Goldman Sachs is one of the most prestigious investment banking firms on Wall Street. It’s also ranked among the global leaders in most of its core operations. What’s unique about its investment model is that Goldman Sachs only caters to financial institutions and to high-net-worth individuals. When the firm issues Buy and Sell recommendations, it is telling the ultra-wealthy where to invest.

The “U.S. Conviction List” is the list of stocks in each sector that Goldman Sachs feels will outperform over the course of the coming year. This January update to the Conviction Buy list is technically the firm’s newest top picks for 2025. There was an adjustment in December and in November, and those seven additions were already featured here on the Tactical Bulls site.

When analysts issue price targets, they generally use a 12-month period in their outlooks. Goldman Sachs makes routine monthly adjustments to the Conviction Buy list, and the firm can make adjustments when price targets are achieved or when the fundamentals are changing.

Now it’s time for the January update, listed alphabetically to avoid any appearance of ranking.

BELDEN

Belden Inc. (NYSE: BDC) was added Belden to the U.S. Conviction List in the January update. The firm already had a Buy rating on the stock and it has a $139 price target. Belden closed out 2024 at $112.61, implying upside of about 23% from the current price.

Goldman Sachs sees the company being well positioned as a cyclical recovery beneficiary in its industrial end markets in 2025. The firm also sees additional upside ahead by continuing to focus on expanding its software solutions business that has higher margins for its earnings.

NORWEGIAN

Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) was also added to the U.S. Conviction List in the January refresh. Goldman Sachs has a Buy rating and a $35 price target. Norwegian closed out 2024 at $25.73, offering an implied upside of 36% if the firm’s projections come true.

The call talks up Norwegian’s strong setup for 2025. The firm also pointed to accelerating net purchase intent from customers for the year ahead. Another boost is some self-help as Norwegian has the opportunity to benefit from significant cost savings that can still be realized after a management shakeup a year earlier.

UBER

Uber Technologies, Inc. (NYSE: UBER) was also added to the U.S. Conviction List for the January refresh. Goldman Sachs has a Buy rating and a $96 price target. What will stand out here is that this call represents more than 50% in implied upside from the $60.32 closing price for 2024 and from the $62.50 price it was trading at after Thursday’s call.

According to Goldman Sachs, Uber should be able to deliver on its prior forecasts from the 2024 investor day. This is despite the rise of autonomous vehicles. Goldman Sachs also sees Uber scaling its end markets and lifting its profitability, margins and free cash flow. Those gains will also be driven by Uber’s platform cross-selling and its flywheel effects.

ALSO READ: WHY THE 20 TOP 2024 STOCKS MAY KEEP SURGING IN 2025

3 DELETIONS

Three deletions were seen from the U.S. Conviction List in the January refresh. These deletions do not mean that Goldman Sachs sees no more upside potential, but the firm sees better implied upside potential in the newer selections from its list of Buy-rated stocks. These were seen as follows:

- Fox Corporation (NASDAQ: FOXA) after a $48.58 close and after a 60% rally over the last year. Goldman Sachs had first initiated its Buy rating in June of 2023 with a $42 price target and that target was raised as high as $57 within the last month.

- Parker-Hannifin Corporation (NYSE: PH) after a $636.03 close, up about 38% from a year ago. The firm has had PH on its Conviction List for a year.

- TPG Inc. (NYSE: TPG) after a $62.84 close, up over 55% from a year ago. Goldman had a Buy rating on it since November of 2023.

DISCLAIMER

Tactical Bulls always reminds its readers and investors that no single analyst report should ever be the sole basis to buy or sell a stock. This remains the case even for the mighty Goldman Sachs. There are of course no assurances that any of the price predictions and the scenarios that back the calls up will actually come to fruition. After all, Goldman Sachs can be wrong just like other firms.

Any decision to buy or sell (or to hold or short sell) is up to each investor and that decision should be made with a financial advisor. All ratings and price targets cited above are from Goldman Sachs. Tactical Bulls does not maintain formal ratings or price targets on the companies mentioned in this report.

STOCK CHARTS INCLUDED

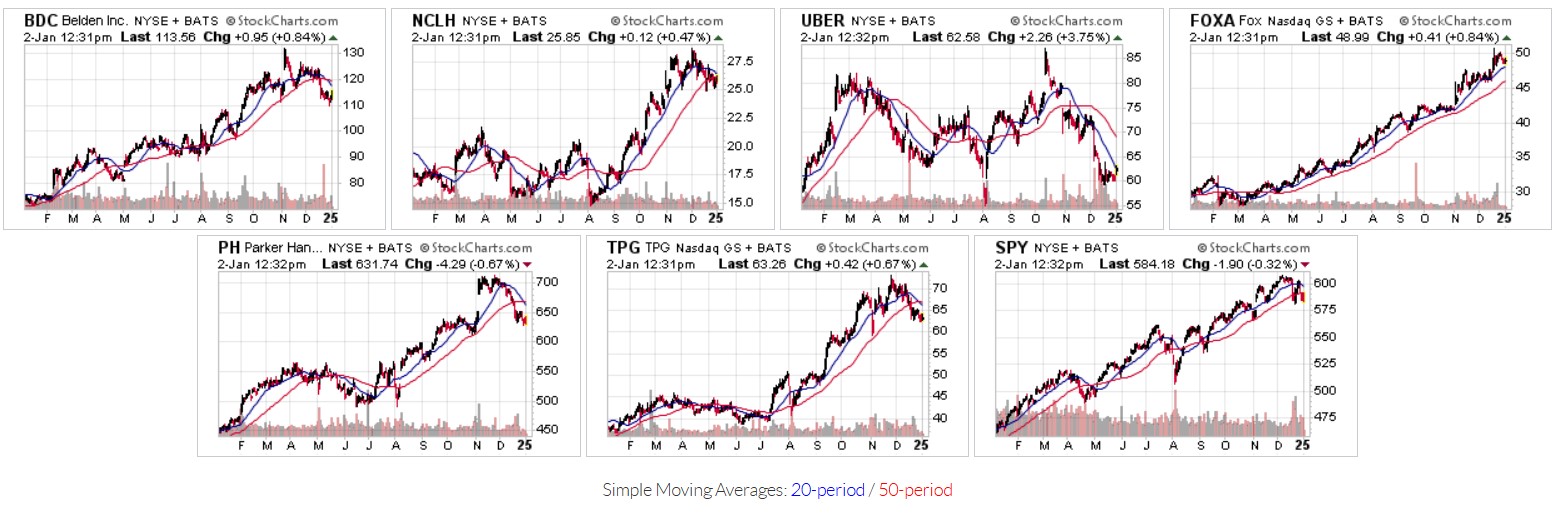

The following charts have been provided by StockCharts.com and include a one-year price move.

Categories: Investing