Should investors chase bankrupt companies for their underlying asset values? This is a legitimate question, particularly for “tactical” investors who are willing to invest where others may avoid. It seems hard to imagine with all the subsidies and tax breaks, but yet another alternative energy company appears to be on death’s door under bankruptcy protection.

SunPower Corp. (NASDAQ:SPWR) claims to be a leading residential solar technology and energy services provider, but the company has filed for bankruptcy protection. This is the big question of the day — What should new and existing investors do at this point?

SunPower has announced an asset purchase agreement whereby Complete Solaria, Inc. (NASDAQ: CSLR) is the Stalking Horse Buyer for assets associated with SunPower’s Blue Raven Solar business, New Homes business, and non-installing Dealer network.

Complete Solaria, subject to court approval, is set to acquire the assets and assume certain related liabilities for $45 million in cash. SunPower will provide other interested parties the opportunity to submit competing bids for SunPower’s assets. This “other interested parties” is where things could interesting for new and existing investors.

ALSO READ: WHAT ACTUALLY TRIGGERS EMERGENCY RATE CUTS!

SunPower’s announcement indicated that the company plans to continue a sale process for remaining assets after this $45 million deal. The company is also said to be working to secure long-term solutions for the remaining areas of its business.

Where this bankruptcy story gets more interesting is that SunPower’s market capitalization is still about $112 million. That is even after its shares are down about 22% at $0.635. While Tuesday’s sharp drop represents an all-time low for SunPower shares, if you back out $45 million this still implies that there is some value left to the assets — to the tune of about $67 million.

Will new investors get a piece of that $67 million? That is the big question, but history should bring more caution than ambition. The bankruptcy process, even with a Stalking Horse Buyer for some assets, generally tends to reward creditors (and the attorneys) long before rewarding shareholders with a return of capital or with a viable future business. That is not always the case, but it’s a generality that usually holds true.

What new investors should consider here is that unlocking any value of the remaining assets will take quite some time. That’s assuming it is even possible. It is very likely that SunPower’s stock will be delisted or trade on over-the-counter in the weeks ahead. There may not even be a market for its shares — and that could last for months or years.

SunPower is a money-loser on a profit and loss scenario. If it was profitable it likely wouldn’t need bankruptcy protection. The company listed assets and liabilities between $1 billion to $10 billion in its filing. And its stock is down 90% this year alone.

SunPower’s remaining operations are likely to keep losing money as the company had already halted issuing new leases, solar shipments and installations.

Now there are other considerations: Did SunPower bother mentioning that, on top of a difficult interest rate and business environment, that there are also allegations of misconduct in its reporting practices? And was a subpoena issued by the Securities and Exchange Commission mentioned? And what about Ernst & Young having resigned earlier this year? And what about the dreaded “going concern” note from last year?

Almost every analyst who followed SunPower slashed their targets in July. Some of these calls were effectively valuing the stock at $0.00 or well under $1.00 — analyst “code” for being nearly worthless.

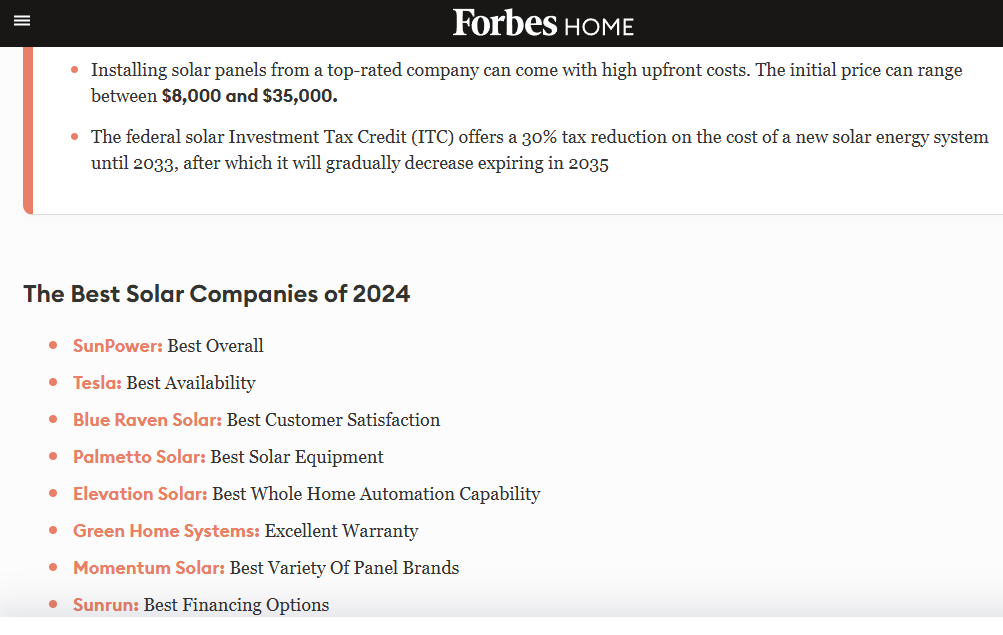

The ripple effect will be far and wide as SunPower has ties to hundreds of thousands of homes with solar equipment. Its components dealer network was extensive, and companies like Total, Enphase, BofA and others all have ties into SunPower exposure. Now homeowners may have to begin new relationships with entities for servicing. And to show how bad this filing is in non-financial implications, Forbes had SunPower listed as the best overall solar company for 2024. The Best… Really?

The Forbes list of best solar companies for 2024… SUNPOWER WAS #1!!!!

If you haven’t been scared into avoiding this SunPower situation yet, what more is it going to take? Existing investors have already endured massive pain here in SunPower’s stock. Why should any new investors choose this carcass when there are so many other stocks to choose from with winning track records?

Categories: Investing