There is a common investor belief that there is an exchange-traded fund (ETF) strategy for just about any sector or theme you can imagine. There are two political-leaning ETFs which track the investments made by Democrat members of Congress and investments of Republican members of Congress. The election looks as though it was a clear victory and mandate for Republicans. It turns out that, as of 11/7/2024, the Democrat ETF has so far performed better than the Republicans.

The tickers should be fairly easy to recognize if you follow politics. The Unusual Whales Subversive Republican Trading ETF (NYSEArca: KRUZ) has only $37 million in assets under management and Unusual Whales Subversive Democratic Trading ETF (NYSEArca: NANC) has $187 million in assets. Both ETFs started trading early in 2023.

While some of these gains may seem like runaway gains, keep in mind that the S&P 500 is up 25% YTD and up 36% from a year ago. The NASDAQ 100 is also up 25% YTD and up almost 38% from a year ago.

BIG DIFFERENCES, ONE KEY STOCK

Some of the top positions may be of little surprise. The democrat positions are dominated by Tech/IT with far larger weightings that may have led to the better performance with a high concentration in the top tech stocks. The democrats also don’t have any oil stocks. The republican positions do have tech/IT but also include oil and financials, and there is a far lower concentration of positions.

At the present time, the only overlapping stock within the top ten holdings of each ETF is NVIDIA Corporation (NASDAQ: NVDA). What, if anything, you take from these ETFs and the positions they own is entirely up to you and is your decision.

KRUZ… AS IN TED

The Unusual Whales Subversive Republican Trading ETF (NYSEArca: KRUZ) was last seen up 19.5% YTD and up 31.9% from a year ago. The KRUZ ETF invests in the same equities purchased by Republican members of Congress and their spouses. Their holdings are disclosed either to the Senate Office of Public Records or to the Clerk of the House of Representatives under the Stop Trading on Congressional Knowledge Act. Its top 10 holdings of 160 total positions as of 11/7/2024 accounted for just 27.04% of the entire ETF. These top 10 are listed as follows (with weightings) and are as follows:

- JPMorgan Chase 4.24%

- NVIDIA 3.59%

- Comfort Systems USA 3.33%

- Simon Property Group 2.37%

- Fidelity National Information 2.34%

- Accenture 2.28%

- Chevron Corp. 2.26%

- AT&T 2.26%

- Intel 2.26%

- Allstate 2.11%

NANC… AS IN NANCY

Unusual Whales Subversive Democratic Trading ETF (NYSEArca: NANC) is winning so far in 2024 with a 29.8% gain YTD. It is up 42.8% from a year ago. The NANC ETF invests in the same equity securities purchased by Democratic members of Congress and their spouses. These holdings are disclosed either to the Senate Office of Public Records or to the Clerk of the House of Representatives under the Stop Trading on Congressional Knowledge Act (“STOCK Act”). The top 10 holdings of 168 total holdings as of 11/7/2024 account for 48.94% of the entire ETF and are as follows:

- NVIDIA 13.26%

- Microsoft 7.76%

- Amazon.com 4.83%

- Salesforce 4.44%

- Apple 3.90%

- Alphabet 3.68%

- American Express 3.08%

- Costco 2.83%

- Philip Morris International 2.63%

- Vulcan Materials 2.53%

DISCLAIMER

Tactical Bulls is not making any recommendations on either of these ETFs. The information provided herein is not to be considered investment advice nor shall it constitute a recommendation to buy or sell the ETFs or any of their holdings. Tactical Bulls does not have any formal recommendations nor does it have any price targets on these ETFS nor on their holdings. There is also a further disclaimer included as “Important Risks” in the ETF parent’s websites:

The Fund is a recently organized investment company with no operating history. As a result, prospective investors have no track record or history on which to base their investment decision.

There is no guarantee that the Adviser’s use of investment techniques and risk analyses to make investment decisions will perform as expected.

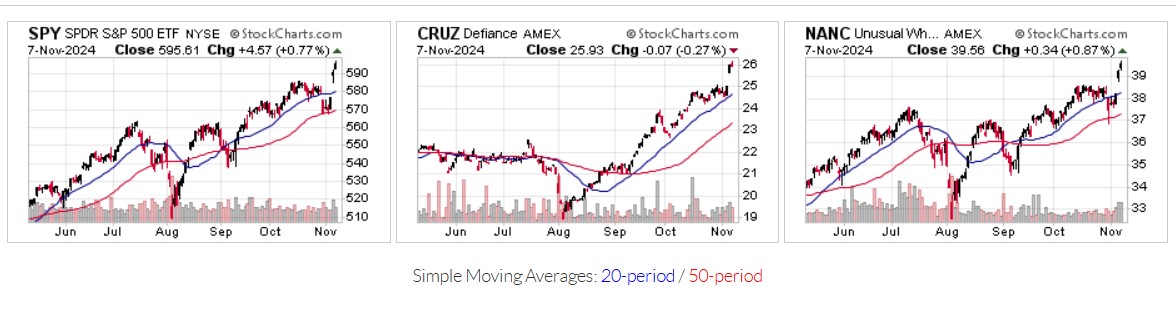

THE CHARTS

The following charts have been provided by StockCharts.com. They include the KRUZ, NANC and SPY.

Courtesy of StockCharts.com

Categories: Investing