The world is going to be in need of nuclear power in the coming decades. We know about the many dangers, but nuclear power is actually zero-emissions as nations rush to get their emission of greenhouse gasses under control to fight climate change. The reality is that there just is not another readily available source of energy that can be rapidly scaled up to meet the ever-growing electricity demands of society.

With electricity demand outpacing all of the concerns, nuclear is yet again a “hot investment” theme for those looking for the next Trillion-Dollar theme. Tactical Bulls wants to review some of the top nuclear power winners that investors can buy into for potential upside ahead.

Investors need to consider that no themes come without risk. Some of the stocks that are supporting the rise of nuclear power have already seen substantial gains. Others have already seen their shares pull back, and it is always a feasible case that even companies with great secular support may be mismanaged and can end with a value of zero.

Extremely high demand for electric power is being magnified by A.I. data centers, but there are also new communities, crypto-miners, and cars that need to be charged rather than filled up at night. And let’s not forget the endless air conditioning and/or heating needs. According to the IEA, more than 70 nations have pledged to cut their emissions to net zero. Many nations are moving toward carbon neutrality from 2030 to 2050.

Nuclear power is not without risk. Beyond Chernobyl in Ukraine in 1986, there was the Fukushima (Japan) incident in 2011 and the Three Mile Island accident in 1979. And there are, of course, energy security concerns (Russia) and a recent surge in energy prices. Nuclear power has to be given much more thought about where its plants can be located (fault lines, coastal waters and population centers). And it does require sensitive planning about how to store and where to ultimately deposit all of that nuclear waste.

Tactical Bulls has identified the top nuclear and uranium exchange-traded funds (ETFs) covering this theme. There are also several companies tied to nuclear power that all line up within the themes of nuclear power and uranium. These are in no way to be interpreted as a recommendation to buy any of these stocks and any price target assignments are from outside brokerage firms. This is also not intended to be viewed as investment advice. Investors also run the risk that they could lose money chasing hot investment themes that have already seen large gains and without doing their own due diligence.

Analyst opinions expressed herein do not represent the opinions of Tactical Bulls. Consensus price target data is from FinViz. The Nuclear Energy Institute also outlines investing benefits for the nuclear power industry.

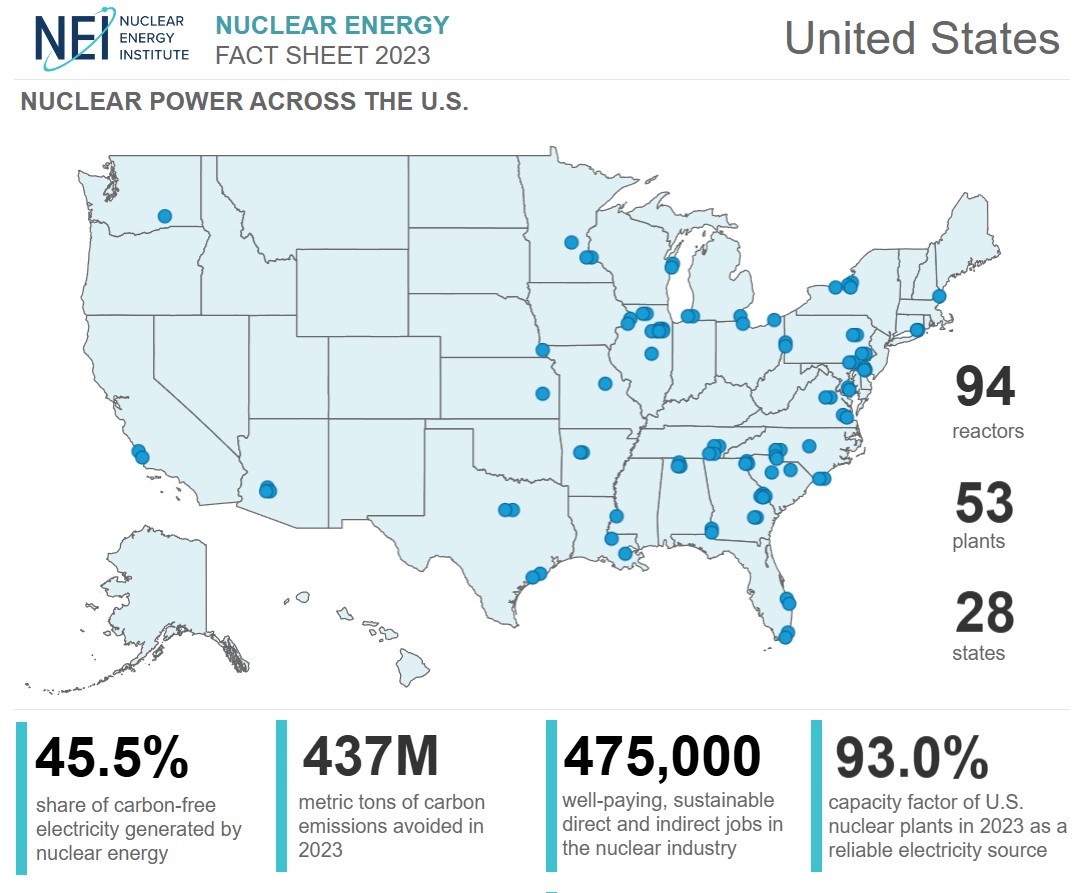

This map shows the distribution of nuclear power plants and generation in the United States. Courtesy of the Nuclear Energy Institute.

NUCLLEAR/URANIUM ETFs

There are three nuclear related ETFs for investors:

Global X Uranium ETF (URA) with $3.4 billion in assets is the largest by far. It is a cap-weighted ETF and Camaco Corp. (NYSE: CCJ) represents nearly 23% of the entire ETFs weighting

VanEck Uranium and Nuclear ETF (NLR) with $247 million in assets

Range Nuclear Renaissance Index ETF (NUKZ) with $27.5 million in assets

CAMECO IN CANADA

Cameco Corporation (NYSE: CCJ)

Stock Price: $48.00

52-Week: $35.18 – $56.24

Market Cap: $21 Billion

2023 Sales: $1.92 Billion

Cons. Target: $57.29

Cameco is a top-tier uranium giant based in Canada. It mines and sells uranium concentrate and refines, converts and sells uranium to nucleal plants. The company’s CEO recently spoke on CNBC about the increasing nuclear demand, global demand for uranium, and how they benefit as countries phase out Russian fuel.

Most of the brokerage firms that cover the stock issue ratings in Canadian dollars, but Goldman Sachs is due to issue an update on its Buy rating and $55 price target from April now that its then-issued 30% upside target has been breached.

ALSO READ: UTILITIES STOCK WINNERS AS RATE CUTS TAKE HOLD

A.I. NUKE WINNER

Constellation Energy Corporation (NYSE: CEG)

Stock Price: $257.00

52-Week: $102.40 – $271.85

Market Cap: $80 Billion

2023 Sales: $24.92 Billion

Cons. Target: $269.23

Constellation recently saw its stock surge after announcing a 20-year pact with Microsoft Corporation (NASDAQ: MSFT) for the launch of the Crane Clean Energy Center and restart of Three Mile Island Unit 1 (nuclear) to power its data centers in PJM use with carbon-free energy. Time will tell if it was a good deal to secure this large of a transaction, but by some measurements Microsoft may have greatly overpaid to lock down this much dedicated power as Microsoft seeks to become carbon-negative. This stock has now more than doubled YTD.

Despite CEG’s stock gain of 22% in a day, many analysts raised their targets handily on the news for this electric power generation leader — KeyBanc ($265); Wells Fargo ($300); Morgan Stanley ($313); UBS ($307); BMO ($278); and BofA ($263).

US URANIUM “LEADER”

Uranium Energy Corp. (NYSE Arca: UEC)

Stock Price: $6.15

52-Week: $4.06 – $8.34

Market Cap: $2.5

2023 Sales: not included

Cons. Target: $10.48

Uranium Energy Corp. (NYSE: UEC) is into exploration, extraction and processing of uranium and titanium concentrates. Its properties are spread out in the United States, Canada and in Paraguay. It actually screens out as the largest U.S.-based uranium company with its $2.5 billion market cap and it recently entered into a deal to acquires Rio Tinto’s uranium assets in Wyoming for $175 million.

While 2023 revenues were $164 million, that was up from $23 million in 2022 and it had no real revenues in 2021 and 2020. Only two known U.S. firms have issued reports of late — Roth MKM (Buy, $9.50 target) and HC Wainwright (Buy, $10.25 target). They are calling for $95 million in 2025 revenues and $202 million in 2026 revenues, with positive earnings called for by both firms in 2026. This stock was actually down 3% YTD at time of publishing.

NEXT IN THE POWER LINES

Vistra Corp. (NYSE: VST)

Stock Price: $117.00

52-Week: $31.16 – $122.01

Market Cap: $40 Billion

2023 Sales: $15.54 Billion

Cons. Target: $128.60

Vistra Corp. (NYSE: VST) recently pushed NVIDIA to the sidelines as the top S&P 500 gainer as it is now up 200% YTD. It is a diversified Texas-based utility player, but it now also happens to be the second-largest owner of independent U.S. nuclear plants.

Vistra is already buying back a 15% stake in its shares from two asset managers and the company is underway to repurchased $2.25 billion (or more in 2024/25) and at least $1 billion more in its own shares in 2026. Some analysts have not aggressively updated their price targets but here are the recent upside target announcements in September — Jefferies ($137); Morgan Stanley ($132); BMO ($125).

THE MICRO-NUKE PLAYS

Tactical Bulls is listing two emerging thematic stocks in microreactors or portable reactors. These would seem to carry unique risks and they are smaller in market capitalization and have far less operating histories to rely upon as proven track records some investors demand. While some established stocks still sometimes manage to find their future value as zero, emerging small cap stocks with limited operating histories are an even higher risk.

NANO Nuclear Energy Inc. (NASDAQ: NNE)

Stock Price: $14.50

52-Week: $3.25 – $37.51

Market Cap: $430 million

NANO Nuclear Energy Inc. (NASDAQ: NNE) is an emerging nuclear power player that designs and installs portable microreactors with a novel heat exchanger concept for portable, secure and reliable nuclear microreactors. The company counted itself as the first portable nuclear microreactor company to be listed publicly in the U.S. earlier this year. Its market cap is tiny at $434 million, and it has been public for less than six months. Benchmark is the only firm seen with a rating (Buy, $39 target).

NuScale Power Corporation (NYSE: SMR)

Stock Price: $11.25

52-Week: $1.18 – $16.91

Market Cap: $1 Billion

NuScale Power Corporation (NYSE: SMR) designs small modular reactor (SMR) nuclear technology with significant financial backing by Fluor Corporation (NYSE: FLR), and its design application is currently under review by the U.S. Nuclear Regulatory Commission. The company’s latest results indicate that approval “remains on track for mid-year 2025 completion” in its own words. NuScale looks to supply nuclear energy for companies involved in electric power generation, data centers, district heating, desalination, hydrogen production and other process heat applications. Only a few firms have ratings — B. Riley (Buy, $14 target); CLSA (Outperform ($11 target); Craig-Hallum (Buy, $16 target).

HIDDEN NUCLEAR EXPOSURE WINNER

Flowserve Corporation (NYSE: FLS)

Stock Price: $51.00

52-Week: $35.32 – $53.86

Market Cap: $6.7

2023 Sales: $4.32 billion

Cons. Target: $56.50

Flowserve Corporation (NYSE: FLS) may not stand out as a nuclear winner in the pumps and valves business. That said, some $150M – $200M of its $4.3 billion sales are tied to nuclear bookings. Its stock was also up about 24% YTD and close to its highs. BofA Securities just recently updated its Buy rating with a $60 price objective that is above-consensus. BofA’s report from 9/24 said “a meaningful inflection in nuclear demand is not embedded in the company’s long-term growth algorithm for mid-single digit growth.” This suggests that there is a potential upside to 2026/27 forecasts as profitability in nuclear is above its Power unit average. Another moat here is that are far fewer competitors in nuclear than in overall flow control market.

Categories: Investing