Gold has been quite volatile in 2024. The reality is that a lot of the bullish stance for gold was interrupted over the last 45 to 60 days. U.S. growth and interest […]

Gold has been quite volatile in 2024. The reality is that a lot of the bullish stance for gold was interrupted over the last 45 to 60 days. U.S. growth and interest […]

Stocks were looking for direction heading into Friday’s key jobs report. The top equity indexes are basically all at all-time highs and investors are planning for 2025 now that the election is […]

Tactical Bulls has been tracking the broad equity market gains since election day. While some gains have been more than impressive, the reality is that the gains are far from universal. Some […]

Stocks were marginally higher on Thursday with the Dow, S&P 500 and NASDAQ all basically at all-time highs. With the election over and a new regime coming in, investors are planning for […]

Salesforce Inc. (NYSE: CRM) has gone from a company that may have lost business as the surge in artificial intelligence was directed toward just a few companies. That was then. Now CEO […]

General Motors Company (NYSE: GM) was a great growth story in 2024. The company was setting solid earnings, it had a dirt cheap earnings multiple, and it was buying back so much […]

Stocks were surging higher on Wednesday based on strong earnings from Salesforce and others riding the AI-growth train. The top equity indexes are basically all at all-time highs and investors are planning […]

The end of each year is a good time to reflect and come up with New Years Resolutions. Companies can make resolutions too, by rewarding investors with shareholder-friendly actions. A stock split […]

Regulated Utilities are supposed to be safe for investors during times of uncertainty. They have decades of operating history and wide moats that are nearly impossible for competition to come in. Regulated […]

Stocks were looking for direction on Tuesday after the indexes were mixed on Monday. Investors may be at a crossroads as major U.S. equity indexes are basically all at all-time highs and […]

As the last month of 2024 has arrived, investors better start making their plans for how they want to be invested in 2025. The election is over, a new regime is coming […]

Intel Corporation (NASDAQ: INTC) is one of the greatest American technology growth stories in history. The problem is that you would never know that if you just tuned into the story in […]

If you have never heard of a company called Nebius Group N.V. (NASDA: NBIS), you probably are not alone. What you have definitely heard of is artificial intelligence. And you have definitely […]

Stocks were mixed on Monday after the Thanksgiving shortened week. The major U.S. equity indexes are basically all flirting with all-time highs. Now is a time for financial reflection with the election […]

There is a lot more attention on bitcoin now that it is so close to challenging the $100,000 price barrier. There is a reason to say that the $100K price barrier may […]

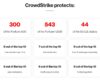

The post-earnings theme for CrowdStrike Holdings, Inc. (NASDAQ: CRWD) was some serious profit taking that was frankly overdue. The data security provider’s self-inflicted software upgrade SNAFU from July took until the very […]

Stocks were looking for direction with major indexes at or just under all-time highs the day before Thanksgiving. Now is a time for financial reflection with the election outcome known, with new […]

We have all heard by now that tariffs are coming more than once or twice. Donald Trump has maintained that he wants to install more tariffs during his campaign and after the […]

Stocks were looking at a mixed open in early trading indications on Tuesday. This is after the strong rally continued and the major indexes are all at or close to all-time time […]

Stocks were looking at a strong open on Monday with the Dow, S&P 500 and NASDAQ all looking at gains of 0.5% or more. Stocks are at all-time highs, the election is […]