Every investor who has a long-term investment plan to get to retirement age has a dividend strategy. If dividends are not at least a part of that overall long-term plan, they better become part of it in the years ahead. Long-term investors know that selective high-quality dividends can often replace long-term bond yields with stronger gains and total returns over time.

Consider this in your long-term investing philosophy for a minute– do you buy and hold a 4% Treasury for 10 years to maturity or do you buy and hold companies paying 4% dividend yields (or higher) that have earnings power, are likely to grow their dividends, and also likely adding to their business value over the next 10 years? If your answer is just the 10-year Treasury, you are likely not taking anything resembling a tactical approach to investing.

Tactical Bulls has screened companies paying better-than-Treasury dividends which are in the S&P 500 or which resemble the criteria of S&P 500 stocks. The idea is to find those great leading companies which are well-known with long operating histories, long dividend histories and which are not likely going away. Now we just have to see what the real dividend situation looks like out of America’s greatest companies.

Of the 500 stocks actually in the S&P 500, only about 90 do not pay dividends at all. The median yield for the 410 dividend-paying members of the index is 1.93%. The median yield for all 500 stocks (including non-dividend payers) is 1.55%. The dividend yield of the SPDR S&P 500 ETF Trust (NYSEArca: SPY) is only about 1.2% as the high mega-cap weighted stocks tend to have lower dividends. Tactical Bulls was looking for more than “just better” than the S&P 500 for median dividend yields.

And what about comparing these to Treasury notes? The 10-Year U.S. Treasury note ended on October 18 back up at 4.08%. We have to keep in mind that this was just 3.65% in mid-September around the U.S. Fed’s first rate cut in years. Meanwhile, the 1-Year Treasury Bill’s “risk-free rate of return” is still about 4.2% today even if it is expected to fall as more rate cuts are made.

THE DIVIDEND CRITERIA

Tactical Bulls used a 4% dividend floor for companies with an ability to keep raising dividends even if the U.S. economy slows or ever gets back into that dreaded recession. That is no assurance their stocks rise, nor is it an assurance that their dividends will be safe in all scenarios.

On top of a 4% floor for dividend yields, the FinViz consensus analyst price target and the current dividend had to leave an implied upside of 10% in total return (expected gains plus reinvested dividends). It also needed to have at least one standout analyst call with an even higher price target in the second half of 2024. Here is a synopsis of all criteria used that would imply at least some protection for long-term high dividend investors:

- long-term operating history;

- steady dividend payments for years;

- preference given to S&P 500 companies over small/mid-caps;

- a 4% dividend yield floor;

- consensus analyst target prices above current stock price;

- nearly 10% targeted total returns, or more, with projected gains plus dividends;

- recent analyst calls also above consensus price targets;

- where dividends do not only erode long-term gains (like mortgage-REITs);

- no companies in train-wreck business models nor death spiral operations;

- no companies where adjusted earnings and key metrics cannot support dividends;

- and a preference given to companies still wanting to grow their dividends.

There are of course no guarantees that these dividends will go on forever. There are also no guarantees of price stability just because a company has a high dividend. The implied total return expectation of “dividends plus expected gains” was also not included in each of these stocks to avoid the appearance of expecting every single “consensus” target to actually live up to expectations.

A review of charts and a disclosure and warnings statement, as well as runner-up picks from the screen, have all been included at the end of this report. Tactical Bulls has listed these in alphabetical order to avoid any sort of ranking and to avoid the appearance of favoring some more than others.

THANK YOU FOR SMOKING (AND EARNING 8% FROM IT!)

Altria Group, Inc. (NYSE: MO) is the domestic play of the king of smoking, plus vaping, plus noncombustible tobacco with a history of 59 consecutive annual dividend hikes. At $49.60 this defensive value stock yields more than 8% at the present time. Altria’s consensus analyst price target is $52.10, but BofA’s Neutral rating still has a $53 price objective (recently cut from $57).

One overhang risk is its NJOY ACE vapor product is in an ongoing patent fight with JUUL at the International Trade Commission with an expected decision due in December. That outcome may be a binary outcome for revenue trends and Tactical Bulls has not handicapped the likely outcome as more likely good or bad at this time.

Long-term combustible tobacco trends (cigarettes) may point lower still, and this is investing in products that help kill their customers, but at least shareholders can think “Thank you for smoking!” when they see people doing things they know they shouldn’t be doing. Then again, pharmaceutical drugs keep getting better at prolonging lives (even for smokers).

CELL PHONE TOWERS & GOLDEN DIVIDENDS (5.6% YIELD)

Crown Castle, Inc. (NYSE: CCI) is one of the two leading cell-towers REITs with a $48 billion market cap. Until recently, before activist Elliot Management took a stake and started adding pressure, its stock was down over 50% from its 2021/22 high. At $112.00 now, Crown Castle’s dividend yield is almost 5.6%. Its consensus analyst target price is only $116.63.

Several firms have higher targets that have been updated in October and September: UBS (Neutral, $118); Jefferies (Buy, $127); TD Cowen (Buy, $123); Goldman Sachs (Neutral, $120); and JPMorgan (Neutral, $124).

Crown Castle also has a strategic review lowering capex, adjusting its and carrier returns, a review of its fiber business, and digitizing its tower portfolio over the long-term. It should also be a REIT beneficiary from lower interest rates ahead.

A DIVERSIFIED UTILITY (4.3% YIELD)

Eversource Energy (NYSE: ES) is not the highest yield of utilities in the S&P 500, but it is within the criteria outlined above. Its earnings suffered because of ongoing charges after completing the sale of its offshore wind and it is back at a core of being “a pure-play regulated pipes and wires utility.” At $66.13, it has a $23.6 billion market cap, with a 4.3% dividend yield and a consensus analyst price target of $73.29.

Eversource is a top New England utility player with about 4 million customers in electric, gas and water services. It has varying coverage in Connecticut (149 towns), Massachusetts (140 towns) and New Hampshire 211 towns). Its stock is still down 30% from its 2022 levels and it pays out about 60% to 65% of non-GAAP earnings in dividends. Eversource is valued at about a 20% discount in peer utility book values and is valued at about 14-times normalized expected earnings (non-GAAP EPS).

One additional overhang is an equity issuance plan of up to $1.3 billion over the next several years. Analysts are moving price targets up and down continually, if not too frequently, but here are some current at or above-consensus $73.29) price targets: Mizuho ($73); Morgan Stanley ($75); and Wells Fargo ($79).

REVVING DIVIDENDS OVER BUYBACKS (FOR A 5.4% YIELD)

Ford Motor Co. (NYSE: F) is in a constant chase with rival General Motors, but Ford’s shareholder returns are more focused on dividends than buybacks as GM’s current path is. GM has outperformed so far (+36% YTD vs -7% for Ford) but Ford’s dividend effort is as the founding Ford family descendants (will with 40% control) love their dividends. Sometimes there are special dividends on top of the regular dividends.

Ford can always focus more on its prized F-150 trucks and on the Ford Pro (and even lower cap-ex as well) if it wants profits to be its focus. At $11.10, its dividend yield of 5.4% is the top among carmakers. Its consensus analyst price target is $12.64 and two recent analyst calls have higher targets: Goldman Sachs (Buy, $13) and Barclays (Overweight, $14). Still, Ford did lose one-third of its value from peak to trough in a short period of time this summer.

IN THE LAP OF LUXURY (AND EARNING 4.5% FOR IT!)

Host Hotels & Resorts Inc. (NYSE: HST) is the largest hotel-REIT with 76 U.S. luxury properties and 5 international properties and a very long operating history. Its dividend history has been mixed, and admittedly it has faced income/dividend problems when the economy has been in turmoil. After closing at $17.77 with a $25 billion market cap, and with a normalized $0.20 quarterly payout now, its yield is 4.5%. Finviz has a $20.63 consensus analyst price target.

Host’s stock generally trades in a band between $16 and $20, with a nearly-absolute trading band of $14.74 to $21.31. The firm Compass Point just raised its rating to Buy from Neutral and raised its prior $18 target back up to $22 (after previously having a $25 target before a brief downgrade in August).

A KEY TO BANK DIVIDENDS (4.7% YIELD)

Keycorp (NYSE: KEY) remains in recovery mode, but that recovery looks more probable each month. Its loan losses on the books are being sold off and it has its key investment from BNS in Canada that should take its stake from 5% to 15% next year (or so). Keycorp entered the Tactical Bull target zone upon the announcement of the $2.8 billion investment from Canada.

After peaking above $17.50 ahead of earnings, its $17.35 share price is still below the $18.70 consensus analyst target price on FinViz. The bank’s dividend yield of 4.7% screens out as the second-highest bank dividend yield (behind Truist) in the S&P 500. Keycorp did not even get punished by the market after taking a $700 million charge for its available-for-sale low-yield assets being sold off.

A POST-COVID DIVIDEND REVIVAL (5.75% YIELD)

Pfizer, Inc. (NYSE: PFE) is a boring pharmaceutical giant with a known gap in Covid vaccine business that helped cut shares in half since the end of 2021. We know the Covid boost is all over now, and now Pfizer can focus on core growth that is normalized. The core business is stable, with a large pipeline and always the potential to make bio/pharma acquisitions. Pfizer’s dividend yield of 5.75% represents about 60% of anticipated earnings per share for a blended 2024/25 view. At $29.22, its consensus analyst price target s $32.90. Cantor Fitzgerald reiterated its Overweight rating with a $45 price target on October 3, while Daiwa raised its rating to Outperform from Neutral and raised its target to $34 from $28 in August. Pfizer has already spun off its legacy and generics drugs business Viatris to focus on growth (and perhaps to avoid government pricing pressure ahead).

AINT THAT THE TRUTH! (FOR A STREET-HIGH 4.77%!)

Truist Financial Corporation (NYSE: TFC) is currently the highest dividend yield of banking stocks in the S&P 500 with a 4.77% yield. It has recaptured most of its early-2023 regional bank losses when low-yield loans, low-yield securities and loan loss provisions were weighing on earnings. Its credit provisions against losses of $448 million improved almost 1% from the prior quarter and was 10% better than a year earlier. It may not be back to “perfect” yet, but its $43.67 share price is a discount to its $44.46 stated book value per share with return on common equity back above 9% with earnings growth to boot. Truist used $500 million to repurchase shares and it paid out 52% of income as dividends (90% including buybacks).

CAN YOU OVERNIGHT THAT DIVIDEND CHECK? (4.8% YIELD)

United Parcel Service, Inc. (NYSE: UPS) may be an accidental high dividend yield at about 4.8%, for now at least. Shares of the freight and shipping giant are down about 13% YTD and not too far off the 52-week lows. UPS’ recent $135.50 share price is still more than $10 shy of the $146.12 consensus analyst price target. On October 9, Citigroup issued a new Buy rating and assigned a more aggressive $162 price target.

CALLING MR. DIVIDEND! (FOR A 6% YIELD!)

Verizon Communications, Inc. (NYSE: VZ) is the king of major telecom/cellular dividends at better than 6%. At $43.95, its consensus analyst target price was $46.71. Goldman Sachs issued a new Buy rating on July 1 and its price target was $50. The stock is still in the middle of its 52-week range at $29.27 and the FinViz consensus analyst target price $32.90. Verizon recently entered into a all-cash deal to acquire Frontier Communications to own the largest pure-play fiber network in the U.S. to prepare for the ongoing and future expansion of AI/IoT trends. Verizon has raised its dividend for 18 years after hiking its payout in September.

DISCLOSURES AND RISKS

Tactical Bulls has conducted this screen to find new ideas for dividend and income investors who prefer more upside in long-term total returns than is offered by long-term Treasury yields alone. The owner of Tactical Bulls invests in dividend stocks and may invest in any of these stocks in the coming weeks and months depending upon share prices and market conditions.

Tactical Bulls would also remind readers and all investors that consensus analyst price targets and individual analyst price targets come with no guarantees nor assurances of these targets ever being reached. Some (or all) of the stocks featured in this report may fall in value and they may have to terminate or cut their dividends for reasons unknown at the time this was prepared.

Some of these companies have yet to report their earnings at the time of this publishing date. This report is in no way to suggest that some or any of these companies will have solid earnings reports. In fact, based on dividend history and how some stocks got here, some of the stocks may even perform badly after their earnings reports.

Automation and screening from FinViz and other tools were used for the initial datapoints herein and sometimes the available information does not update or is just wrong. While these were manually checked, there are no assurances that all of the information presented is accurate.

AND WHAT ABOUT RUNNER-UPS?

There are many “other” companies which offer close to or above the 4% dividend yield strategy here. Imagine that only a month ago the criteria would have been only 3.7% or higher dividends. Tactical Bulls screened out most defensive consumer products and most utilities because they payouts were either too low or their share gains had risen above fair-value. And traditional energy players, pipelines and many utilities and infrastructure yields are lower due to their strong stock performance. Many others were not included in the primary screen nor in the runner-up category as they have such a spotty history of price performance impacting their dividends.

Tactical Bulls also saw the following stocks as having “close to the right stuff” for this screen and they will be kept under review for inclusion or substitution in the weeks and months ahead:

- AT&T Inc. (NYSE: T) — 5.1% yield

- VICI Properties Inc. (NYSE: VICI) — 5.0% yield

- Conagra Brands Inc. (NYSE: CAG) — 4.6% yield

- Kinder Morgan Inc. (NYSE: KMI) — 4.6% yield

- Simon Property Group, Inc. (NYSE: SPG) — 4.5% yield

- Dominion Energy Inc. (NYSE: D) — 4.4% yield

- Philip Morris International (NYSE: PM) — 4.4% yield

- Chevron Corp. (NYSE: CVX) — 4.3% yield

- T. Rowe Price Group (NASDAQ: TROW) — 4.3% yield

- CME Group Inc. (NASDAQ: CME) — 4.2% yield

- Oneok Inc. (NYSE: OKE) — 4.1% yield

- Regions Financial Corp. (NYSE: RF) — 4.1% yield

- U.S. Bancorp (NYSE: USB) — 4.0% yield

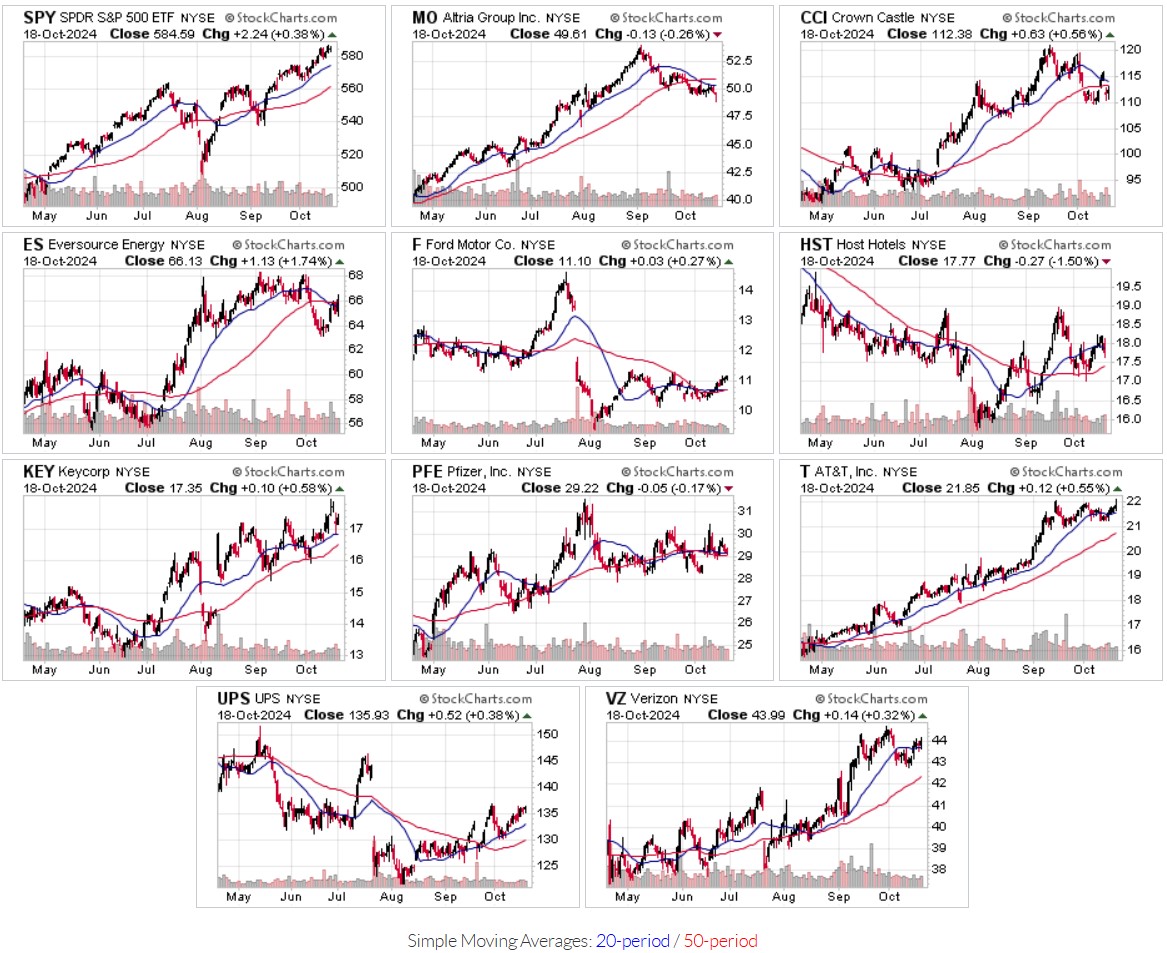

ARE THE CHARTS GOOD?

Tactical Bulls would always at least look at a price chart before blindly targeting consensus analyst price targets and stock performance metrics. Not all charts are created equally. The following charts 6-month charts are from StockCharts.com and the image below includes the S&P 500 (“SPY”) chart for a reference.

Categories: Investing