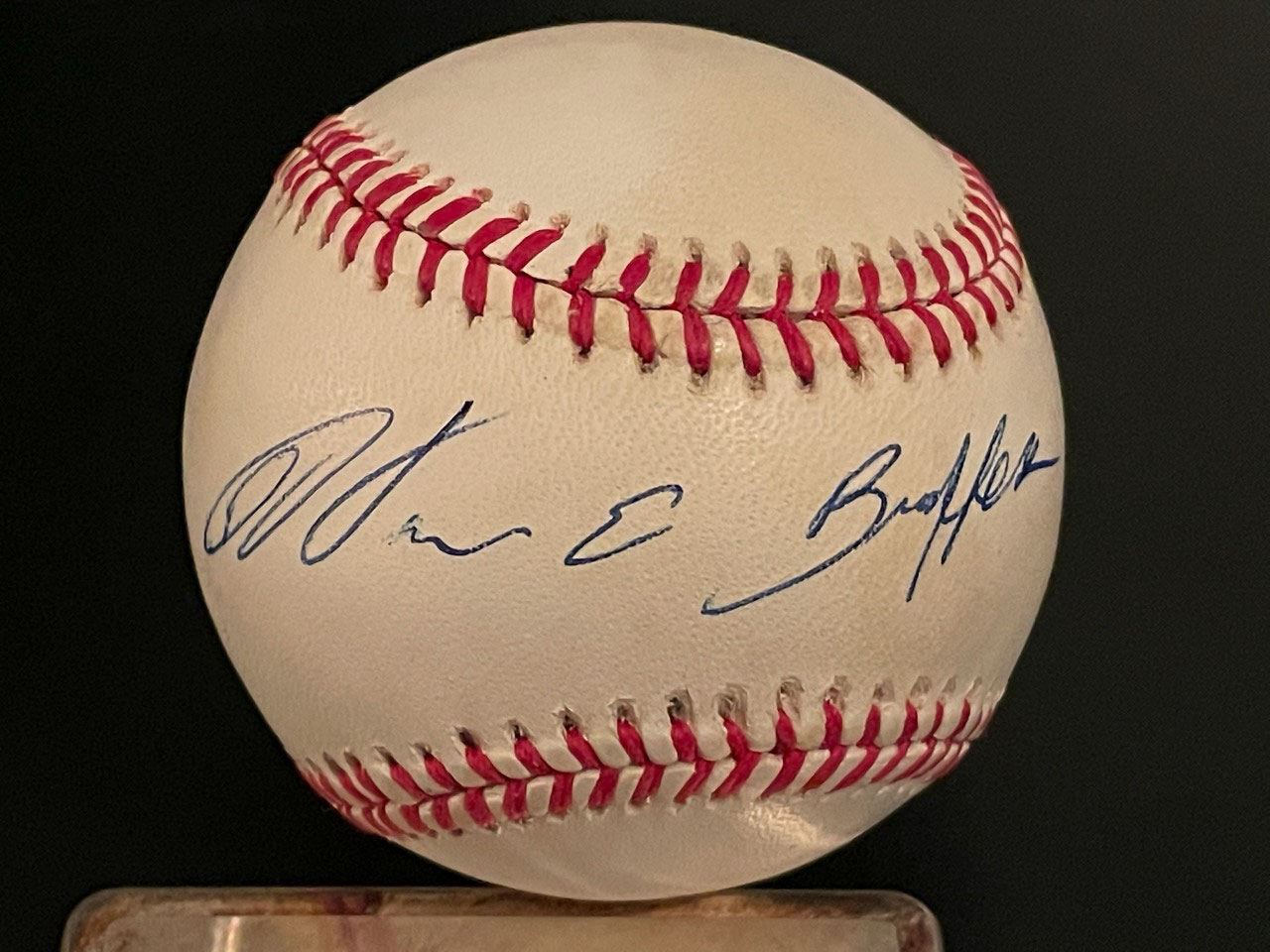

My personal collection Warren Buffett signed baseball

Warren Buffett is considered by many market observers to be the ultimate long-term investor. His vast empire within Berkshire Hathaway Inc. (NYSE: BRK-B) is changing after having reached a $1 trillion valuation earlier this year. He has sold more of the company’s vast stock holdings and he is buying back much less of the company’s own shares. After a fresh earnings report, Berkshire Hathaway is now sitting on a mountain of approximately $325 billion in cash. Holding this much cash sure seems to be a clear signal that something is brewing — but what?

The formal earnings report does not offer any real insight into what the inside mindset happens to be. But there are some things that Buffett followers do all know. The stock market is at all-time highs and we know Warren Buffett is a stickler about valuations of the market and his own stock. Buffett has hedged his company against adverse events before (and still does with insurance). Buffett loves the acquisitions he calls a “whale of a deal.” Buffett’s impetus of stock buybacks and his stance against paying dividends (even if he loves receiving dividends) is longstanding. There may even be a legacy issue that is hard to quantify by still needs to be considered. So…

THE MOUNTAIN OF CASH

Buffett’s cash pile rose by $48 billion in the latest quarter. About $10 billion of that added cash was from operating earnings. The lion’s share of the cash contributions was from more than $36 billion in stock sales mostly tied to Apple Inc. (NASDAQ: AAPL) and Bank of America Corporation (NYSE: BAC). That mountain of cash was already an astounding $277 billion as of June 30, 2024.

This mountain of cash is larger than the likes of the major technology combined. Or it is the same net cash as the combination of many major banks. Perhaps Berkshire Hathaway is the true “fortress balance sheet” in Corporate America.

One thing we all do know, short of a major change of heart, is that Buffett is not likely holding all this cash to make a huge dividend payment.

THE SHRINKING STOCK PORTFOLIO

According to the investor presentation, approximately 70% of the aggregate fair value of Berkshire Hathaway’s equity securities were concentrated in five companies (with values):

- American Express Company – $41.1 billion;

- Apple Inc. – $69.9 billion;

- Bank of America Corporation – $31.7 billion;

- The Coca-Cola Company – $28.7 billion;

- and Chevron Corporation – $17.5 billion.

Berkshire Hathaway still owns close to 2% of Apple, but by taking the BofA stake down to less than 10% Buffett can now wait longer regarding any mandatory disclosures before Berkshire Hathaway’s 13F quarter filings showing the public stocks it owns. To show what this means in total dollar terms, Berkshire Hathaway’s total equity portfolio of $271.65 billion at the end of the third quarter is down from $353.842 billion at the end of 2023.

Apple Inc. (NASDAQ: AAPL) has been a homerun for Warren Buffett. It would be easy to argue that Buffett simply needed to diversify out of the stock after having more than 900 million shares at the peak. And even though Buffett still praises Apple, the trust is that Apple may have become more expensive to own at 30-times earnings considering that its growth is now incremental.

WHAT HAPPENED TO BUYBACKS?

Perhaps one of the more concerning issues was that Berkshire Hathaway spent zero-dollars buying back its own stock. This was the first time to not repurchase any Berkshire Hathaway shares in more than 5 years. The company spent less than prior quarters in Q2-2024, but it still had spent over $5.1 billion on repurchases in the last three quarters alone. Was this because the stock rose, or was it because he could make 4% to 5% in Treasuries? Or just to save up even more rainy-day cash?

Buffett historically used his formula of a discount in the intrinsic value of his stock to the book value to decide when to and not to buy back stock. That criteria had widened out to basically “whenever he thinks it’s a good time to buy back stock.” So, what does it mean when he has been slowing down buybacks and then skips out entirely on buying back Berkshire Hathaway’s stock in a quarter?

DOES BUFFETT WORRY ABOUT A CRASH?

Even large investors will tell you that they worry about a stock market and economic crash. Most of them don’t have to worry, but even Warren Buffett would admit that no company is immune to a market and economic meltdown. For a company worth $950 billion to have pared down this much stock (even if it’s just taking gains in BofA and Apple) is not insignificant. Neither is sitting on $325 billion in cash and short-term Treasuries. Buffett is now less public about major long-term market bets in derivatives and contracts as they have to now be marked to market.

Is it possible that Buffett is just holding this much cash to preserve the rest of the company if the economic world comes crashing down again? Owning $271 billion in stocks is not chump change and hedging losses of that size becomes more than difficult. This was ahead of the election uncertainty, as the Fed was starting to cut rates, and as the economic numbers were holding but far from robustly. Berkshire Hathaway’s balance sheet for “Insurance and Other” was $884 billion, but it was $1.147 trillion if you include Railroad, Utilities and Energy in the mix.

If it is impossible to hedge using expensive stock options and if derivates and contracts have to be marked down, then a $325 billion mountain of cash would be ample to absorb any economic shock short of extinction level events. Just don’t forget that Buffett always touts America surviving economic crashes, world wars and pandemics. And he always opines that “America’s greatest days are ahead of it” if you still believe that. Buffett has previously warned:

Occasionally, markets and/or the economy will cause stocks and bonds of some large and fundamentally good businesses to be strikingly mispriced. Indeed, markets can – and will – unpredictably seize up or even vanish as they did for four months in 1914 and for a few days in 2001. If you believe that American investors are now more stable than in the past, think back to September 2008. Speed of communication and the wonders of technology facilitate instant worldwide paralysis, and we have come a long way since smoke signals. Such instant panics won’t happen often – but they will happen… One investment rule at Berkshire has not and will not change: Never risk permanent loss of capital.

IS A “WHALE OF A DEAL” COMING?

It is fairly common knowledge that Warren Buffett keeps a target list of companies he would love to acquire. For these to make a long-term difference and impact to a $1 trillion conglomerate they have to be big deals. The reality is that, at least as of today, big companies are expensive to buy into. And those same big companies do not like selling out on the cheap. The most recent Buffett Letter (see below) even says:

There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced.

Berkshire Hathaway’s largest holdings are spread out. There is GEICO and a whole slew of insurance entities. There is BNSF from the great railroad acquisition. And there is Berkshire Hathaway Energy with more than 13 million customers and end-users of its utilities.

Buffett has also been the financier of last resort in times of crisis with his famous 10% convertible preferred packages (BofA, GE and others). Maybe the whale of a deal could be a simple round of bailout cash on the sidelines if the you-know-what hits the economic fan.

AND A LAST ISSUE… LEAVING A LEGACY

Perhaps the last issue to consider is that maybe, in the aftermath of partner Charlie Munger’s unfortunate passing away, Buffett’s is simply planning on leaving a legacy for the next head of Berkshire Hathaway. He is 94 years old. Maybe building this mountain of cash is simply to allow the next king of the empire to have all of the runway and flexibility humanly possible to get Berkshire Hathaway through the end of the twenty-first history.

Buffett’s latest annual letter to shareholders covered the end of 2023 and start of 2024. That letter and prior letters have offered a bit of insight into each of the issues brought up in this review. That said, Buffett wants to be steady in his demeanor but also mercurial as to where he might strike next.

As Warren Buffett likes to hint about the future without ever fully tipping his hand, his letter addresses the future and present of the company about as concisely as it could be communicated:

Berkshire is built to last.

DISCLAIMER

None of the views in this report are intended to be investment advice nor do they constitute a recommendation to buy or sell Berkshire Hathaway shares or any of the shares mentioned in the reporting. Tactical Bulls does not have any formal ratings nor price targets on Berkshire Hathaway and the companies mentioned in this report.

Any decision to buy, sell, hold, short or avoid is the responsibility of each investor individually. Those decisions should also be made with a financial advisor. And Warren Buffett would be the first to tell you that losses can happen in any type of investment.

Categories: Investing