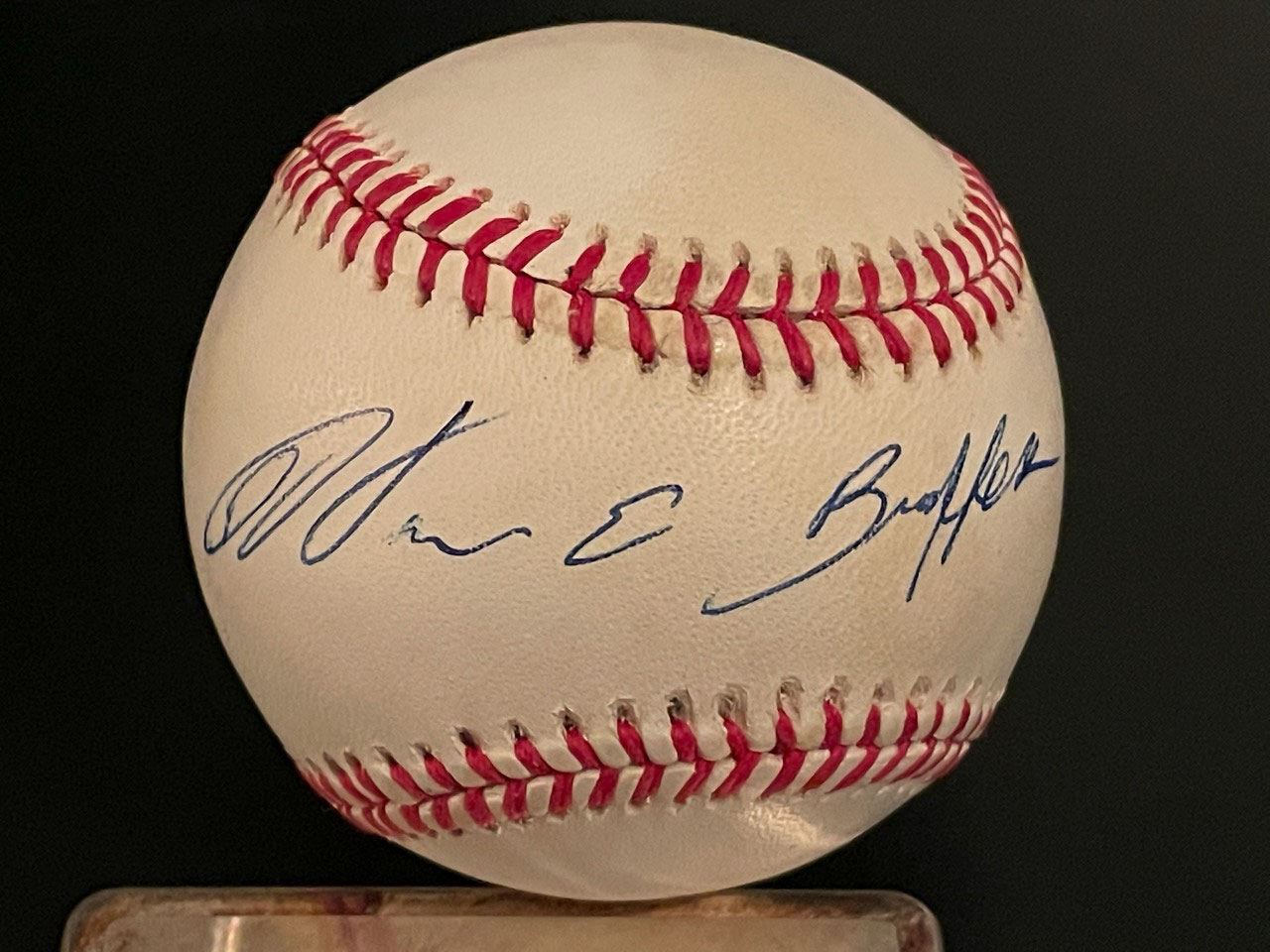

My personal collection Warren Buffett signed baseball

If there is one investor that has proven to have a golden track record for many decades, Warren Buffett might be the first person that comes to mind. Berkshire Hathaway Inc. (NYSE: BRK-B) had been systematically selling off shares of some key holdings earlier in 2024, and the company had stopped repurchasing its own shares. It was as if Warren Buffett was preparing for a crash or a serious reversal of the gains seen over the last two years. But now the election is over, a new regulation-lite and pro-business regime is coming in, with favorable tax policies — and suddenly Warren Buffett is buying some of his stocks that have been knocked lower on recent weakness.

Tactical Bulls is looking into whether or not tactical investors should be chasing after Buffett’s recent stock purchases. After all, Buffett’s holding period can be years (or decades) and that is usually longer than most tactical investors are willing to stick around in a position.

SEC filings show that Berkshire Hathaway has recent accumulated about $405 million more in shares of Occidental Petroleum Corporation (NYSE: OXY) after the stock hit a 52-week low. That purchase of roughly 8.89 million shares takes the Berkshire Hathaway stake up to 264.17 million shares for a 28.1% stake in the oil company. After closing at $45.36 on Thursday, its 52-week range is $45.17 to $71.19 and it was down another 15% or so since the election. Berkshire Hathaway had not purchased Occidental shares in about six months prior to this purchase.

Sirius XM Holdings Inc. (NASDAQ: SIRI) has also recently hit a fresh 52-week low and down over 50% YTD as there are just more options for in-car radio entertainment. Berkshire Hathaway spent nearly $113 million to buy about 4.96 million shares of the satellite radio leader. Investors have been unimpressed with its 2025 guidance, and the recent lows actually represent multi-year lows. The Sirius XM stake is a position that was put on by one of the Berkshire portfolio managers rather than by Buffett himself, but it was already listed a 31% stake as of the end of September before Buffett’s team purchased more shares in October. The total stake now listed as roughly 117 million shares, so minus buybacks or any other inside transaction in the company (and its old ties to Liberty) it would be closer to a 34.5% stake.

VeriSign, Inc. (NASDAQ: VRSN) is one stock that was not close to 52-week lows and its shares had been rising since the election up until the last week or so. VeriSign is also a position managed by one of Buffett’s portfolio managers for domain registration and internet infrastructure services. That said, Berkshire Hathaway’s purchase this week was 234,312 shares for close to $45 million. Berkshire now has a stake of about 13.05 million shares (over a 13% stake) worth close to $2.5 billion at present levels.

When new positions are announced by Warren Buffett and Berkshire Hathaway, there is an obvious one-time boost to the stock price. Then the companies have to start proving themselves again. One question now is what Berkshire Hathaway will decide to do with its $325 billion cash position after selling off significant portions of its stakes in the likes of Bank of America Corp. (NYSE: BAC) and Apple Inc. (NASDAQ: AAPL).

Two new stakes were taken out in Q3-2024 as disclosed in mid-November SEC filings. The standout stake was 1.27 million shares of Domino’s Pizza (NYSE: DPZ) worth about $550 million at the end of the third quarter. Pool Corp. (NASDAQ: POOL) was the other new stake of 404,057 shares worth some $152.2 million at the end of the third quarter. That was also a stake put on by one of Buffett’s portfolio managers.

What may be more interesting to tactical investors looking into quicker trades ahead of the data is whether this also means that Buffett is willing to buy back more of his own stock again. Berkshire Hathaway’s stock was last seen at $448.50 — down about 8.8% from its high of $491.67. Even though that high was just at the end of November, Berkshire Hathaway shares were still last seen up 26% YTD even taking that pullback into consideration. Now you just have to determine whether that’s enough of a pullback for Buffett to think it merits share repurchases after a long pause.

Tactical Bulls does not maintain any in-house formal price targets or ratings on any of the stocks mentioned. This information is not intended to investment advice and is not to be intended as a recommendation to buy or sell any of these stocks. All investing decisions are the responsibility of each investor and those decisions should be made along with a financial advisor.

Categories: Investing