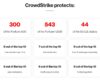

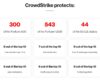

The massive software upgrade SNAFU from CrowdStrike Holdings, Inc. (NASDAQ: CRWD) was self-inflicted and quite painful for its customers and shareholders alike. Many investors worried at the time that botching a software […]

The massive software upgrade SNAFU from CrowdStrike Holdings, Inc. (NASDAQ: CRWD) was self-inflicted and quite painful for its customers and shareholders alike. Many investors worried at the time that botching a software […]

The rise of NVIDIA Corporation (NASDAQ: NVDA) was already impressive enough before 2023, but the surge to well over $3 trillion in market value in the period of time is something that […]

The bull market rages on. Many stocks have pulled back from their post-election highs, but the Dow hit a record high closing price and the S&P 500 itself is within 1% of […]

It’s time for some sincere insensitivity when it comes to you and the funding of your retirement. If you want to scare most old people, don’t bother telling them they will not […]

There are monopolies and there are oligarchies. The United States may not have a monopoly in retail, but there sure seems to be an oligarchy for the “haves” crushing the “have-nots.” Imagine […]

Stocks were looking for direction to close out the week, with the Dow up 0.1% and the S&P 500 and NASDAQ both down 0.1% to 0.2%. The markets are trying to plan […]

The Bitcoin bull market is in full swing and the digital asset has nearly hit $100,000 (it just broke $97,500 for the first time). Bitcoin was already having high hopes in 2024, […]

Stocks were indicated open up yet again on Thursday with the Dow, S&P 500 and NASDAQ all showing green. With a new regime set to make changes in the coming years many […]

Walmart, Inc. (NYSE: WMT) has become the king-maker retail stock in 2024. It’s already the world’s largest retailer and within two years it is expected to post more than $700 billion in […]

Chewy, Inc. (NYSE: CHWY) was a huge winner during the stay-at-home lifestyle during and after the pandemic. And then the bottom fell out as Chewy fell to under $15 per share during […]

Stocks were positive on the Dow, S&P 500 and NASDAQ on Wednesday morning with all indexes still very close to all-time highs. With a new regime set to lead and make changes […]

There are many different investment and trading strategies that tactical investors use to try to make outsized gains. One common theme is to buy companies that keep exceeding earnings estimates with “beat […]

There is a lot of excitement about the economy and stocks now that the election is over. It’s just hard to ignore that stocks are basically at all-time highs after that post-election […]

Stocks were looking lower on Tuesday as international tensions with Russia are hot, and even oil and bond yields are lower as a result. Stocks are still very close to all-time highs […]

Investors often want to know why they should dare keep buy stocks if the stock market is at all-time highs. The reality is that stocks do rise over time, or at least […]

Many investors are looking for new ideas that can juice their equity returns now that the 2024 presidential election results are known. With a sweep in the House and Senate, big policy […]

Ingram Micro Holding Corporation (NYSE: INGM) is public once again. After its private equity-backed offering of 18.6 million shares, and an additional 2.79 million shares in an overallotment option, the world’s top […]

Stocks were looking for direction on Monday with the Dow slightly in the red and the NASDAQ and S&P 500 barely positive. With a new regime set to lead and make changes […]

If you hear the name Warren Buffett and “he bought shares of…” in the same sentence, it means a whole bunch of investors just started paying attention. The new 13F filing from […]

Cisco Systems, Inc. (NASDAQ: CSCO) is just not what it used to be. Its stock may be close to challenging multi-year highs, but its stock chart shows that it still hasn’t taken […]