Sometimes there are just companies or trends that you overlook or miss out on. If you only invest in mega-cap stocks or dividend stocks, AppLovin Corporation (NASDAQ: APP) is a stock you wish you didn’t miss out on. Here is why — it’s up 325% in 2024 alone, and it’s up about 370% from a year ago.

Now investors have to wonder if its $56 billion market is sustainable. Many analysts on Wall Street believe it’s sustainable because the trend has been for higher and higher price targets being issued on AppLovin.

So what exactly is AppLovin? The company’s mobile marketing platform AppDiscovery (and MAX, Adjust, and SparkLabs) caters to mobile application developers with the aim of improving marketing and monetization of applications. Its AI Engine matches up about 100,000 mobile game advertisers with one of more than 1 billion mobile gamers.

Wall Street’s targets were already “high” in the first half of the year when they were showing $80 price targets. Now we are seeing those targets being issued up in the $200 range.

DISCLAIMER & NOTICE

Tactical Bulls has no formal price targets and has no formal ratings on AppLovin. As such, this is showing only outside analyst views. All price targets and investment opinions are those shown by each firm’s summary.

Any recommendations mentioned herein are not from Tactical Bulls and Tactical Bulls assumes no responsibility for investors’ decisions to buy, sell, hold or short sell.

CURRENT ANALYST CALLS

Wells Fargo started it as Overweight with a $200 target on October 29. The firm’s Alec Brondolo sees similarities between its market position in mobile games and the strength of Google’s in programmatic advertising. Brondolo is calling for AppLovin to keep grabbing market share with 20% to 30% growth through 2027 in what’s already a $34 billion space.

Another big analyst call was issued by Omar Dessouky at BofA Securities on October 21. This call reiterated its Buy rating and raised price objective to $210 from $120, saying point blank that AppLovin’s valuation is too low for a core biz growing 20% sustainably. BofA’s forecasts are significantly above-consensus and are the highest on Wall Street at the present time.

From 2024 to 2026, BofA sees earnings rising from $3.49 to $8.15 and revenues rising from $4.45 billion to $$6.69 billion. Its 2023 figures were just $0.99 EPS on $3.28 billion.

On October 28, CFRA (S&P) maintained its Buy rating and raised its target to $185 from $143. That report said:

Despite its rapid gains, we think that APP remains reasonably valued when compared to peers. We believe APP is an underappreciated growth story. It has grown total addressable market, expanded market share, and significantly adjusted EBITDA margins…

Other analysts have been gaga over AppLovin as well. Here are some calls from October 21-23:

- Citigroup reiterated its Buy rating and raised its target to $185 from $155.

- Stifel reiterated its Buy rating and raised its target to $185 from $100.

- Oppenheimer reiterated its Outperform rating and raised its target to $180 from $105.

- Loop Capital started it as Buy with a $181 price target.

- JPMorgan reiterated its Neutral rating, but still raised its target to $160 from $57.

AND THE CAUTIOUS ANALYSTS?

Even the more cautious analysts have capitulated by issuing much higher price targets.

On September 17, UBS raised its rating to Buy from Neutral and raised its price target to $145 from $100.

On October 14, Goldman Sachs couldn’t take the gains any longer. The firm downgraded AppLovin to Neutral from Buy, but it still raised its price target up to $150 from $103.

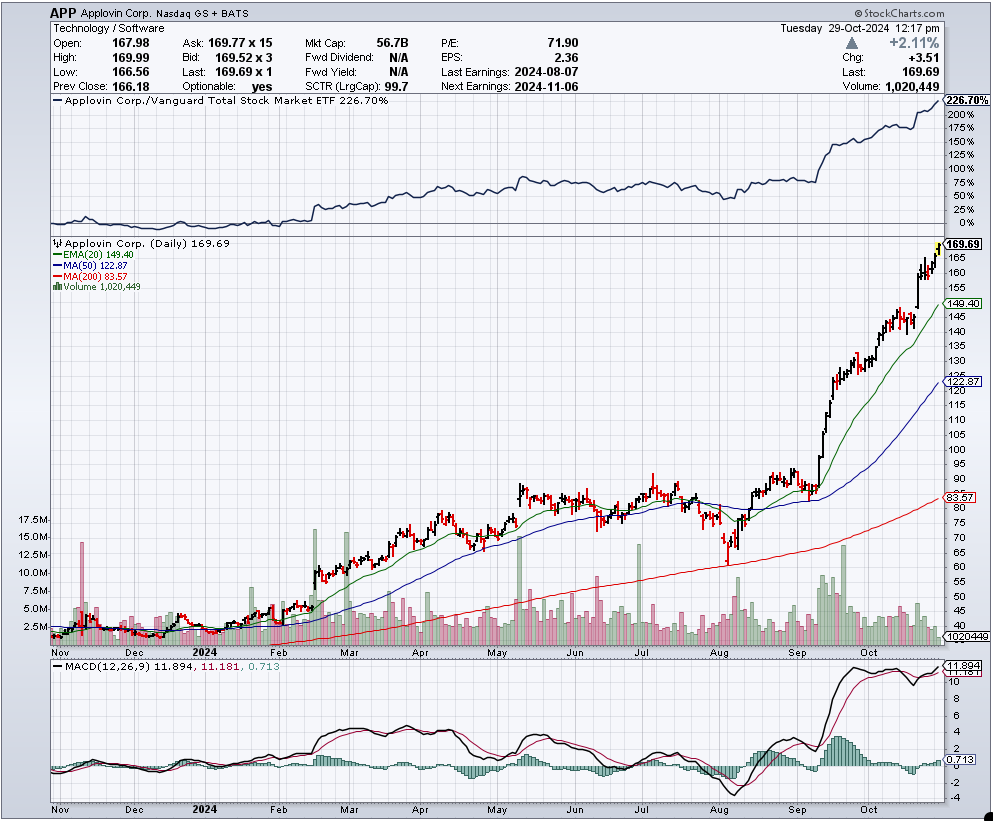

A CRAZY CHART?

The following chart is from StockCharts.com:

Courtesy of StockCharts.com

Categories: Investing