Gold just hit a new all-time high. The shiny yellow metal’s rise to almost $2,600 per ounce only continues the theme for higher gold prices. Tactical Bulls believes that gold will rise to at least $3,000 per ounce soon, even if that may not happen just in 2024 (barely three months remain). Gold has risen despite a stronger dollar for much of this year. It rose as international conflict persists. It fought off inflation and a rocky economy. It rose even as some central banks paused or slowed their buying.

Gold just hit a new all-time high. The shiny yellow metal’s rise to almost $2,600 per ounce only continues the theme for higher gold prices. Tactical Bulls believes that gold will rise to at least $3,000 per ounce soon, even if that may not happen just in 2024 (barely three months remain). Gold has risen despite a stronger dollar for much of this year. It rose as international conflict persists. It fought off inflation and a rocky economy. It rose even as some central banks paused or slowed their buying.

Tactical Bulls has already laid out the case that much lower interest rates are coming gradually over the next twelve to fifteen months. It is quite possible, at least using the CME FedWatch Tool, that extremely short-term rates will be 200 basis points lower than the 5.25% to 5.50% range today.

Tactical Bulls has also decided to publish more than 10 forces that are all supportive of the price of gold for the rest of 2024 and into 2025. Again, $3,000 is the published target. The “when” remains the big question. That said, neither Tactical Bulls nor any other independent source can guarantee any asset price’s future value. It is even possible that gold’s current price is above fair-value — but it just doesn’t look and feel that way at all!

Here are a dozen supporting themes for higher gold prices as 2024 becomes 2025. These are presented in a random order and are not intended to be a ranking of issues by any measures. As always, the datapoints included herein are not intended as investment advice and this is not a recommendation to buy or sell gold or any of the securities mentioned. All investors are responsible for their own decisions to buy or sell any asset and those decisions should be made carefully with the help of a financial advisor.

GOLD’s “TACTICAL BULL” ROLE

As this is the Tactical Bulls website, it might make sense to explain gold’s “tactical” investment theme. Gold has been and will remain a a secular bullish theme for long-term gold bugs. It seems nothing can deter the bullishness of a gold bug as every sell-off is a chance to buy more gold. Rather than hearing this from a biased horse’s mouth, here what SSGA says about gold as a Tactical play:

Investors have often used gold tactically in their portfolios, with an aim to help preserve wealth with a relatively liquid asset that can potentially help navigate risk during market corrections, geopolitical stress or persistent dollar weakness. But in addition to gold’s tactical benefits, its function as a core diversifying asset during a variety of business cycles may demonstrate that gold can potentially play a more long-term strategic role.

SSGA also cites issues such as risk management, capital appreciation, and wealth preservation as drivers. And the low correlation to other asset classes is also cited.

Scott Redler, a well-known trader, has also cited “more room to run” for silver and gold and his take here is that it is a tactical trade.

INTEREST RATE CUTS SHOULD HELP GOLD

The Federal Reserve’s upcoming interest rate cuts will absolutely help gold. If extremely short-term yields are going to go from 5% or so now to around 4% by the end of 2024 and perhaps as low as 3% by the end of 2025, it’s good for gold on a relative basis. After all, gold pay’s no dividend nor interest. So competing with 3% or 4% is better than competing with 5%. And no one ever buys into money market funds because they think they are going to rally. They buy gold for some of the same safety that may be there in money market funds, but gold bugs usually buy gold because they think it will appreciate.

AS RATES FALL, THE DOLLAR MAY WEAKEN — GOOD FOR GOLD!

If falling U.S. interest rates weakens the U.S. dollar, that is also good for the price of gold. In a static world, there is an inverse relationship between gold and the U.S. dollar as the world’s reserve currency. If the dollar weakens, the gold price is supposed to increase. It the dollar strengthens, the price of gold is supposed to decrease. This is assuming all other aspects of financial markets remain static, so it doesn’t always work that way.

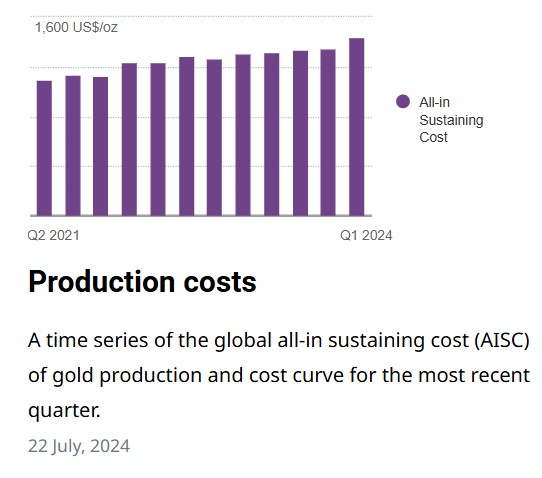

ALL-IN MINING COSTS KEEP RISING

The cost to produce gold keeps rising. This stems from environmental costs, regulations, location, depth, mine density, energy costs and also rising labor costs. The World Gold Council shows a chart with steadily rising all-in sustaining cost (AISC) of gold production and cost curve for the most recent quarter all the way back to 2021. It used to be routine to see ASICs of under $1,000 but many large miners and producers now run 25% to 30% higher than that.

World Gold Council shows a continual rise on all-in sustaining costs for gold production.

WHAT ABOUT GOLD STOCKS & ETFs?

The demand for gold stocks and ETFs seems to be almost insatiable. The SPDR Gold Shares (NYSEArca: GLD) from SSGA is the largest gold ETF in the world by a wide margin with a whopping $72 billion in assets. It has risen 24.8% YTD in 2024 and held $62.13 billion worth of gold at a cost basis of $46.8 billion as of June 30, 2024.

The gold mining ETFs have even done better than gold itself so far. The Van Eck Gold Miners ETF (NYSEArca: GDX) was up 29.3% YTD (with $15.2 billion in assets) and the Van Eck Junior Gold Miners ETF (NYSEArca: GDXJ) was up 29.2% YTD (with $5.6 billion in assets).

The two largest North American gold giants are up strong too. Newmont Corporation (NYSE: NEM) is up 29.7% YTD ($61 billion market cap) and Barrick Gold Corporation (NYSE: GOLD) is up 15% YTD ($36.5 billion market cap).

TOTAL GLOBAL GOLD SUPPLY

The World Gold Council’s estimate as of early 2024 was that around 212,582 tonnes of gold has been mined throughout history. About two-thirds of that amount has supposedly been mined since 1950. Gold mines are becoming harder to find in the old traditional mine shafts you see in movies. This was broken down as follows (approximate): https://www.gold.org/goldhub/data/how-much-gold

- Jewelry 96,487t (45%)

- Bars and coins (plus ETFs) 47,454t (22%)

- Central banks 36,699t (17%)

- Other 31,943t (15%)

- Proven reserves 59,000t

TOTAL GOLD DEMAND

Since 2010, global gold demand has been between 4,000t and 5,000t every single year except for 2020. The demand in 2021 was barely 4,000t as well, and you know what was happening around the globe — covid-related shutdowns.

In the last two years, central bank buying has been over 1,000t each year. Jewelry fabrication has been over 2,000t in each of the last three years. Gold demand from investment averages just over 1,000t per year but can be slightly under that some years.

It remains to be seen whether central banks and whether jewelry fabricators will continue their gold buying as prices rise.

CAPITAL NEEDS A SAFE HAVEN

Whatever money is not kept in cash or money markets has to be invested somewhere. Stocks, bonds, commodities, private businesses, real estate, alternative assets and so on. Gold is considered to be the world’s ultimate safe haven in times of turmoil. This case for gold revolves around geopolitical uncertainty, social unrest, global debt worries, wars and skirmishes. Famine and health scares count too. While these can take paper assets into a state of financial paralysis, gold is supposed to rise or perform better than riskier paper assets.

DOES BITCOIN COMPETE OR COMPLIMENT?

Some bitcoin and cryptocurrency investors believe that they are investing in “the new digital gold equivalent.” AS some nations have begun to embrace bitcoin, it does lend at least some credence to the “digital gold” aspect. Then again, a central bank’s gold is unlikely to go missing or get hacked away. Whether or not crypto is a DeFacto competitor of gold remains to be proven. The website GoldenEagleCoins lists the value of the entire world is more than $13.3 trillion based on a $2,591.20 price per ounce.

If all the 21 million bitcoin allowed to be printed (not including what has been lost to error, password loss and drives crashing) then all the bitcoin in the world would be worth $1.25 trillion based on a $59,500 price — but some estimates exist projecting 5 million to 6 million have been lost forever, but that may also include how much hasn’t ever moved in five-years as well. We will never truly know how much Bitcoin has been lost forever as long as bitcoin is held offline and in cold storage. https://www.goldeneaglecoin.com/Guide/value-of-all-the-gold-in-the-world

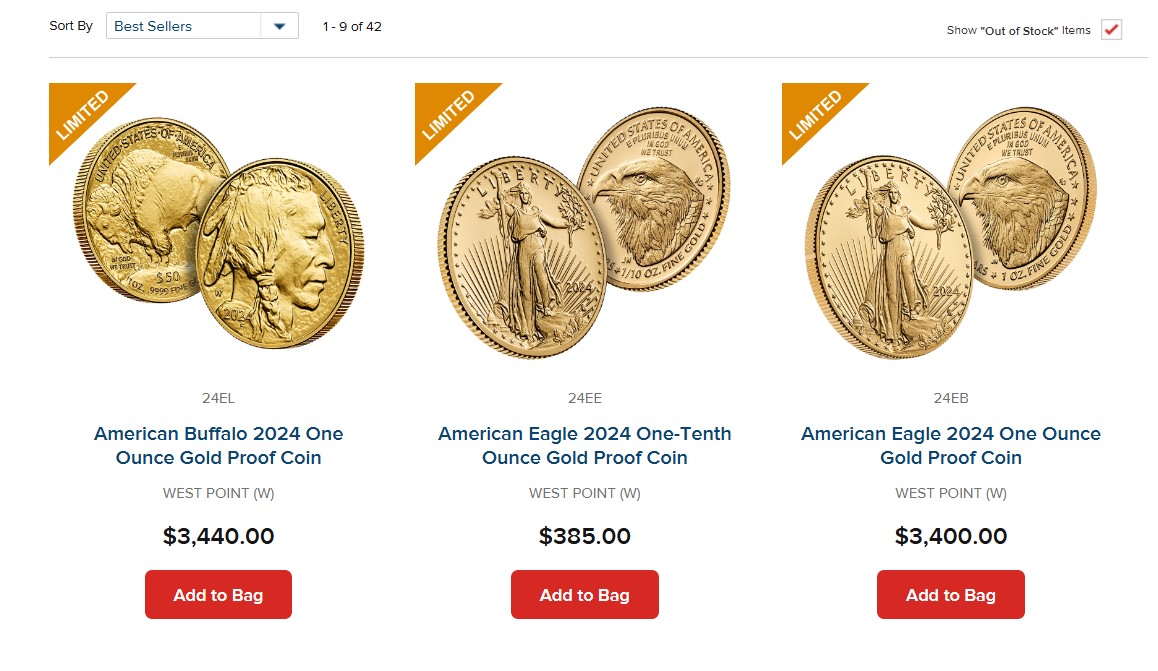

THE GOLD COIN PREMIUM

Gold coin investors have to pay a premium to buy gold coins over the spot price. After all, the spot price is a market price for delivery. Then there is the processing, packaging, and shipping. There is also marketing, like of all those commercials telling you to buy gold. With gold at just under $2,600 per ounce on last look, the U.S. Mint’s price was last shown as $3,400.00 for an American Eagle 2024 1-oz gold proof coin (a 30% premium). The Mint’s 1.10-oz gold coin is $385.00 per coin, or $3,850 per ounce equivalent for a 48% premium). The website Monex on Sunday showed the ask price (sale price to you) as $2699.20 for a generic gold eagle, $2664.70 for a South Africa Krugerrand and $2663.80 for a Canadian gold maple leaf coin.

THE EXTREME UNITED STATES ELECTION

This is an election year and both U.S. parties now demonize each other in public every single day. The presidential election (and much of Congress) will hopefully be a known decision in less than 60 days now. That said, many Americans on both sides expect whatever the transition is to be less than normal. Does that mean national protests? Does that mean riots? Does that just mean lawsuits over ballot counts and access?

There have now been two assassination attempts on former President Donald Trump. Many Americans believe that the Democrats skipped and usurped the entire democratic process by getting President Joe Biden out of the way and naming Kamala Harris their candidate. Regardless of which party you will be voting for in November, do we all really still want the same thing in the end? That’s gone. And that uncertainty is more bullish than bearish for gold.

HOW HISTORY MAKES GOLD WHAT IT IS

Let’s not kid ourselves about a few key issues here if there is going to be uncertainty. You cannot eat or drink gold. You cannot make clothing or shelter out of gold. And gold isn’t going to heal most ailments and diseases. What makes the real case for gold is thousands of years of history. Kings, national treasuries, gold coins, and empires all relied upon the power of gold (and other precious metals) to represent the strength of their time.

The United States has been off the gold standard for barely 50 years, but gold was the basis for backing global currencies up until the world decided it could foster more growth by using “full faith and credit (and armed strength)” to back up their currency. The US Money Reserve site shows that the U.S. dollar has lost 96% of its purchasing power since the creation of the Federal Reserve in 1913.

J.P. Morgan was one of the most influential men in business history, even if he is considered a robber baron. He is quoted:

Gold is money. Everything else is credit.

Imagine what the price of gold might be if the gold standard had never been abolished — or for those who still say we should consider a return to the gold standard.

THE CAVEATS

There are many caveats that could prevent gold from its strong march higher. Russia, Ukraine, China, Taiwan, Israel and elsewhere could all decide to settle down. They don’t show any sign of that, but they could. There are also issues around central bank demand, interest rates, mining costs, crypto competition, and currency fluctuations

Short-term interest rates are probably 200 basis points higher than a natural rate around 3%. How many governments can afford to pay 5% at debt servicing with record debt loads? At this time, the U.S. national debt was more than $34.67 trillion.

China and other central banks could decide that they need to refrain from buying gold at such high prices. China has paused but other central banks have almost no choice but to keep adding gold as part of their reserves. That said, China’s core economy is not strong and the government has to likely do whatever it can to keep their economy from rolling back.

There are many other caveats that can come into play that would send gold back down toward $2,000 rather than upwards toward $3,000. That said, the cost of mining has only risen and the geopolitical risk premium only seems to be adding catalysts at this time.

It is always possible that the continued interest in Bitcoin and crypto assets can continue to take away from the interest in gold. That doesn’t appear to be the case today and there very well may be plenty of room for continued growth for both assets.

Again, none of the data and issues brought up are intended to be investment advice or a recommendation to buy or sell gold or any assets and securities mentioned herein. There is no assurance at all that gold will continue rising in price. History has proven time and time that the price of gold could even fall. That price can also fall rapidly and without any warning or evident reason. All investors and readers are responsible for their own decisions to buy or sell any asset and those decisions should be made carefully with the help of a financial advisor.

Categories: Investing