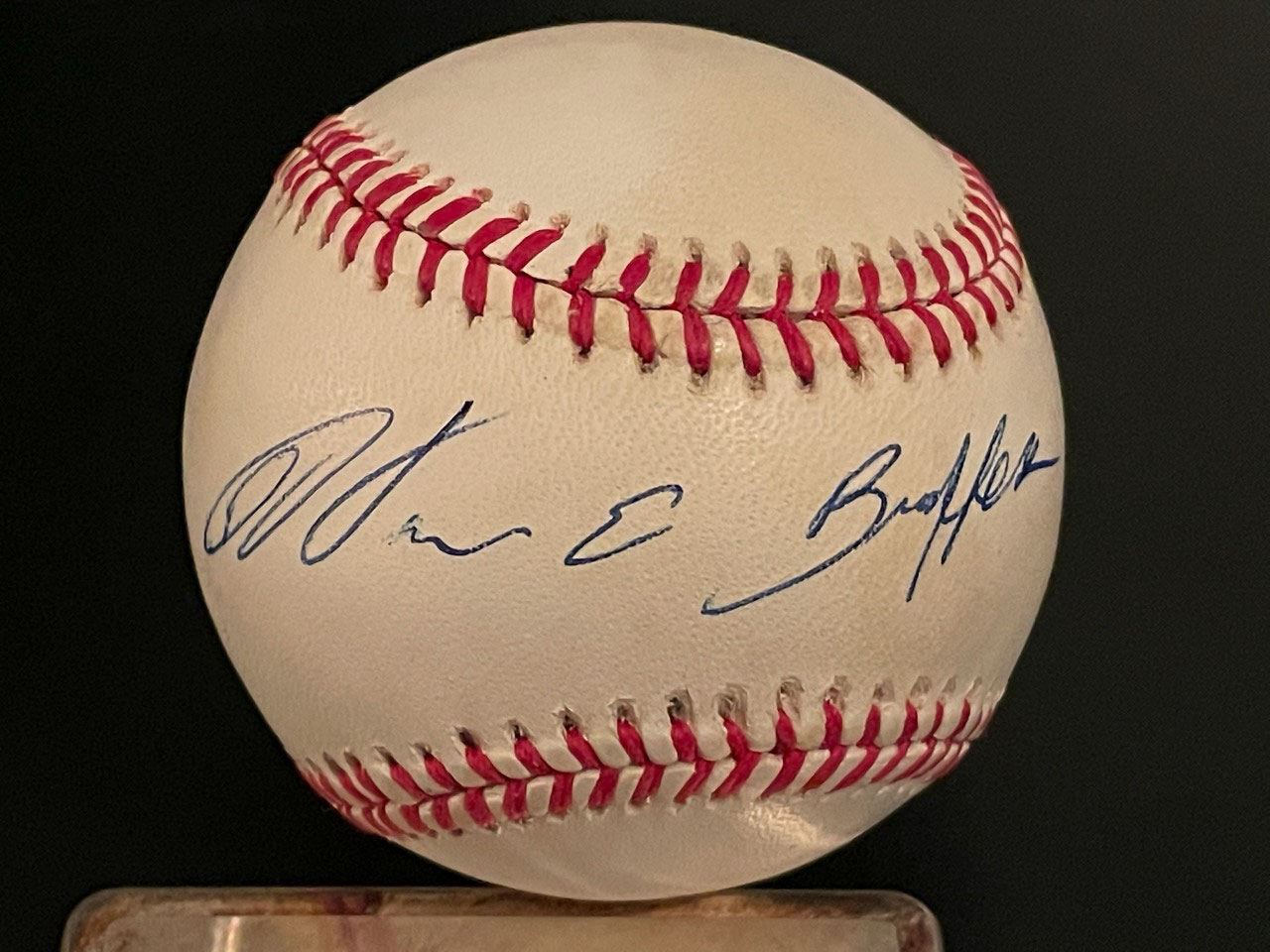

My personal collection Warren Buffett signed baseball

Berkshire Hathaway, Inc. (NYSE: BRK-B) is one of the largest companies in the world. What’s unique about it versus other conglomerate operations is that it has very few analysts who routinely issue changes to their ratings and price targets. Now there have been some analyst changes after Warren Buffett’s annual letter to shareholders that comes with each year-end earnings report from his giant company — but tactical investors may feel less confident at all-time highs than its long-term shareholders feel.

Berkshire Hathaway is the only company with a $1-trillion market cap that is not part of the techno-economy. After a nearly 4% gain, the stock is worth $1.07 trillion. Warren Buffett has amassed more than $300 billion in cash after liquidating some of his key stocks over the last year or so. He has also been buying back far less stock, effectively none of late. And now both the A-shares and B-shares are at all-time highs again after earnings.

CEO Warren Buffett, who is a young 94, communicated in his shareholder letter that it will not be long before Greg Abel replaces him as CEO of Berkshire Hathaway. Abel is more than 30 years younger than Buffett, but this succession will create a potential issue for tactical investors and long-term investors alike. This is because there has long been considered to be a “Buffett Premium” as long as Buffett is there running the show and maintaining continuity of the structure and corporate gel.

The reality is that the market just doesn’t know the rest of Berkshire Hathaway’s team the same way they know Buffett (and the late Charlie Munger). This and valuations (below) may pose the potential problem for tactical investors.

Warren Buffett has also communicated for years that intrinsic value is the key metric to use for evaluating Berkshire Hathaway total valuation. Unfortunately, Buffett doesn’t disclose what he pegs the intrinsic value at. But without share buybacks to lend mass support, perhaps even Buffett is a bit puzzled over $1 trillion valuation.

So where does all of this leave tactical investors in the crosshairs of long-term versus rotational themes?

Long-term investors may keep loving Berkshire Hathaway. The tactical investment case may be a bit more jaded considering book value, all-time highs, and the inevitable day when Warren Buffett is no longer there.

KBW SAYS…

Analyst Meyer Shields of Keefe Bruyette & Woods has a Market Perform rating on Berkshire Hathaway. He boosted his class-A price target to $775,000 from $750,000 after the earnings report. His 2025 earnings estimate was raised nearly 5% to $31,600 per A-class share.

His view is that 22-times estimated earnings (and 159% of book value per share) fully reflects the company’s earnings prospects, ongoing macro uncertainty and Berkshire Hathaway’s unique management succession risks.”

UBS SAYS…

Brian Meredith of UBS noted positive developments in Berkshire Hathaway’s insurance unit like GEICO’s underwriting margin coming in at 19%. UBS’s rating is Buy and the price target on Class A shares was raised to $836,135 from $803,444. The analyst also raised his 2025 earnings estimate (per share) buy 5% to $31,565. That is roughly 23-times expected earnings. Meredith’s intrinsic value of about $710,000 is close to the current share price.

CFRA SAYS…

CFRA (S&P) has a Hold rating on Berkshire Hathaway. The firm’s most recent investment rational said:

Our opinion on the shares is Hold. We lowered our view on the shares from Buy on November 4, 2024, after Berkshire posted Q3 results that were broadly weaker than expectations. We applaud improved results at GEICO, but believe weak top-line results and adverse claim trends at BRK’s reinsurance and commercial insurance units, plus weak revenue trends at most other units, remove a catalyst from the shares. We also note that Berkshire did not buy back any shares in Q3, despite having more than $325 billion of cash and equivalents on hand.

THE REACTION AT ALL-TIME HIGHS

Berkshire Hathaway’s B-shares were last seen trading up 4% at $497.88, after having hit an all-time high of $499.88 after this earnings report. The shares were last seen trading up 3.9% at $746,707 on Monday, after hitting an all-time high of $749,611 earlier on the day.

Some tactical investors believe stocks hitting all-time highs will keep hitting all-time highs. Others may want to wait and hope for a pullback. That said, there is simply no denying that long-term investors have won the investing race if they stuck with Buffett and Berkshire for any period of time.

Please note that Tactical Bulls maintains no formal rating, nor does it maintain any price targets on Berkshire Hathaway’s stock.

Categories: Investing