Bulls usually win over bears in the long-term. Can long-term value win over growth?

The classical definition of a bear market is where the broad stock market indexes sell off by 20% or more from their highs. Most investors are not happy during a bear market because their assets are down an average of 20% or more. The reality is that not all bear markets are equal. Some bear markets, but not all bear markets, also create almost immediate opportunities for long-term investors and short-term traders alike.

As 2025 initially saw the Trump-Bump turn into the Trump-Fade around tariffs and higher macro uncertainty, the U.S. markets did briefly enter bear market territory. Even the NASDAQ was down 23%, led by losses in the favorites of Artificial Intelligence and the Magnificent 7.

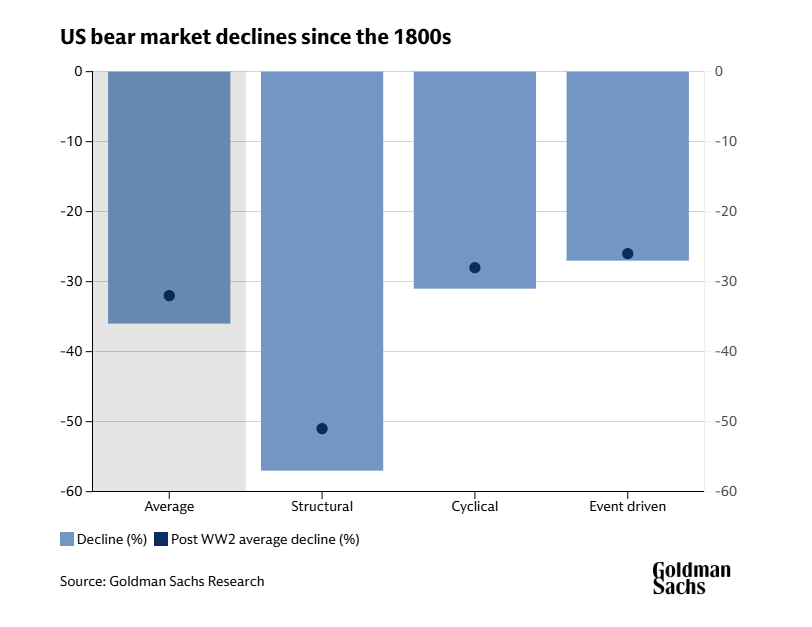

Goldman Sachs may have some identifying tools that can help investors of all sorts identify what sort of bear market investors are in when they arise. The firm used data that was said to go back as far as the 1800s to differentiate between types of bear markets.

Every bear market, just like each recession, is different. To prove this, Goldman Sachs noted that these bear markets differ in depth and length AND differ by the factors that trigger them. The three types of bear markets are identified as follows:

1 — The Structural Bear Market

2 — The Cyclical Bear Market

3 — The Event-Driven Bear Market

There is just one trick to identifying bear market classifications. Investors and traders can always look back in time and identify what type of bear market the market was seeing. The trick is to differentiate what type of bear market is unfolding using real-time economic data, sentiment and market prices. It’s not always that easy, and sometimes it feels at any given moment a developing bear market could turn into a grizzly bear market.

STRUCTURAL BEAR MARKETS

According to Goldman Sachs, structural bear markets are generally considered to be the worst type of all three bear market categories. Fortunately for those of us who have to invest long-term and short-term regardless of market conditions, structural bear markets are also the rarest sort of bear markets.

Structural bear markets are said to always be preceded by asset bubbles of some form or another, usually backed by very high private sector debt. Look out when these bubbles burst, and for whatever reason. These bear markets tend to trigger a deleveraging cycle and a very sharp fall in asset prices. According to Goldman Sachs Insights:

In a structural bear market, equities may fall by 50% or 60% over three or four years and take a long time, typically about a decade, to recover fully in nominal terms.

Goldman Sachs also warns that structural bear markets usually feed into some kind of problem in the banking sector or the real estate sector — or both. Can you say “Global Financial Crisis” fast enough here?

CYCLICAL BEAR MARKETS

Cyclical bear markets oscillate around the downs of economic cycles. When investors anticipate a recession, stock prices fall ahead of the potential downturn in activity and profits. Stock prices then recover as investors get some kind of policy response that improves the prospect of an economic recovery.

It’s too soon and the markets have recovered too much to include “tariffs” in a cyclical bear market example. This latest example hasn’t played out long enough (or may have already been squashed) and you have to study the cycles before World War II and in the very early 1990s for relevant context.

See more below on the blending of cyclical and event-driven bear markets.

EVENT-DRIVEN BEAR MARKETS

Goldman Sachs’ third classification is an event-driven bear market. This is where stocks slide lower by some kind of shock that derails an economic cycle. This would be like a war or a commodity crisis. And let’s go ahead and throw the pandemic in there — the fastest bear market and the shortest recession.

Goldman Sachs noted that the downturn in equities in 2025 was triggered by tariffs — this is event-driven, at least as of this time. Their reporting shows how cyclical and event-driven bear markets don’t tend to vary that much in terms of the absolute price declines (typically around 25% to 30%). The difference between the two is the speed of decline and the subsequent recovery.

Goldman Sachs showed that event-driven bear markets are much quicker, but the main difference is whether a recession comes or not. It said:

Sometimes shocks lead to recessions, and what starts out as a temporary drawdown can last a bit longer as that shock morphs into a recession.

LOOKING BEYOND TARIFFS & TOWARD 2026

Goldman Sachs recently raised its S&P 500 price target back up to 6,500 (closer to 6,020 at this print time). The firm did say that, at this stage, it’s not certain whether we are avoiding a recession or not. It was also noted that corporations broadly have very healthy balance sheets and that households currently have pretty good balance sheets. And even with much higher valuations, and the decade-long rise in corporate profits, has Goldman Sachs in the camp of not being in a speculative bubble now.

Our view is that recession risk has definitely moderated because tariffs have largely been wound back for large parts of the world and indeed, most recently, for China. Goldman Sachs economists had forecast the probability of recession at around 45% in the US over the next 12 months, and after the recent pause between China and the US, they reduced that probability to around 35%. That’s still above the usual background risk in any given year of about 15% probability of recession.

And while Goldman Sachs sees reasonable upside in equities looking a year out, the general view is that there will also be more volatility ahead.

HISTORIC BEAR MARKE DECLINES

Goldman Sachs created a table identifying typical U.S. bear market declines since the 1800s.

Chart Courtesy of Goldman Sachs Insights

Categories: Economy, Investing, Personal Finance, Retirement