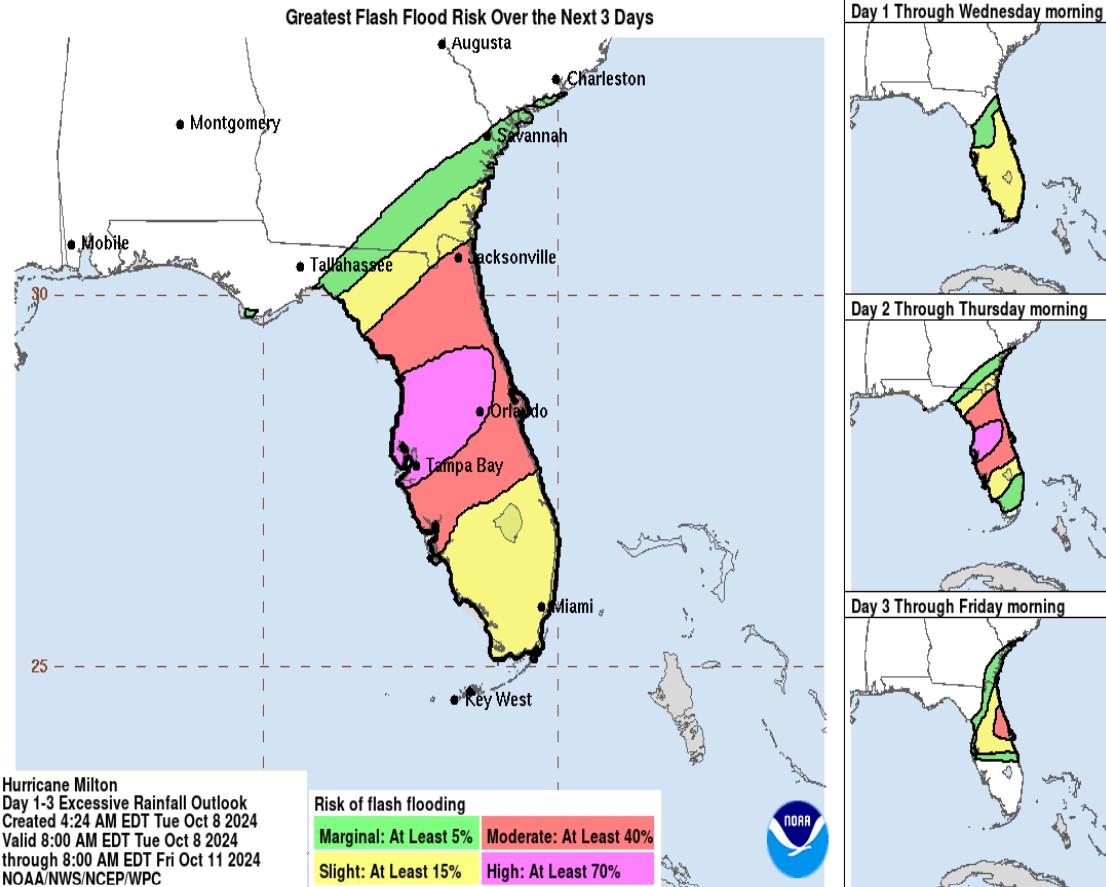

NHC NOAA Milton Flood Map

Tactical Bulls believes that homeownership is one of several mandatory steps to ensure long-term success into your retirement years. One pitfall with ownership is that insurance costs (well, property taxes too) can become a burden over time. With two major hurricanes in just two weeks, the realization that flood insurance alone is simply not enough has thousands and thousands of families on edge and all within a very short period.

Insurance policies, even with the resentment on each billing date, are necessary to help protect against catastrophic losses on your home and your belongings (or your business). Loss of life is the worst outcome, but the sort of damage from Helene and Milton are coming with the realization flood insurance policies alone are just not enough to insure against catastrophe.

Let’s get to the bad news first. Many homeowners and business owners are going to face untold losses as a result of these powerful storms. Many homes, businesses, cars and belongings have some sort of insurance. THEY JUST MIGHT NOT HAVE ENOUGH INSURANCE, OR WORSE… NOT THE RIGHT TYPE OF INSURANCE!

Now comes the worst realization regarding insurance. Every home with a mortgage may have to pay for flood insurance with many who are buying coverage effectively getting zero benefits from that mandatory coverage.

Seeing the potential impact of flood insurance not being enough is a personal issue for the owner of Tactical Bulls. Let’s just say that building a preventative reinforced retaining wall to prevent erosion cost nearly $20,000. And it wasn’t mandatory — but it may have saved the future homeowner(s) from worse than flooding during Hurricane Harvey and future storms. The home did reportedly take in 4 feet of water during Harvey, but there was no erosion that would have wrecked the home’s integrity.

The damage from Hurricane Helene has been estimated by Verisk’s Extreme Event Solutions group has published an estimated industry insured losses due to wind, storm surge and hurricane precipitation induced flood in the U.S. for Hurricane Helene will range between $6 billion and $11 billion. National Flood Insurance Program (NFIP) policies are said to typically cover up to $250,000 in damages, but they do not include additional living expense coverage and even some with the proper insurance may face a gap between coverage and rebuilding costs. Verisk did warn that most homeowners in these areas will not have flood insurance because they were outside of any previously affected zones and deemed to be safe.

Moody’s has also spelled out some disastrous numbers. It also stated that many people in the worst-affected regions of Helene (Carolinas) do not have flood insurance. This means that most of Helene’s damage will be uninsured — and economic property losses will far outweigh insured losses.

A separate report from Jefferies has outlined that damages from Hurricane Milton could cause damage of more than $50 billion and with a total devastation of nearly $175 billion in a worst-case scenario in the Tampa region.

Flood insurance and other types of insurance are mandatory for just about any home with a mortgage. Some lenders are much more strict than historical floodplain maps. As we have all just witnessed in North Carolina, flood insurance alone is not necessarily the right type of insurance. Many homes need a “Difference in Conditions” policy as all-in-one coverage that protects against losses from landslides, mudflows, earthquakes, and floods.

The Insurance Information Institute outlines other dangers outside of flooding: heavy rainfall can also lead to mudflow, basically creating a river of mud; and landslides, which are caused by the movement of the destabilized land—due either to gradual erosion or an accumulation of water.

Mudslides are where a mass of earth (or rock or trees) moves downhill. As they typically do not contain enough liquid to get into a home they are not covered by flood insurance. Mudflow is said to be covered by FEMA’s National Flood Insurance Program and by some private insurance companies, but the III notes that mudflow is excluded from standard homeowners and business insurance policies.

It is very possible that homes have been hit by mudflows, floods and landslides all in one swoop. If you have seen videos of homes being swept away or where the earth underneath has literally vanished, flood insurance is generally worthless in those instances. The Difference in Conditions must be in place and what is (and is not) covered may vary from state to state and geography to geography based upon elevation, ground composition, and other risks.

Landslides are classified under earth movement, but just like earthquakes it is a separate policy outside of standard homeowners insurance and business insurance policies.

For your vehicle, the typical liability coverage requires optional comprehensive coverage. You may have this without even knowing it if you financed your car purchase. Just don’t bank on it. Seeing your car with water up to the roof, or seeing it float down a river of mud and debris, is only ok when that comprehensive coverage applies. The III data show over 7-in-10 U.S. drivers choose to buy comprehensive coverage. That covers flood and earthquake damage.

Perhaps the saddest part of these storms is that there are millions of homes which simply do not have insurance that protects and reimburses for this sort of damage. Every homeowner in coastal areas and low-lying areas knows that flood insurance is a must-have policy. The problem is that flood insurance is very limited — and in many instances that flood insurance does not cover the type of damage that is caused by storms.

Flood insurance is effectively only there to cover the damage caused by a typical flood. It replaces the fixed and structural parts of a home. It does not generally cover contents and personal belongings, or if it does then not by very much. Now consider what a flood really means — rising water. Not mudflow, mudslide, wind, hail, debris, erosion and so on.

The Insights website for March & McLennan showed that U.S. property insurance rates rose just 2% after much larger hikes in the second quarter of 2024. The insights at that time expected that property insurance price increases should continue to slow. That was before Helene and Milton. And it also remains to be seen if this statement holds true after this hurricane season:

Insureds with assets concentrated in natural catastrophe (CAT) zones — such as the Gulf of Mexico, Atlantic coast, and California — that in recent years experienced greater than average rate increases are now generally seeing above average decreases.

If you have flood insurance, this is in no means a suggestion to cancel it. What you better do is evaluate all of the risks that are within normal parameters and then evaluate some unpleasant scenarios you wish you didn’t have to think of.

Categories: Personal Finance