There are stocks and then there are “meme stocks.” Apparently, they are back. Welcome to the world of “stonks” all over again.

The phrase “It’s time to buy California utilities stocks” is probably difficult for many investors to fathom. Difficult disasters like fires, earthquakes, mudslides and floods make up one part. But the hardest part for many investors to digest is that the state of California just loves proposing new fees, taxes and surcharges any time they want to pay for damages and new ideas. The reality is that dividend-loving utility there are so many other utilities to invest in around the country without these headwinds. It’s a miracle anyone would want to buy stocks in these California utilities. Many investors might even say investing in California utilities is somewhere near the corner of Irony Street and Paradox Avenue.

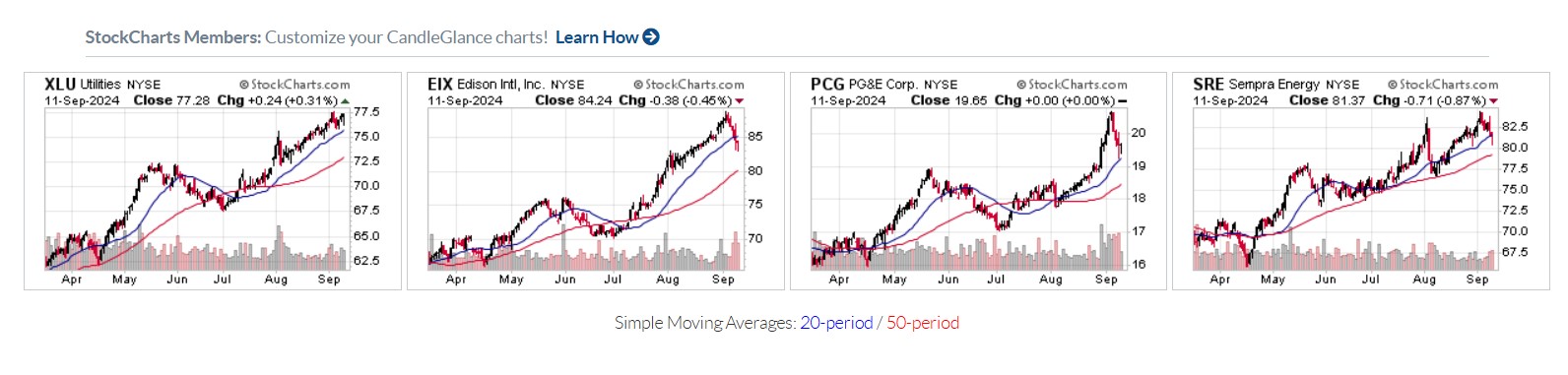

BofA Securities has reinstated three California utilities with Buy ratings. These buy ratings also come with above-average implied upside potential if the firm’s views are correct. That makes this as “tactical bull” call in the utility sector. There is also a severe catch-up potential since the charts show all three of these have underperformed the XLU ETF so far in 2024.

Again, the views and targets shown on these three California utilities are solely the opinion and stance of BofA Securities. The Tactical Bulls site is not issuing formal views nor price targets in any of these companies.

One goal of Tactical Bulls is to continually be searching for new ideas as well to share with its readers. With the Federal Reserve about to finally begin a rate-cutting campaign there are potentially many changes investors should be considering. Tactical Bulls would also remind its readers and all investors that no single analyst report should ever be used as the sole reason to buy or sell a stock. That ultimate decision is the responsibility of each investor and should be made along with their financial advisor.

WHAT BOFA THINKS

Is it possible California is doing something pro-shareholder for California utilities? BofA reinstated three of the leaders out there with Buy ratings after the California Public Utilities Commission (CPUC) ALJ published a proposed decision suggesting to lower California utility ROEs across the board. If the data comes as first shown, it theoretically lowers authorized ROEs for PG&E, Sempra and Edison by 42 basis points across the board. BofA pointed out that the three utilities stocks sold off somewhat meaningfully in late afternoon trading based on fears of an ongoing earnings power decline.

BofA’s team believes that the proposed decision and actual impacts are far less draconian. The firm sees PG&E and Sempra as the best positioned to absorb a lower ROE. The view on Edison is that it likely has operational variances, but how achievable that is depends on the rate case outcome. Another issue is that the proposed decisions have generally been more negative than the final orders in most California proceedings in the last 14 months.

EDISON INTERNATIONAL

Edison International (NYSE: EIX) was given a double-upgrade as it was reinstated with a Buy rating (previous was Underperform) with a $95 price objective at BofA Securities. That implies an upside target of about 12.7% versus Edison International’s $84.24 prior close. Then there is also a 3.7% dividend yield for total return investors to consider.

BofA noted that there should be “further multiple expansion and upside to consensus depending on recovery outcomes for phase 2 of the 2017/2018 cost recovery proceedings.”

The firm’s main view on EIX was to reinstate its Buy rating on prospect of fire liability recovery (Woolsey). The report even calls EIX unique “as an electric-only California utility with leverage to the state’s electrification policy.”

PG&E

PG&E Corporation (NYSE: PCG) was reinstated with a Buy rating and $24 price objective (versus $19.65 prior close) at BofA Securities. If the call is right this implies about a 17% total return opportunity. This is what the report said about PG&E:

While the shares have lost steam relative to the group YTD in 2024, we think the relative pullback is reflective of a healthy investor rotation following nearly 100% relative outperformance off trough multiples set in late 2021. We view management as among the best in our coverage and they have cleaned up the story post emergence. Further, we think they have established an achievable, peer-leading path ahead as PCG starts to look more like a true regulated US utility. Customer rates are objectively high and the cash flow profile likely needs to start turning toward modest equity issuance soon, but we think PCG will look increasingly like most utilities by 2026.

SEMPRA

Sempra (NYSE: SRE) was reinstated with a Buy rating and a $94 price objective at BofA Securities. The report gives this an implied upside of about 15.5% versus its $81.37 prior close, but that’s about 18.5% in implied upside with the dividend included. Sempra is called out as having the “favorite child status in California and Texas. BofA thinks the real value is in its regulated utilities in the two states as the utility-heavy capital plans organically shift the earnings mix to its regulated businesses.

Sempra’s “pre-funded equity raise” was also said to “provide balance sheet flexibility for the first time in recent memory.” The views also conclude with “earnings risk skews to the upside given management’s tendency to plan conservatively for rate cases.”

CHARTS

The following charts are courtesy of StockCharts.com to show a 6-month history of how these have performed versus The Utilities Select Sector SPDR Fund (NYSEArca: XLU). The XLU ETF has risen 22% year-to-date in 2024, handily above the gains of these three — EIX is up 17.8%; PCG is up 9%; and SRE is up 8.9%.

COURTESY OF STOCKCHARTS.COM

Categories: Investing