ASML

It’s no secret that the whole world runs on semiconductors. Electricity is a given in most places. But the rest of the equation – computers, servers, smartphones, cars, televisions, video games and just about anything else runs on semiconductors. So what happens when the number-one semiconductor capital equipment maker has earnings and guidance that are bad enough that it’s hard to stay excited about the semiconductor sector? And does it signal a broader economic slowdown — or even a recession?

Before this goes any further, maybe the semiconductor story should have the caveat of “outside of AI.” Tactical Bulls does not cover individual earnings report in-depth because there are so many sites that already do. Still, if this were to be even on the low-end of the new expectations, this may be a disaster in the making for the bulk of the semiconductor industry and the broader global growth story.

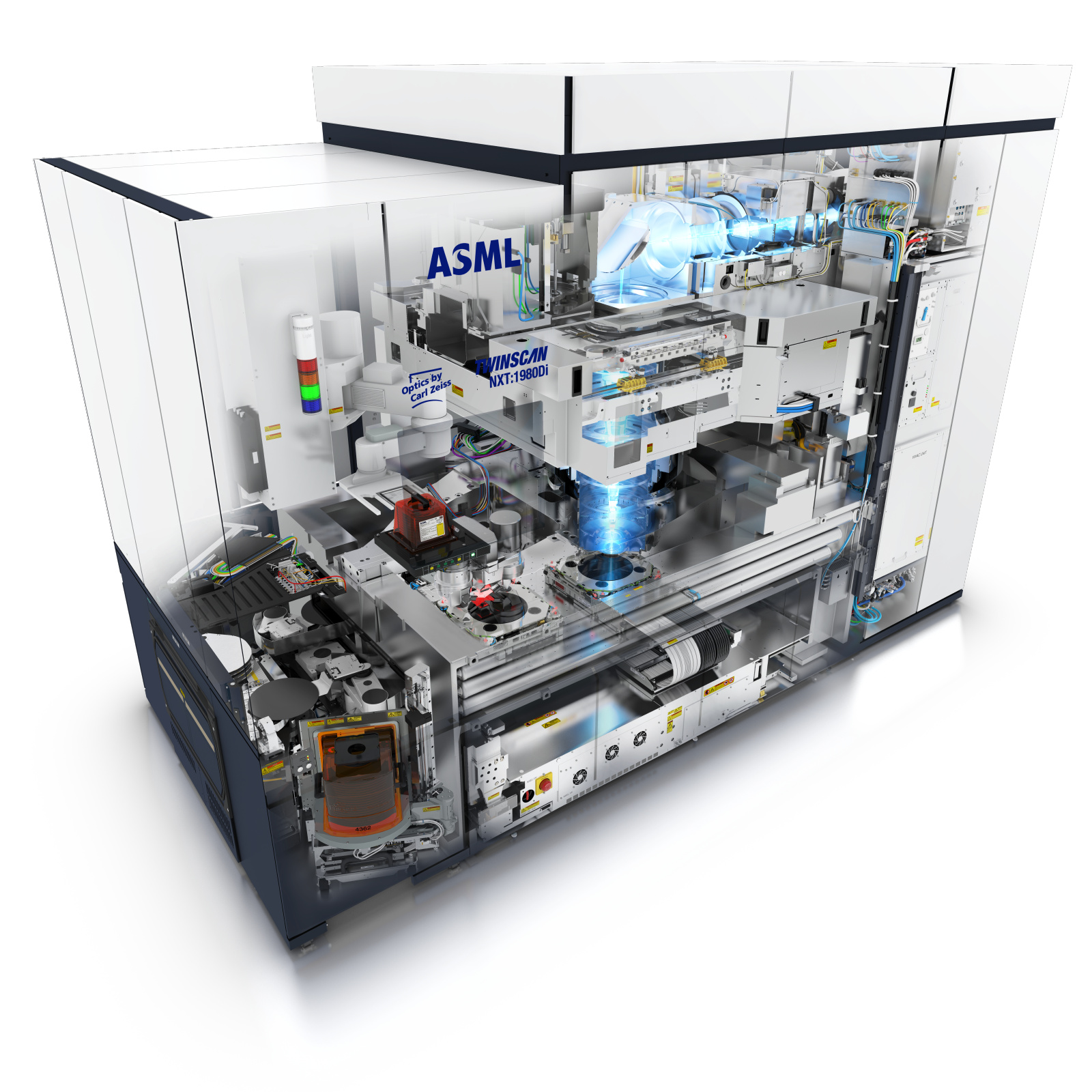

ASML Holding N.V. (NASDAQ: ASML) is the largest semiconductor cap-ex player of them all. It even dubs itself as “the world’s supplier to the semiconductor industry.” ASML’s earnings results and the guidance that followed were released a tad early on Tuesday during the trading session. Let’s just say it created havoc. It looks like everything that isn’t about AI is taking longer to recover (see below). And all the stocks, even in AI, spent a day in the barrel along with ASML.

As semiconductors are used in so many ranges of products now, the industry as a whole can be a barometer used as a leading economic indicator. ASML is on the capital equipment side of the equation in semiconductors and that means that the leading supplier to the chip industry is signaling trouble. Are all of its customers now looking for cover well into 2025, or is the over-supply and double ordering from a year to two years ago still acting as a drag on expansion?

These items telegraphed by ASML may act as a “tipping of the hand” showing what semiconductor businesses are planning for several months to a year in the future. ASML’s instant drop of 16.2% to $730.00 should be quite alarming considering that its market cap is $286 billion after the plunge. And the 9.3 million shares that traded hands was about a 6-times volume spike. ASML is now down firmly in bear market territory as it is down 34% from is 52-week high.

ASML’s equipment is the top-of-the-line semiconductor equipment systems used for manufacturing semiconductors. Its advanced semiconductor equipment systems are sold globally and if its orders have slowed it means that the companies which do all the semiconductor manufacturing are hitting the brakes on how much they are willing to spend on new equipment.

ASML’s GROWTH FIASCO

Investors may generally talk more about earnings than sales, a 3% miss on earnings was from a 5.5% revenue miss. Revenues of 7.9 billion euro were up 19.6% from a year ago but the company’s net bookings of 2.6 billion euro were less than half of the 5.39 billion euro expected by analysts. The guidance of 8.8 billion to 9.2 billion euro in sales (with gross margins of 49-50%) and full year revenue of about 28 billion euro are also under expectations.

Where ASML’s growth story is murkier is looking out to 2025. This was the real issue hurting the entire semiconductor sector on Tuesday. Revenues were put in a range of 30 billion to 35 billion euro and margins of 51-53% for next year. Some analysts were looking for as much as 40 billion euro in sales. ASML itself said this was the lower half of the range it provided at its 2022 Investor Day presentation. ASML’s next Investor Day is set for November 14, 2024.

ASML’s CEO still talked up strong developments and upside potential in AI aspects of chips, but “other market segments are taking longer to recover” means there is still a large overhang after companies over-ordered during the last supply crunch. ASML’s CEO formally touted the strong developments and upside potential in AI, but he highlighted how other (semiconductor) market segments are taking longer to recover:

It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness. Regarding Logic, the competitive foundry dynamics have resulted in a slower ramp of new nodes at certain customers, leading to several fab push outs and resulting changes in litho demand timing, in particular EUV. In Memory, we see limited capacity additions, with the focus still on technology transitions supporting the HBM and DDR5 AI-related demand.

CAPEX RIVALS DROPPED HARSHLY

The fallout for ASML’s shortfall was fast and swift (if not immediate). It also begs to question just how strong the overall recovery looks. It may still be a soft landing of sorts, but maybe a soft landing after a very turbulent ride. Here are the top three reactions in the semiconductor capital equipment picture:

- Applied Materials, Inc. (NASDAQ: AMAT) closed down 10.7% at $191.02, with a $158 billion market cap and a 52-week range of $129.21 to $255.89. AMAT is down 25% from its 52-week high.

- KLA Corporation (NASDAQ: KLAC) closed down a much worse 14.7% at $707.72, with a $95 billion market cap and a 52-week range of $452.01 to $896.32. KLA is now down 21% from its high.

- Lam Research Corp. (NASDAQ: LRCX) was down 10.9% at $76.36. Its market cap is $99 billion, and it has a 52-week range of $57.44 to $113.00. Lam Research is now down 32% from its 52-week high.

ARE A.I. AND COMPUTING REALLY OK?

Things went from bad to worse because the fallout hit all the top players. Even the mighty Taiwan Semiconductor Manufacturing Company Limited (NYSE: TSM) closed down 2.6% at $187.13 with a $970 billion market cap, although this is still only almost 4% from its 52-week high.

NVIDIA Corp (NASDAQ: NVDA) as the AI leader still closed down 4.7% at $131.60. Keep in mind that NVIDIA had just managed to recover back to an all-time high before the ASML news broke. And then there was Super Micro Computer, Inc. (NASDAQ: SMCI). SMCI shares have already fallen by two-thirds from its peak, and its shares actually rose by 0.8% to $47.76 on this same day.

Lesser rivals took it on the chin. Advanced Micro Devices, Inc. (NASDAQ: AMD) recently announced more chips to rival NVIDIA on A.I., but perhaps without any excitement by Wall Street. AMD closed down 5.2% at $156.64. The bloodied Intel Corp. (NASDAQ: INTC) closed down 3.3% at $22.66 and it remains a fraction of its former glory days.

WASN’T MOBILE SUPPOSED TO BE SAFE?

With A.I. and smartphone domination, many investors expected mobile and communications related chips to be immune to the current news. Perhaps immunity is never as safe as it seems. Still, mobile chipmakers fared better than most chip stocks:

- Qualcomm Inc. (NASDAQ: QCOM) fell only 2.2% to $174.09 with a $194 billion market cap, down 24% from its 52-week high as it faces its own headwinds.

- Broadcom Inc. (NASDAQ: AVGO) lost 3.5% to $175.98, and it is still down less than 6% from its 52-week high.

- Chip-design leader ARM Holdings PLC (NASDAQ: ARM) closed down 6.9% $150.67 and it is down 20% from its 52-week high.

- Marvell Technology Inc. (NASDAQ: MRVL) managed to buck the trend as it closed up 2.2% at $79.41 on Tuesday, but it is still down over 7% from its highs.

AND WHAT ABOUT DRAM & DIVERSIFIED CHIPMAKERS?

Even DRAM and specialty chip makers lost steam on Tuesday. Micron Technology Inc. (NASDAQ: MU) lost 3.7% to close at $104.32 with a $115 billion market cap. Micron had already reported its earnings release ahead of ASML, and it may have pulled back too much after losing over one-third of its peak value. That said, Micron was more upbeat about how it is entering 2025 and many analysts had raised their targets after having cut those targets too much ahead of earnings.

Texas Instruments, Inc. (NASDAQ: TXN) closed down 4.2% at $199.89 with a $182 billion market cap. Micron’s price was down over 33% from its high, versus only about 7% lower for Texas Instruments. Shares of Analog Devices Inc. (NASDAQ: ADI) closed down 4.5% at $225.87 with a $112 billion market cap.

RECESSION WORRIES VERSUS REALITY

None of the reporting in this should be interpreted as a recommendation to buy or sell any of the securities mentioned herein. And it’s certainly not a call to short sell any of the leading semiconductor companies. The good news, as of now, is that the expansion here in the chip sector’s leading capex player is still targeting expansion. Otherwise ASML would have been warning of revenues contracting rather than growing slower than prior presentations. Whether or not this slide is the start of something worse or just a reset to more reasonable growth levels remains to be seen. Just keep in mind that none of the 12 most upgraded stocks ahead of earnings season were in chip stocks (and not even in NVIDIA!).

Categories: Investing