Steel stocks are supposed to be extremely cyclical. After all, steel is for building ships, homes, cars, planes and skyscrapers all driving steel demand. The steel sector is usually strong when the goods-producing and construction markets are strong. It generally suffers handily during economic slowdowns. So what happens when steel stocks get a key analyst upgrade on Wall Street ahead of interest rate cuts, a soft landing and/or a mild recession? That is the case for JPMorgan upgrading three key U.S. steel stocks this week.

The recent news flow had shares of United States Steel Corporation (NYSE: X) down handily on news that the U.S. wants to block its acquisition by Nippon Steel of Japan. The worry, on top of competitive threats is also that U.S. jobs would be lost as a result. But there is something else to this JPMorgan research entirely. This call is looking for strong above-market potential upside after the steel stocks have been under severe stock market pressure this year.

So, what exactly is the team at JPMorgan thinking? JPMorgan’s call is very “tactical” in its nature. Is there an opportunity for tactical investors to step into steel stocks to generate absolute returns or above-market (alpha) returns? Apparently, the $55 per share acquisition of U.S. Steel facing a likely merger blockage is not even the reason for this sector call even though that news of a likely Biden deal blockage took 20% out of the U.S. Steel stock price. JPMorgan is expecting benchmark steel prices to drift up to $750 per ton in a 2026 outlook and the firm generally sees strong standalone valuations.

A BRIEF REMINDER

Tactical Bulls always take the opportunity to remind its readers and to remind all investors that no single analyst report should ever be used as the sole reason to buy or sell a stock. That decision to buy, sell or hold ultimately needs to be made by each investor along with their financial advisor. The research and price targets issued herein are from JPMorgan and are not the price targets and are not the formal ratings of Tactical Bulls. There are no assurances that the outlook offered in this sector report will come to fruition. And most analyst reports issuing price targets are generally considered to be for the following 12-month period.

U.S. STEEL UPSIDE

On U.S. Steel, JPMorgan analyst Bill Peterson raised U.S. Steel to Overweight from Neutral. He also raised his price target to $42 from $40. Peterson had lowered his target on U.S. Steel down to $40 from $43 in July and also lowered his target to $43 (from $47) in early-May. U.S. Steel’s pullback is now considered an attractive buying opportunity on standalone l to Overweight valuation support for the best positioned steel stock.

U.S. Steel’s stock price was recently trading close to $31, implying about 35.5% upside from the most recent prices. U.S. Steel’s dividend yield is only about 0.6%, and its 52-week range is $26.92 to $50.20. Shares of U.S. Steel were last seen up only about 1% from a year ago, but the performance so far in 2024 has been down a sharp 36% now that the Nippon Steel premium has been wiped out.

In general, the research team feels steel has underperformed due to weakening fundamentals. After the weakness has been seen Peterson now believes that the risk/reward is more favorable for North American stocks. His take — “investors will begin to positively discount an improved rate environment and stable post-election backdrop in 2025.”

NUCOR UPSIDE

As well as being favorable on U.S. Steel, Nucor Corporation (NYSE: NUE) is also considered to be the best positioned steel stocks for upside into next year. Whether or not the market is efficient enough to get past negative headlines this time around remains to be seen — and stocks in general do often discount news months into the future. Peterson raised his rating on Nucor to Overweight from Neutral and its price target was raised to $174 from $170 in the call with a similar view of an improved rate environment and stable post-election backdrop next year. Nucor was also given strong marks for strong product diversification.

Nucor’s stock was recently trading close to $136, implying about 28% upside from the most recent prices. Nucor also has a 1.55% dividend yield and its 52-week range is $135.62 to $203.00. Nucor shares are still down 17% from a year ago and its year-to-date performance is even worse at -22.2%.

ALSO READ: WHERE PRICE-GOUGING IS A FALSE FLAG

EVEN STEEL DYNAMICS HAS UPSIDE

Steel Dynamics, Inc. (NASDAQ: STLD) was also raised at JPMorgan, but only to a Neutral rating from a more cautious Underweight rating. Its price target was raised to $131 from $120 in the call — also citing strong product diversification for the upgrade.

Steel Dynamics shares were recently trading close to $107, implying about 22.5% upside from the most recent prices. Steel Dynamics also has a 1.7% dividend yield and its 52-week range is $95.53 to $151.34. Steel Dynamics’ stock is up about 6% from this time last year but the year-to-date performance of -10% is still underperforming the broad market.

IN THE END…

Most investors expect average stock market returns to be 8% or so annually over time. The case for JPMorgan’s steel stock gains has yet to be determined as analyst reports are typically looking a year into the future. With even a Neutral rating projected at more than 22% gains and the two Overweight ratings projected to offer 35% (U.S. Steel) and 28% (Nucor), this JPMorgan call is much more aggressive than a typical upgrade in three deeply established cyclical stocks.

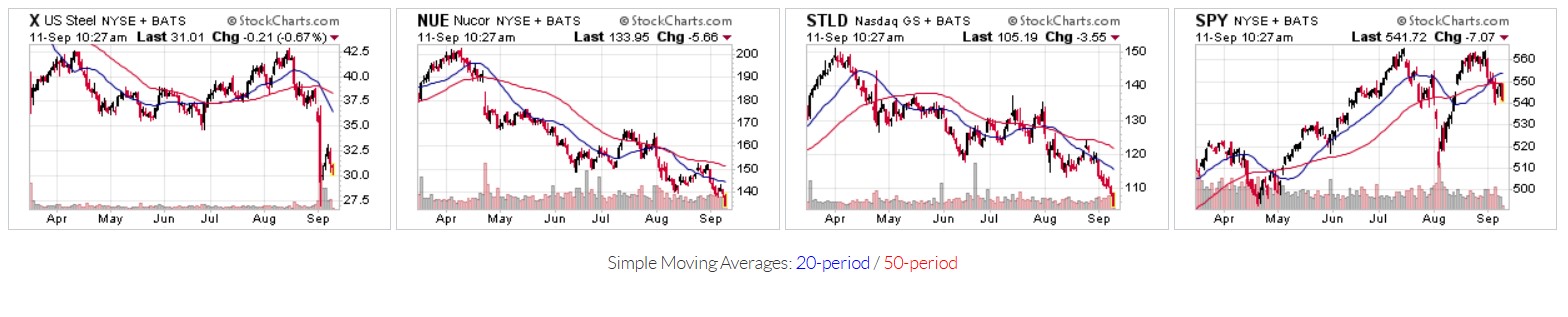

Again, the ratings, targets and views issued in this report were issued by JPMorgan. Tactical Bulls has no formal ratings or price targets on any of the companies mentioned in this report. The three stock charts below are from StockCharts.com and a chart of the S&P 500 has been added for your reference.

Categories: Investing