BP PLC (NYSE: BP) saw its credit rating outlook cut to Stable from Positive at S&P Global. The ratings agency did maintain its ‘A-‘ long-term and ‘A-2’ short-term issuer credit ratings for the British oil and gas giant. The question at hand is whether BP’s use of its cashflow surplus to facilitate more share buybacks will overpower any meaningful debt reduction and create lower operating ratios than its peers.

Tactical Bulls now hold the BP ADSs in a different light compared to other oil giants. The problem is that BP’s new repurchase plans are eating up too much capital that could otherwise be used to help the company out on a longer-term basis. Having higher debt levels was not a problem when interest rates were so low that debt felt almost free to carry. Issuing new debt when 10-year Treasury rates are 4.50%, and short-term rates are even higher, comes with a real sacrifice to liquidity and cash flow.

THE RISK…

One interesting aspect about BP’s capital allocation plans under its new leadership is that the damage appears self-inflicted. For management to focus on further share reduction at the expense of maintaining higher debt levels means that it is opting to lock-in higher capital costs in an effort to offer a short-term juice to its stock. One problem — that “juice” did not add to the share price. Not yet at any rate.

Perhaps the silver lining is that BP could learn from what the market is telling it. After all, its problems are not irreversible like Petrobras in Brazil.

BP’s debt load was $24 billion as of the first quarter of 2024. That is up from $21.2 billion a year earlier. Its debt-to-capitalization ratio also rose to 22% from 19.6% over the same period. Allocating 80% of surplus cash flow toward dividends and share buybacks is not without a cost.

BofA NOW SAYS…

BofA Securities is sounding more cautious on BP leaning heavily on its balance sheet to fund its additional share buyback plans. The firm maintained its Neutral rating on BP shares and the $38 price objective is less than 10% higher than the current $35.50 share price.

BofA noted that BP’s new cash return commitments push the oil break-even price up to $90 versus less than $70 (per barrel) for European rivals like Shell and TotalEnergies.

REVERSING POSITIVE CALLS ELSEWHERE?

Some other analysts had maintained some positive directional bias hiking BP’s share price targets over the last 60 days. That was before the S&P notes so some of the data may now be considered “dated” compared to newer calls.

- TD Securities (Buy) raised its target to $44 from $43 (May 8)

- Piper Sandler (Neutral) raised its target to $43 from $40 (April 18)

- Raymond James (Outperform) raised its target to $45 from $42 (April 15)

- Scotiabank (Sector Outperform) raised its target to $47 from $45 (April 11)

- Wells Fargo (Equal Weight) raised its target to $42 from $38 (April 11)

BP’s NYSE-listed shares were closer to a $37 to $39 range when those target hikes were being made. Now BP’s shares trade close to $35.50. The 52-week range of $33.52 to $40.84 isn’t indicative of a massive turnaround being expected by investors using real capital decisions to buy or sell the shares.

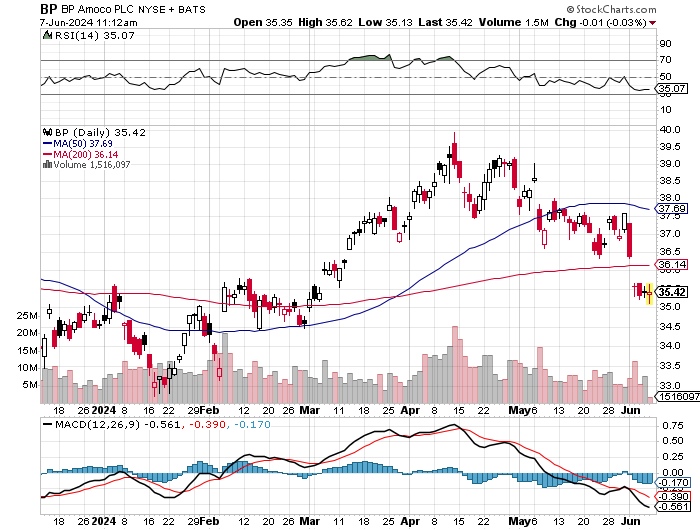

WHAT’S THE CHART SAYING?

The stock chart below has been provided by StockCharts.com.

BP chart courtesy of StockCharts.com

Categories: Investing