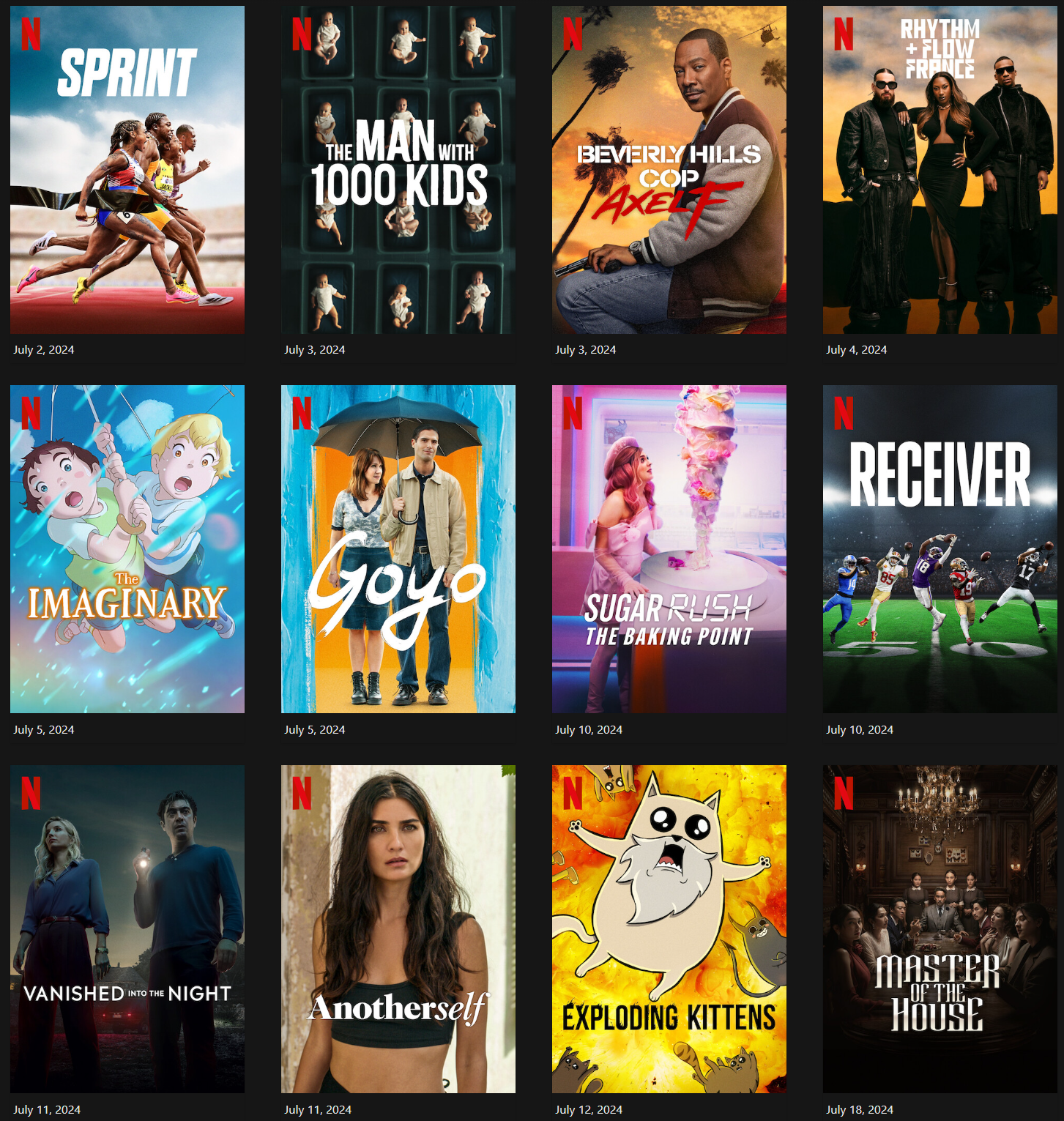

What’s coming soon to Netflix

Netflix, Inc. (NASDAQ: NFLX) just seems as though it can do no wrong. This growth is happening despite price hikes, despite cutting off account sharing abuse, and despite introducing lower-fee tiers with ads. The streaming media leader closed up 1.3% at $869.68 ahead of earnings on Tuesday. It was last seen trading up over 11% at $967.50 in mid-day trading.

The performance for 2024 was more than impressive with Netflix shares raising 83% for the year. That’s even after a 65% gain for all of 2023 after a very difficult 2022.

Tactical Bulls had tracked how Netflix analysts had been continually raising their price targets during 2024. The company managed to add more subscribers in Q4-2024 than in any quarter in its history after more than 20 years as a public company. In fact, the 18.9 million additional paying subscribers was nearly double the expectations.

Analysts will love the moderate price hikes and the additional $15 billion authorized for share buybacks. And with additional sports exclusives and additional reboots of series features like Squid Game, keeping its paying subscribers as customers is being viewed as a nearly certain lock.

Two big analyst upgrades have already been seen after earnings and guidance. Barclays upgraded Netflix to Equal-Weight from Underweight and raised its price target to $900 from $715, which means one of the last big bears has thrown in the towel. Canaccord Genuity also raised its rating to Buy from Hold and its price target was raised to $1,150 from $940. And the boutique firm Rosenblatt also raised the rating to Buy from Neutral and raised the target to $1,494 from $680.

ALSO READ: WILL TOP 20 STOCKS OF 2017 DELIVER IN 2025 UNDER TRUMP 2.0?

Here are more than a dozen additional analyst calls reiterating the ratings and increasing the target prices in the reports:

- Baird (Outperform) target to $1,200 from $875

- BofA (Buy) target to $1,175 from $1,000

- BMO (Overweight) target to $1,175 from $1,000

- Deutsche Bank (Hold) target to $875 from $650

- Evercore ISI (Outperform) target to $1,100 from $950

- Goldman Sachs (Neutral) target to $960 from $850

- JPMorgan (Overweight) target to $1,150 from $1,000

- KeyBanc (Overweight) target to $1,100 from $1,000

- Loop Capital (Hold) target to $1,000 from $925

- Morgan Stanley (Overweight) target to $1,150 from $1,050

- Needham (Buy) target to $1,150 from $800

- Pivotal Research (Buy) target to $1,250 from $1,100

- Macquarie (Outperform) target to $1,150 from $965

- Oppenheimer (Outperform) target to $1,150 from $1,040

More price target hikes are expected from reports which were not yet available or seen this morning. Just a week before earnings an upgrade had been seen by Seaport Global, raising the rating to $Buy from Neutral with a $955 price target.

One additional issue to consider is that Netflix is now trading with more than a $400 billion market cap. The company’s 2025 revenue target range is $43.5 billion to $44.5 billion, which was above Wall Street’s midpoint estimate of $43.6 billion.

Categories: Investing