The future of computing power will be dominated by artificial intelligence and quantum computing… A.I. is already being used, and companies are spending billion on hardware from NVIDIA Corporation (NASDAQ: NVDA) and others to fund this expansion in all aspects of business. And quantum computing stocks were surging in late-2024 and right at first in 2025.

There is just one problem with quantum computing — it’s still likely many years away before it can actually be used. Investors who had the fear of missing out (FOMO) have seen massive losses in the last week. It was billions in stock market gains, and now it’s billions in stock market losses. Poof!

Perhaps the first crack in the armor after some small stocks saw exponential gains came when NVIDIA CEO Jensen Huang said in a discussion that quantum computing will not be very useful for 15 to 30 years. NVIDIA has seen billions in orders flooding in for Blackwell and other AI systems, but quantum computing is something else entirely. His comments cost the main “quantum computing stocks” hundreds of millions to billions of dollars in the companies tied to quantum computing.

It’s important to actually consider what quantum computing really is. There is a reason it sounds like SciFi more than reality. According to International Business Machines (NYSE: IBM), here is how to think of quantum computing:

Quantum computing is an emergent field of cutting-edge computer science harnessing the unique qualities of quantum mechanics to solve problems beyond the ability of even the most powerful classical computers.

The end goal for quantum technology is to solve complex problems that the current supercomputers cannot solve — or solve fast enough.

The stock Rigetti Computing Inc. (NASDAQ: RGTI) was a $1.00 stock in November. It then peaked at $21.42 on January 6, 2025 — and now it’s down over 30% this day alone and at $6.15. In just a week, its current market cap of $1.7 billion is down by more than $3.5 billion from its peak. The analysts who cover Rigetti have annual estimates of $11 million in 2024 revenues and $15.5 million in 2025 revenues.

Quantum Computing Inc. (NYSE: QUBT) is another quantum player that lost massively. This was also a $1.00 stock in November. While the 27% drop on Monday to $6.50 is massive, it peaked at $27.17 in mid-December. The $840 million market cap at the current price is down close to $2.5 billion from its peak.

D-Wave Quantum Inc. (NASDAQ: QBTS) was last seen down 33% at $3.85 on Monday but still with a $1 billion market cap. QBTS was basically a $1.00 stock in November and rose up to over $11.00 to kick 2025 off. Its drop is close to $2 billion in market cap.

IonQ, Inc. (NASDAQ: IONQ) has actually been punished the least. With a 14% drop to $27.75 on Monday, its shares went from roughly $15 in early November up to a zenith of $54.74 on January 7. Its market cap of $6 billion is down almost the same $6 billion from its peak — with expected $41.6 million in 2024 revenues to grow to $83.5 million in 2025 revenues. Goldman Sachs recently raised its price target to $30 from $16, but that was while it maintained its Neutral rating.

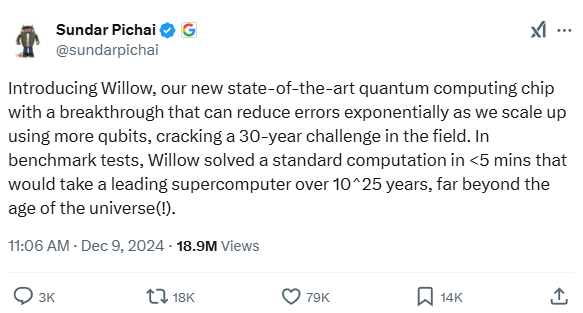

One of the biggest boosts for quantum computing stocks was the news in December when Google’s parent Alphabet Inc. (NASDAQ: GOOGL) signaled that it had experienced a major breakthrough with its new “Willow” quantum computing chip. If the information was accurate, it could move the process of what the best supercomputers might take generations to solve currently less than 5 minutes to solve the problem.

It sure sounds like about $10 billion in market value has been lost over the last week. And sadly, the value of these stocks are still by and large all exponentially higher than when “the quantum bubble” started.

Categories: Investing