a month ago:

- 3.50-3.75% at 22.7%

- 3.75%-4.00% at 28.8%

- 4.00%-4.25% at 22.1%

- 4.25%-4.50% at 9.3%

In short, the odds of Fed Funds staying flat are now higher by almost 4 percentage points. The odds of only one rate cut in 2025 are up almost 10 percentage points, and the odds of two rate cuts are up less than 3 1/2 percentage points. And the odds of a third rate cut, already statistically low (1 in 6) have dropped by well over 5 percentage points.

ALSO READ: WILL WORST STOCKS OF 2024 SHINE BRIGHT IN 2025?

WHAT THE FED ITSELF THINKS

This whole worry at the end of 2024 and start of 2025 is coming more and more in line when the data are compared to the FOMC’s December Median and Central Tendency charts from the December 2024 meeting. And for that theoretical 3.875% Fed Funds rate for 2025, the highest number of FOMC member forecasts (10) was at that 3.875% Level — with an equal number of 3 projections each at 3.625% and 4.125%.

WHAT TREASURY YIELDS ARE SIGNALING

And to add more to the fire, the Treasury yields on the first day of 2025 are as follows:

- 1-year at 4.15%

- 2-year at 4.25%

- 5-year at 4.38%

- 10-year at 4.57%

The good news is that U.S. Treasury yield curve is no longer inverted like it was before the interest rate cuts finally started in 2024. The bad news is that the yield curve such a slow slope that skiers would be stuck on the mountain.

ALSO READ: TOP 20 STOCKS OF 2024 MAY KEEP SURGING IN 2025!

RATES HIGHER FOR LONGER?

The phrase “Higher for Longer” may also prove to be higher interest rates for a much longer period of time. The median Fed Funds rate for 2026 was for Funds at 3.4% over 2026 and 3.1% over 2027. And the longer run was only 3.0%. These are drastically much less aggressive on interest rate cuts than had been projected even last summer and versus the start of 2024.

It may seem like a serious case of ambiguous wishful thinking to only want lower interest rates now and in the future. Interest rates are supposed to be dictated by the financial markets and then influenced by the Federal Reserve’s FOMC policy on interest rates and the use of the Fed’s balance sheet.

THE U.S. MOUNTAIN OF DEBT

Where the dilemma we are all facing as a nation comes into play is that the U.S. Treasury’s site for the Debt to the Penny ended December above $36.1 trillion. The debt-limit extensions from June-2023 to January-2025) has seen the national debt rise by about $4.7 trillion, rising from $31.5 trillion to almost $36.2 trillion. There was roughly a $1.8 trillion budget deficit in 2024 and the Congressional Budget Office and other forecasters have warned that high deficits will continue until government spending is corrected.

And now here is the real kicker — the U.S. had net interest expenses of $658 billion in 2023. By the end of Q3-2024 the annual debt servicing cost has crossed above $1.1 trillion. And with 2023 projections of $7.6 trillion maturing in 2025 still being the top search result, presumably being reissued by the Treasury at higher rates than the average maturing coupons in the monthly Treasury auctions, how long will it be before the annualized debt servicing costs reach $1.5 trillion?

The U.S. has never experienced a time when the world was unwilling to finance the United States by purchasing evermore Treasury bills, notes and bonds. That status is not likely to last forever. This is why the stance of Tactical Bulls has been and will remain that the Federal Reserve has a serious conflict of interest when it comes to setting interest rates in the same manner today as it has for the last century. It’s becoming real money. Actually, it already did.

CAN TRUMP NAME A NEW FOMC CHAIRMAN?

Donald Trump is to be sworn in as the 47th President of the United States on Monday, January 20, 2025. Many regulations that have been put in place will be reversed and many new executive orders are expected. And even with the DOGE being run by Musk and Ramaswamy, serious government spending cuts should not truly be expected until 2026 or even in 2027.

One of the key issues about the Federal Reserve which Donald Trump will not likely be able to do anything about is that Fed Chairman Jerome Powell’s current term does not ends until May 15, 2026 (and his term as a member of the Board doesn’t end until January 31, 2028). Trump has noted that the Chairman’s term is more than a year into his presidency and Powell has said he would not resign if he was asked to.