JPMorgan Chase & Co. (NYSE: JPM) is the most envied money center bank in the entire banking sector. Some banks are also considered to be of high quality, but the team and operation under Jamie Dimon is considered the safest bank in America under any adverse scenario. Jamie Dimon has even argued for more than a decade that his bank was the only or one of the only banks that could have survived the Global Financial Crisis without taking the government bailout cash.

But now it’s time to sell JPM’s stock. At least that’s the take of a fresh analyst downgrade. And applying this toward Tactical investors — there is better upside elsewhere.

JPMorgan Chase & Co. is a bank that Tactical investors may have to avoid if the team at Robert W. Baird is accurate. This doesn’t mean that JPM stock has to sell-off or crash. It’s just that there may be too many other investment choices with better upside, better dividend yields, and with more supportive analysts. Just don’t forget that if the broad market or all of the banks suddenly sell off, JPM will probably suffer the least.

BIG CHEERS!

On the day after the election, when just about any and every bank stock was ripping higher, this stock peaked at $248.00 (up 11.9%) before closing at $247.06. Analysts at firms like Morgan Stanley, Oppenheimer, Barclays, Wells Fargo, Citi and other had already hiked their price targets in the summer. Then after October’s earnings, analysts at firms like RBC, Barclays, Oppenheimer, BofA and others hiked their price targets again.

The stock has surged so much it is handily over the consensus analyst price target of $235.00.

THE DOWNGRADE

David George of Robert W. Baird has downgraded JPM to Underperform from Neutral and the price target is down at $200. This is effectively telling investors it’s time to take their profits after hitting all-time highs.

JPM shares at the present time are up over 11% in a month, up over 15% in the last 90-day period, up over 39% YTD, and up about 65% in the last year.

STILL BEST-IN-CLASS

Before JPM shareholders panic, this downgrade is a classic valuation downgrade. George still calls JPM as Best-in-Class and he still believes JPM has the best reach and the largest market share of the major U.S. banks. His problem is that the risk-reward is now unattractive at current share prices. He is urging clients (and therefor investors in general) to take their profits.

Ahead of this downgrade, and with the obvious massive jump in stocks on Wednesday, investors were very encouraged that a more friendly regulatory environment towards Wall Street is coming now that Trump won the presidential election. This was in fact, the largest one-day gain for JPM shares in about four years.

The problem looking forward in a valuation downgrade is that there is now the appearance of limited upside. The current share price is now above Baird’s target handily — but also higher than three-quarters of Wall Street analysts’ price targets too. And while there may be a more benign regulatory environment despite a more pro-growth economic agenda, it might not help Chase as much as other banks.

THE GUTS OF THE DOWNGRADE

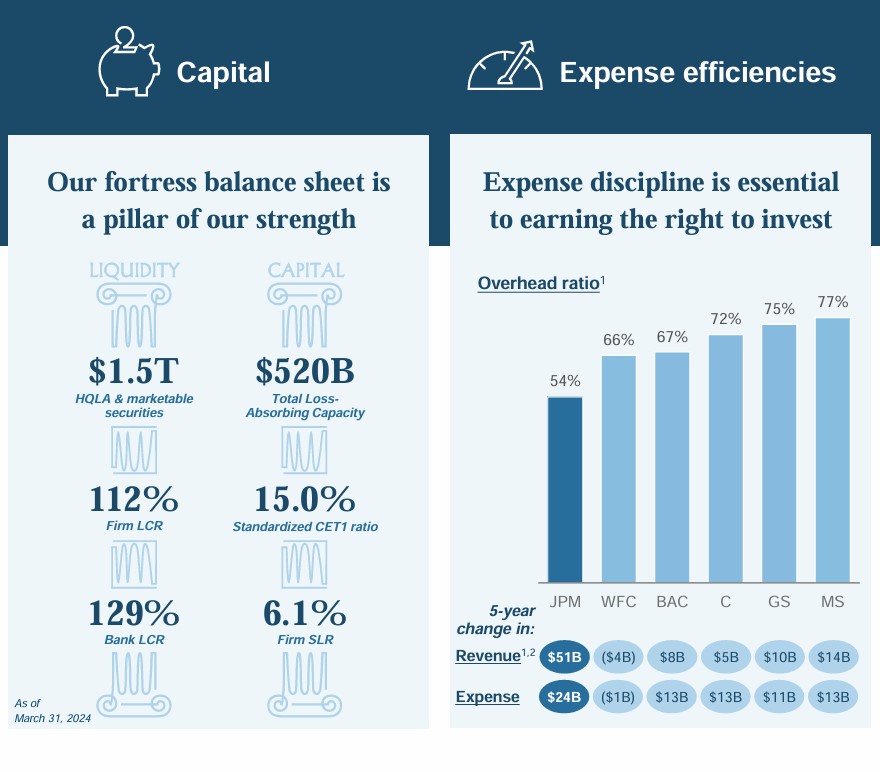

Baird’s report shows that JPMorgan now trades over 2 1/2 times tangible book value. That makes it extremely expensive when comparing other bank values. The bank also trades at almost 15-times forward earnings, also a much higher premium than other banks.

One last issue is that JP Morgan is not going to be aggressive on capital returns like stock buybacks. Jamie Dimon even said during an investor presentation earlier this year that he considers stock buybacks as giving cash to exiting shareholders rather than using that after-earnings capital to build for current shareholders.

RELATIVELY SPEAKING

JPMorgan’s dividend yield is also just 2% at the present time, the lowest dividend yield of all the major diversified banks in a Finviz screen. And widening the Finviz screen to a larger set of regional banks, JPM’s yield is in the bottom 15% dividends and more than a full percentage point under the median yield of those regional banks.

Please keep in mind that this is so far the only significant “Sell” equivalent rating issued on JPM’s stock. Whether more similar ratings follow remains to be seen.

DISCLAIMER & WARNING

Every analyst call needs to come with a disclaimer. Tactical Bulls always reminds its readers that no single analyst report should ever be the sole basis used to buy or sell a stock. Any decision to buy or sell (or hold, short, or avoid) is up to each investor and the decision should be made with a financial advisor.

There are never any assurances in any of the analyst reports issued that their price target predictions and the scenarios that back up the calls will actually come to fruition. If you ask analyst whether their calls and predictions always come to fruition, they will almost all say “Nope!”

Categories: Investing