ServiceTitan, Inc. (NASDAQ: TTAN) came public at a very unusual time when it priced the IPO for a December 12 debut. This is when most investment banks and research outfits are gearing down for the year and making forecasts into the next year. This is a unique company serving the trades industries with an all-in-one software platform and it may have incredible growth opportunities in the years ahead.

ServiceTitan is a company most investors may have overlooked. It calls itself “the operating system for the trades” with more than 11,800 customers. The reason for this review is that the various trades industries have been very underserved by technology historically. This software suite helps to modernize a very discombobulated sector that often relies on basic spreadsheets, paper business forms and paper receipts.

Now is a time for investors to reflect on whether this company offers any tactical upside for 2025 and beyond. There is a huge upside opportunity in the marketplace if it can grow into its addressable total market opportunity. There are also some unusual risks that investors need to consider before just blindly chasing growth. And to add yet another risk into the mix, its first earnings report as a public company will be in just a week. There are stock options that are available, but they are thinly traded, have a low open interest, have wide bid/ask spreads and trade at high premiums.

This could be the IPO that we all missed out on together. — or it could be the IPO that was forced into the market at a strange time at too much of a premium to its formal pricing. The outcome is not set in stone and there are many considerations to consider here on both sides of the coin.

THE COMPANY PLANS

ServiceTitan offers trades businesses an end-to-end cloud-based software platform for contractors to run their business, and to manage back-office functions for better experiences. This allows its trades subscribers to generate leads, book appointments, make bids, dispatch crews, accept payments, and to run the back office.

Its IPO price was at $71 per share for 8.8 million shares, above the initial pricing estimates offered up by the underwriting syndicate. It was originally indicated top price under $60. Its shares closed at $101.00 on the first day of trading on just 5.1 million shares. Again, many investors didn’t even know about it due to the timing. Its stock has since traded in a range of $94.02 to $112.00 since the IPO. After closing out the 2024 priced at $102.87, this stock has an impressive $9 billion market capitalization.

The underwriting syndicate did announce the closing of the overallotment option. That was an additional 1.32 million shares of its Class A common stock at $71 per share, for total gross proceeds of $93,720,000.

WALL STREET SPEAKS

Goldman Sachs and Morgan Stanley were its lead book-running managers for the offering. The quiet period has ended, and analysts have issued their new coverage with ratings and price targets:

- Canaccord Genuity (Buy) with a $120 target

- Citigroup (Neutral) with a $109 target

- Goldman Sachs (Neutral) with a $100 target

- KeyBanc (Overweight) with a $120 target

- Morgan Stanley (Equal-Weight) with a $104 target

- Needham (Buy) with a $125 target

- Loop Capital (HOLD) with a $105 target

- Piper Sandler (Overweight) with a $125 target

- Robert W. Baird (Outperform) with a $117 target (December call, non-underwriter)

- Stifel (Buy) with a $120 target

- Truist (Buy) with a $120 target

- Wells Fargo (Overweight) with a $125 target

Morgan Stanley, a lead underwriter, said:

ServiceTitan operates in large & expanding markets, with strong competitive differentiation, clear market leadership, an impressive track-record of innovation, multiple, powerful growth vectors & solid unit economics; however, trading at ~11x sales, the risk/reward looks balanced…

Morgan Stanley also noted that it has a massive TAM (total addressable market) with the potential for a durable 20% platform growth and a long-term path for over 25% operating margins. Of the $1.5 trillion that is spent by the trades each year, ServiceTitan’s serviceable addressable market based on current products and markets is approximately $13 billion, but Morgan Stanley also believes that opportunity will expand as it introduces new products and enters new trades and markets.

TIGHTLY CONTROLLED & CLOSELY HELD

ServiceTitan is in many ways going to be considered a closely-held entity where public shareholders will have very little say when it comes to voting. Its share base is dominated by venture capital investors and insiders even after the IPO. There is also a split share class (3 classes of stock) that gives the two founders a combined 70% or so of the voting power.

Insiders control 41.5% of the A-shares and four VC and investment related parties (Battery Ventures, Bessemer, ICONIQ, TPG) still have a cumulative 46% of the outstanding shares after this offering.

TIMING & SMALL TRADING VOLUME RISKS

It is unusual to see a mid-December IPO for a $9 billion market cap. One of the reasons appears to be that ServiceTitan would be in a dilutive agreement after mid-2024 if it did not become a public company.

Stocks that are thinly traded are often overlooked or intentionally screened out of any growth and value reviews by investors. The current float is barely 6.4 million shares and the 5.14 million shares that traded in the open market after those were priced on the first day (at more than a 40% instant profit to the IPO price) indicate that there is not a very large share rotation. There were only two trading since the IPO date with over 1 million shares, and even on the Jan. 6 quiet-period expiration only 546,000 shares traded that day despite some of the “Buy” ratings.

MASSIVE GROWTH

The company is growing rapidly. Revenues from Fiscal Jan-2024 were $614.3 million and Fiscal Jan-2023 revenues were $467.7 million. Its operating loss for 2024 was -182.8 million and the loss for 2023 was -$221.8 million.

Morgan Stanley sees its platform revenue growing to $724 million for Fiscal Jan-2025. It ten sees revenues growing to $834 million and then to $949 million over the next two years. One beneficiary is that the renewal rates are roughly 88% of subscribers, and the gross margins are running in the 70% and higher range.

The amended S-1 SEC filing ahead of the IPO addressed its serviceable market opportunity of approximately $13 billion also growing ahead. The filing said:

We believe that this opportunity will continue to grow as we continue to expand our platform to reach trade spend we currently do not fully service. Specifically, we do not serve all trade verticals and businesses focused on heavy commercial and construction work, and we do not focus on down-market trades businesses, which we define as having five employees or fewer.

We believe we can further expand our serviceable market opportunity by increasing the percentage of our customers’ GTV that we are able to capture as revenue, which we aim to do by providing additional value to our customers and potential customers through the development of new add-on products and deploying additional features in our Core product.

LOW FLOAT SUBJECT TO LOCKUPS

The SEC generally has a 180-day lockup period, whereby insiders of the company and their venture capital (or private equity) backers are required to hold their shares regardless of market conditions. While there can be exceptions, this means that the small float will suddenly increase in a series of secondary offerings and/or private transactions in waves. This implies that the stock’s free float that is not held by new institutions and mutual funds will be small and trading volume is likely to remain light until at least May/June of 2025.

As IPO lockups come in stages, it can allow for large gap-downs in the shares. That’s simply because more shares coming on the market act to dilute the free float even though the actual total shares outstanding is not changing. There is no rule set in stone that share prices have to fall upon the release of more shares coming into the free float.

BULL & BEAR CASES

Morgan Stanley has a Bull Case valuation of $162 for the stock that implies about 53% upside. This bull case is assuming a 21.9% revenue CAGR in CY23-CY26, gross margins reaching 73.5% in CY26, and free cash flow margin in the high-single digit range.

Morgan Stanley’s Bear Case valuation is $55, implying a nearly equal downside of about 48%. The bear case assumes a 12.9% revenue CAGR in CY23-CY26, gross margins reaching 70.0% in CY26 and free cash flow margin in the low-single-digit range.

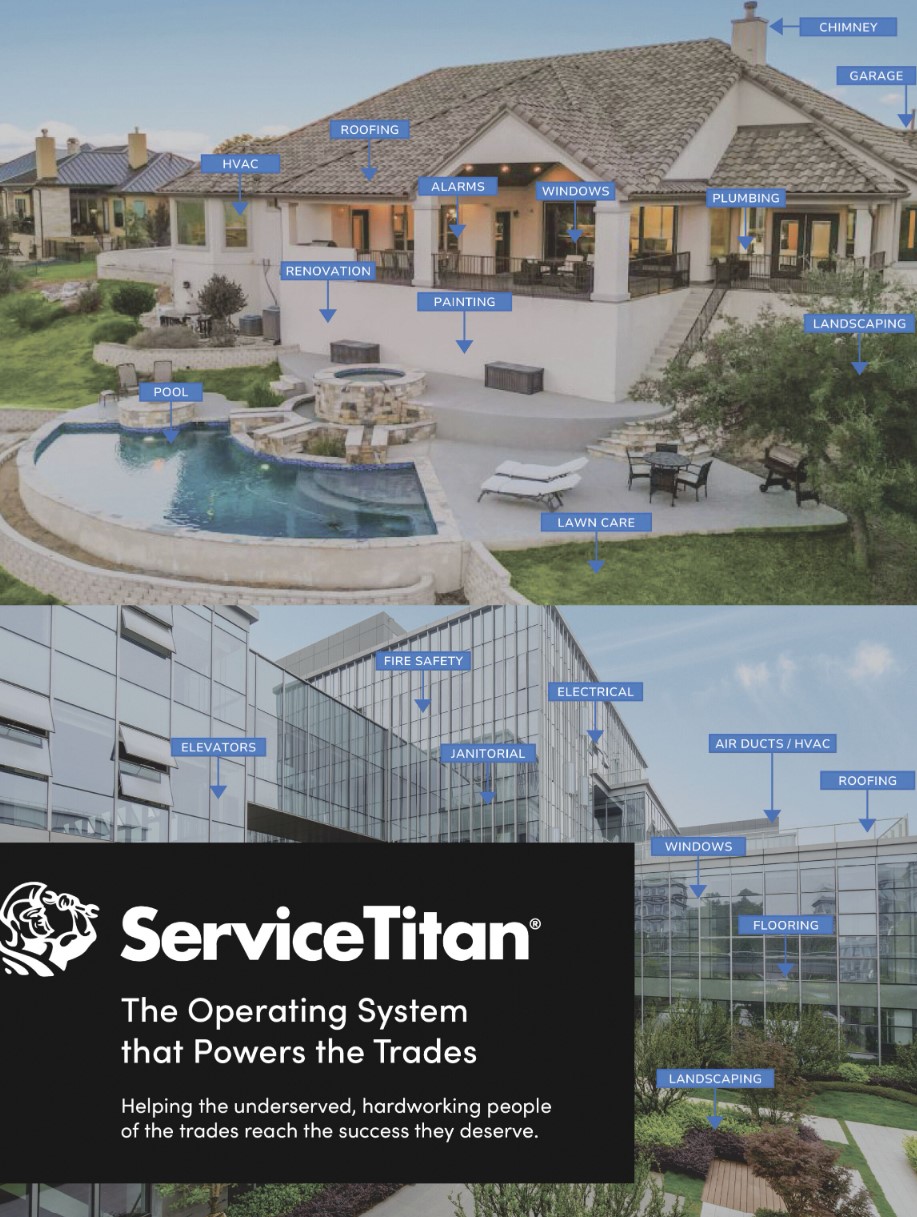

THE PICTURE WORTH 1,000 WORDS

While Service Titan serves many trades, the opportunities here may seem endless. They serve plumbing, electrical, HVAC, garage door, pest control, landscaping and others. It serviced over $62 billion in total business transaction volume for the trailing 12-month period ending July 31, 2024. The image of what are defined by “trades” should explain how many businesses and segments there are to capture.

The company claims to have over 11,800 trade customers. That number could be exponentially higher. The image below should speak at least 1,000 words. Every single one of those bullet points has thousands upon thousands of trades contractors around the U.S. alone which offer single services or multiple services shown.

DISCLAIMER

The actual IPO timing for ServiceTitan was even missed here at Tactical Bulls. Tactical Bulls does not maintain any formal price targets or any ratings on ServiceTitan. This report is not intended to be considered investment advice and this report is not a recommendation to buy or sell the stock.

All recommendations and targets offered in this report were made by the companies named. Any decision to buy or sell a stock is the responsibility of each investor. Those decisions should be made with a financial advisor. All investments involve the risk of losses.

Categories: Investing