The stock market was trying to recoup some of last week’s losses based on a Trump tariff delay with the European Union. Whether a “deal” comes to pass or not, investors should keep in mind that stocks had recovered more than 20% since the early-April selling panic. Some investors now are wondering whether they should be buying or selling after such a strong recovery.

Tactical Bulls reviews the daily flow of Wall Street research each morning to hunt for some of those overlooked items and hidden gems that would have otherwise been missed. The effort in finding those new ideas is also for short-term traders and long-term investors alike. Many of these analyst calls are targeted directly at tactical investors who rotate their assets more than buy-and-hold investors.

The primary theme in research reports from the start of April into May was “downgrade lite” calls — where analysts maintain their formal ratings but slash their price targets to reflect lower share prices or a slower economy. This has started to reverse with more price target hikes and some formal upgrades, but the trend still favors price targets being cut. There have been very few stocks getting formal downgrades and Tactical Bulls wants to see what is happening with those few large stocks that are receiving actual downgrades from analysts.

Investors need to always keep in mind that no single analyst report should ever be the sole basis to buy or sell a stock. Analysts can get their thesis wrong just like the rest of us. And sometimes the market or a company’s fundamentals can change in the blink of an eye. And some investors may even take a contrarian view for long-term opportunities if the bulk of analysts have already downgraded the stocks.

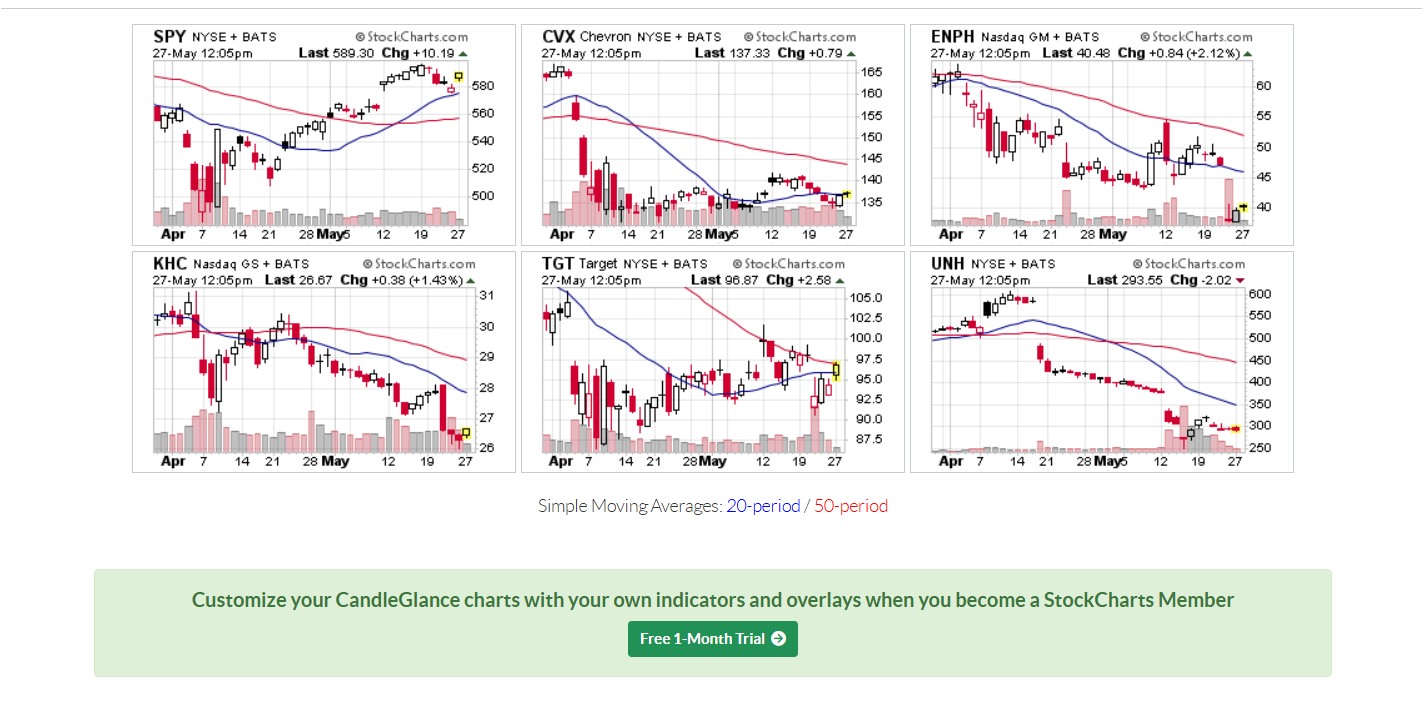

Here are 5 grouped analyst calls of underperforming S&P 500 stocks from recent weeks where Wall Street is voicing formal concerns rather than positive outlooks heading into the summer doldrums. Performance and short interest data has been included on each, as well as a chart from stockcharts.com at the end. Please read the disclaimer at the end of this reporting to read about additional investing risks.

BIG OIL – CHEVRON

Chevron Corporation (NYSE: CVX) is feeling the sting of lower oil prices with oil at $80 in January falling to nearly $60 per barrel. Wall Street has been adjusting its stance accordingly. While the shares are down just 5% YTD, it is down 18% from its highs just two months ago. Chevron also had 60.6 million shares in its short interest, about 6.5 days to cover.

Chevron was downgraded to Hold from Buy and the price target was cut to $158 from $176 at HSBC on May 13. The firm Redburn Atlantic cut Chevron to Sell from Neutral and its target was cut to $124 from $156 on April 23. Barclays downgraded Chevron to Equal Weight from Overweight and its target was cut to $152 from $171 on April 23. Scotiabank cut Chevron to Sector Perform and cut its target to $143 from $160 on April 11.

SUNSET – ENPHASE

Enphase Energy Inc. (NASDAQ: ENPH) is being deemed as a top loser in alternative energy as the tax bill is not favoring it, to say the least. The markets for solar micro-inverters, battery energy storage and EV charging stations just isn’t as promising when so many solar and alternative energy tax credits are not going to be given as favorable treatment under new tax policy. Its stock is down 14% over the last month but is down 41% YTD. Enphase also had 16.8 million shares in its short interest, representing 3.5 days to cover.

Citigroup was among the first to throw in the towel, cutting it to Sell from Neutral and cutting its price target to $47 on April 17. Enphase Energy was cut to Sell from Neutral with a $33 price target at Guggenheim on April 24. BMO downgraded Enphase Energy to Underperform from Market Perform and its target was slashed to $39 from $46 on May 13, with Barclays cutting it to Underweight from Overweight and cutting its target to $40 from $51 on the same day.

UNREAL – KRAFT HEINZ

Kraft Heinz Co. (NASDAQ: KHC) was down 14% YTD and down 11% in the last month, and it has not even responded well to “strategic alternatives,” stock buybacks and investing $3 billion into U.S. manufacturing. Kraft Heinz had 46.66 million shares in its short interest, representing 4.2 days to cover.

While this first call is not a downgrade, the first big analyst to start negative coverage was Morgan Stanley with a Underweight rating and $29 target back on March 24. Citigroup had already cut its rating to Neutral from Buy back in February, but on April 4 it cut the rating to Sell with a $27 target price. Bernstein downgraded Kraft Heinz to Market Perform with a $31 target on April 22. And DZ Bank downgraded KHC to Hold from Buy with a $31 target on May 9. And with the Berkshire Hathaway directors leaving, Morgan Stanley more recently cautioned that the move brings up its future role in a post-Buffett era.

BLAME D.E.I & TARIFFS – TARGET

Target Corporation (NYSE: TGT) had horrible earnings, but the downgrades began long before the formal report. Target blamed consumer weakness, tariff concerns, and even shopper revolts over rolling back on some of its D.E.I. initiatives. Target had 16.88 million shares in its short interest on last look, worth only about 2.1 days to cover. Its stock is down 29% YTD on last look.

On April 16, Goldman Sachs downgraded Target to Neutral from Buy and cut its target to $101 from $142. Bernstein downgraded Target to Underperform Market Perform and slashed its target to $82 from $92 on May 12. BofA downgraded Target to Neutral with a $105 price objective on May 22, and Telsey Advisory cut Target down to Market Perform from Outperform with a $110 price target on May 22.

SICKLY STOCK – UNITEDHEALTH

UnitedHealth Group, Inc. (NYSE: UNH) has been gutted in 2025 and is the worst performer of the last month in the Dow and S&P 500. From its CEO being murdered in cold blood, from withdrawing guidance, from losing its new CEO suddenly to Medicare fraud investigations. UnitedHealth’s short interest was only 8.85 million shares (1.3 days to cover), but that may not represent the sentiment after the most recent drop in the shares yet.

Argus was among the first significant and formal downgrades, cutting its rating to Hold from Buy on April 21. HSBC followed on April 22 by cutting its rating to Hold from Buy. BofA Securities downgraded UnitedHealth’s rating to Neutral from Buy and slashed its price objective to #$350 from $560 on May 14. TD Securities downgraded UnitedHealth to Hold from Buy and slashed its price target down to $308 from $520 on May 19. And HSBC, which was among the first real downgrades, cut UNH’s rating again to Reduce from Hold and cut its target to $270 from $490 on May 21.

************

PLEASE NOTE: All analyst ratings and their price targets mentioned above were issued by each firm named in this summary. Their ratings and targets may differ greatly from firm to firm on Wall Street. Tactical Bulls does not issue any formal ratings and does not maintain any price targets of its own on these stocks. No analyst report, even those with very strong conviction, ever comes with any guarantees of profits and they never contain money-back guarantees in case you lose money.

The chart montage below is courtesy of StockCharts.com for each stock.

COURTESY OF STOCKCHARTS.COM

Categories: Investing