NVIDIA image of Quantum Cloud

There has been a lot of noise around the DeepSeek AI release. It also caused a lot of financial damage in the stocks targeting the growth of AI due to its low-cost claims versus what has spent by U.S. companies. NVIDIA Corporation (NASDAQ: NVDA) even lost several hundred billion worth of market cap in a single session the prior week. What if this huge drop was all a misunderstood opportunity?

Morgan Stanley’s team was led by Joseph Moore and the team has maintained its Overweight rating and $152 price target on NVIDIA. And while the firm acknowledges that DeepSeek does create some headwinds, NVIDIA is still Morgan Stanley’s “Top Pick” in the sector.

Investors should keep in mind that Morgan Stanley did cut NVIDIA’s price target to $152 from $166 back on January 28 in response to the DeepSeek impact and sentiment. Tactical Investors have recently found themselves wondering where might be safe after hundreds of billions of dollars in market cap vanished after the DeepSeek release news.

Some of the headwinds addressed by Morgan Stanley are around export controls regarding China. There are also concerns regarding longer-term investment (capex) and that sentiment on Nvidia took a big hit from potential longer-term risks. The report noted:

It’s a strong evolutionary upgrade in the AI space, but one of many that has taken place in the last year – in a space where the CEO of NVIDIA has said that they have improved AI performance at the processor level by one million x in the last decade and will do so again in the next decade, some deflation is not surprising.

Morgan Stanley did note that the stock drop has become the bigger story for now. The three biggest risks involve further export controls, the financing for AI spenders, and negative investor sentiment.

The positive case beyond the noise is in the channel checks for revenues. Morgan Stanley’s near term checks are said to be firming for its Hopper and all Blackwell models. After speaking with buyers, there are no changes in spending plans by the major participants – and clearly there is still a commitment and financing for large scale clusters.

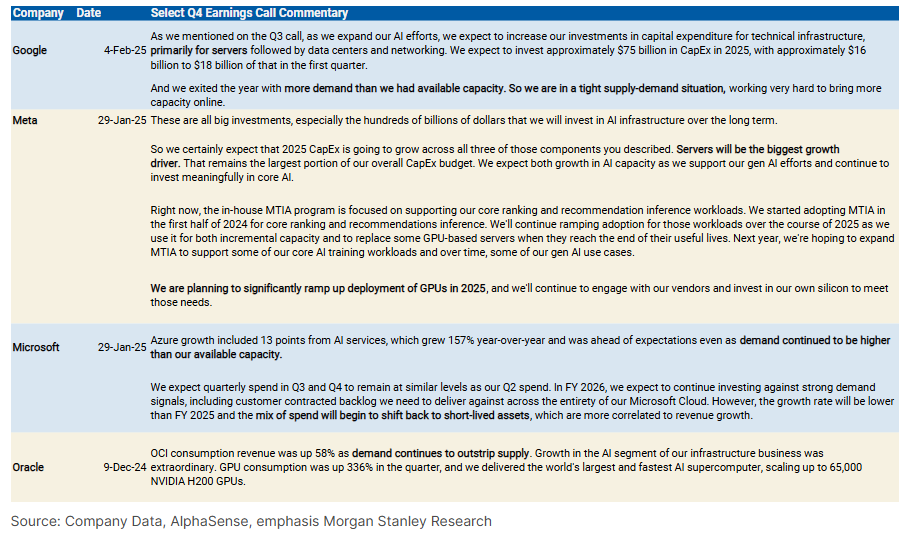

The team also noted that it expects positive language to come back into the mix after NVIDIA reports its quarterly results. The big spending outline in the report also featured a detailed view (see below) of what Google, Meta, Microsoft and Oracle all have in their spending plans for AI. In the end, Morgan Stanley believes that the recent DeepSeek-inspired sell-off created a buying opportunity.

NVIDIA shares were last seen trading up 1.5% at $126.75 on Thursday morning. Its 52-week trading range is $66.25 to $153.13 and Morgan Stanley’s $152 price target is handily lower than the consensus price target of about $175 listed on NASDAQ.

Categories: Investing