Tactical Bulls does not cover individual earnings reports on an in-depth basis. Instead, the focus is on what the earnings and guidance really mean for each company, and if applicable their sector and the economy as a whole. It is undeniable that NVIDIA Corporation (NASDAQ: NVDA) is a key company to the markets with an astonishing $2.97 trillion market cap (after 3.8% drop). It’s also undeniable that NVIDIA is a critical component for the semiconductor and technology sectors. And it is also undeniably a key economic company because of its size, its dominance of multiple ETFs, and mostly because it is the absolute leader in the race toward artificial intelligence.

There has been a changing trend taking place since NVIDIA’s last formal earnings report versus the report from August 28, 2024. NVIDA was previously in a debated position of being a “tactical” stock to increase returns (or alpha for the picky traders). And NVIDIA’s leadership position in the field of Artificial Intelligence also made some secular investors looking to capitalize on this never-ending growth trend. Is it possible that NVIDIA now has just become more of a secular theme rather than also being a “tactical” theme for aggressive investors?

To see if NVIDIA is now becoming more of a Secular story rather than a Secular AND Tactical theme, this 360-degree view looks at multiple facets. This looks at trading history, short selling trends, analyst calls, ratings changes, the media reactions, charts and more.

OWN IT, DON’T TRADE IT ! ? ! ?

Perhaps you have heard Jim Cramer and others discuss a theme of secular stocks — own it, don’t trade it. This is regarding secular themes suggesting that you should not try to trade in and out of the stocks around news cycles. It means you should just buy them and hold them for a long period of time.

Tactical Bulls would point out that NVIDIA’s earnings report in May-2024 was stellar by all counts, but it was also temporarily juiced up by the massive 10-for-1 stock split. Wall Street came out swinging for the fences with even larger analyst price targets in May, some of which have been raised yet again after the August earnings report. Some analysts just maintained their aggressive price targets.

As far as why the NVIDIA story may be finally moving toward a secular hold rather than a tactical buying opportunity is that NVIDIA’s split adjusted pre-earnings price in May was $94.95. Then shares were indicated up 7% at $101.725 initially as the following morning’s post-earnings reaction after. It had just hit $100 ($1,000 before the split) for the first time ever that same day ahead of earnings. We have to consider what trends have occurred since that time the pre-earnings close and then the peak going into and immediately after its 10-for-1 stock split.

- The first day after earnings NVDA shares closed up 9.3% at $103.79.

- Then the 10-for-1 split took effect June 10, 2024 with an adjusted close of $121.78.

- NVDA hit $130 for the first time ever on June 14, 2024.

- NVDA his $140 briefly for the first time ever on June 20, 2024.And by June 18, 2024, NVDA closed back under $120 at $118.11.

- And zooming forward to the August sell-off, NVDA’s low close was $98.91 on August 7, 2024.

- By August 19, 2024, NVDA was back at $130 again.

- And the reaction before this earnings report (Aug. 28) was $125.61.

- And the afternoon reaction on August 29, 2024 — -5.7% to $118.40 as of 2:00 Eastern Time (on 361 million shares).

Rather than going over the entire earnings report and making verbatim quotes you can read anywhere, Tactical Bulls is giving a very brief summary of each and every source it has screened and monitored on Thursday. At 2:00 Eastern Time the stock was seen with a 5.7% drop to $1118.40 and it had traded close to 360 million shares — a sum of about $33.8 billion in a fraction of a single trading day.

ANALYSTS RAISING TARGETS

These are the analyst price targets we have already seen with reiterated ratings and with price target hikes:

- BofA Securities (Buy) to $165 from $150

- Craig-Hallum (Buy) to $165 from $125

- JPMorgan (Overweight) to $155 from $115

- Mizuho (Outperform) to $140 from $132

- Morgan Stanley (Overweight) to $150 from $144

- Needham & Co. (Buy) to $145 from $120

- R.W. Baird (Outperform) to $150 from $120

- Raymond James (Strong Buy) to $140 from $120

- Truist (Buy) to $148 from $145

- Wells Fargo (Overweight) to $165 from $155

- WestPark Capital (Buy) to $165 from $127.50

Be advised that more analyst price target changes are anticipated throughout the coming days.

ANALYSTS STAYING POSITIVE, BUT NO TARGET CHANGES

Here are the analyst calls where the firm’s ratings AND price target had no change (so rating not automatically included):

- Argus stays $150, noting remains Top Pick in semiconductors.

- Benchmark stays $170

- Cantor Fitzgerald stays $175

- DA Davidson stays $90

- Piper Sandler stays $140

- Rosenblatt stays $200 (as the street-high “Buy”)

- Wedbush stays $138

WHAT THE FINANCIAL MEDIA HEADLINES SAY

Here are also some of the key headline summaries signaling how the financial media covered NVIDIA (often citing analyst reports):

- ‘Move Over Nvidia.’ Apple Is Citi’s Top AI Stock Pick (Barrons)

- Nvidia’s Share Fall Shows Even Biggest Companies Can Experience Setbacks — Market Talk (Dow Jones)

- Nvidia Share Dive Is Buying Opportunity — Market Talk (Dow Jones)

- Nvidia Pays Price of Lofty Expectations, Stoking Fear for Rivals (Bloomberg)

- Nvidia Tumbles After Disappointing Forecast, Blackwell Chip Snags (Bloomberg)

- 7 takeaways from Nvidia’s big earnings report (TheStreet)

- Nvidia’s Slowing Growth Disappoints Investors — Market Talk (Dow Jones)

- Nvidia Shares Fall Premarket After Earnings Undershot Most Optimistic Expectations — Market Talk (Dow Jones)

- Nvidia shares fall despite results, guidance beat; Analyst says “buy the pullback” (Investing.com)

- Nvidia Growth Expected to Continue But With Little Room for Error — Market Talk (Dow Jones)

- Morning Bid: Nvidia ‘beats’ as expected, but fallout limited (Reuters)

- Nvidia’s rally takes a break after forecasts leave investors nonplussed (Reuters)

- Has Nvidia’s stock been too priced to perfection? Two top investors weigh in (CNBC)

- Frasse: Nvidia beat expectations, but they continue to do this at a slowing pace (CNBC)

- Nvidia drives path Tesla would find familiar (Breakingviews)

- Nvidia chief vows flagship AI chips each year despite delays (Financial Times)

- Nvidia takes $100bn hit on outlook fears (Financial Times)

- Nvidia revenue up, stock price down (Silicon Valley Business Journal)

- In NYC, techies partied over Nvidia’s quarterly earnings report (SFGate)

- Buy the Dip Calls Come in for Nvidia Stock (Barrons.com)

SHORT SELLER TRENDS

Short sellers have lowered their bets around NVIDIA, but honestly not by very much. The split brought a jump in the short interest in June. Short sellers have only dialed down their short selling efforts marginally and we still do not have the data for the end of August yet. Here is that short interest by date:

- 08/15/2024 — 293,539,007

- 07/31/2024 — 275,196,949

- 07/15/2024 — 280,295,880

- 06/28/2024 — 300,415,949

- 06/14/2024 — 315,033,985

Pre-Split (/10):

- 05/31/2024 — 29,202,972

- 05/15/2024 — 27,890,572

- 04/30/2024 — 26,745,995

- 04/15/2024 — 29,081,302

- 03/28/2024 — 28,356,794

- 03/15/2024 — 30,321,554

IS JENSEN HUANG SOUNDING MORE SECULAR?

Perhaps CEO & Founder Jensen Huang had the star quote going just above and beyond technology and data centers. This may sound a tad more secular than tactical than just calling for endless growth ahead quarter after quarter:

Hopper demand remains strong, and the anticipation for Blackwell is incredible. NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.

Blackwell samples are shipping to our partners and customers. Spectrum-X Ethernet for AI and NVIDIA AI Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform. Across the entire stack and ecosystem, we are helping frontier model makers to consumer internet services, and now enterprises. Generative AI will revolutionize every industry.

DISCLAIMER

The opinions herein have taken into account outside analyst, media and website reports using screening tools. No investors owning (or short selling) NVIDIA should consider any of these views expressed herein as investment advice. The information provided may contain recommendations by brokerage firm analysts to buy or sell NVIDIA, but none of these ratings, views or price targets are issued by Tactical Bulls. All decisions to buy, sell, hold, short sell, trade NVIA options and related ETFs are the responsibility of each investor and those decisions should be made with a financial advisor.

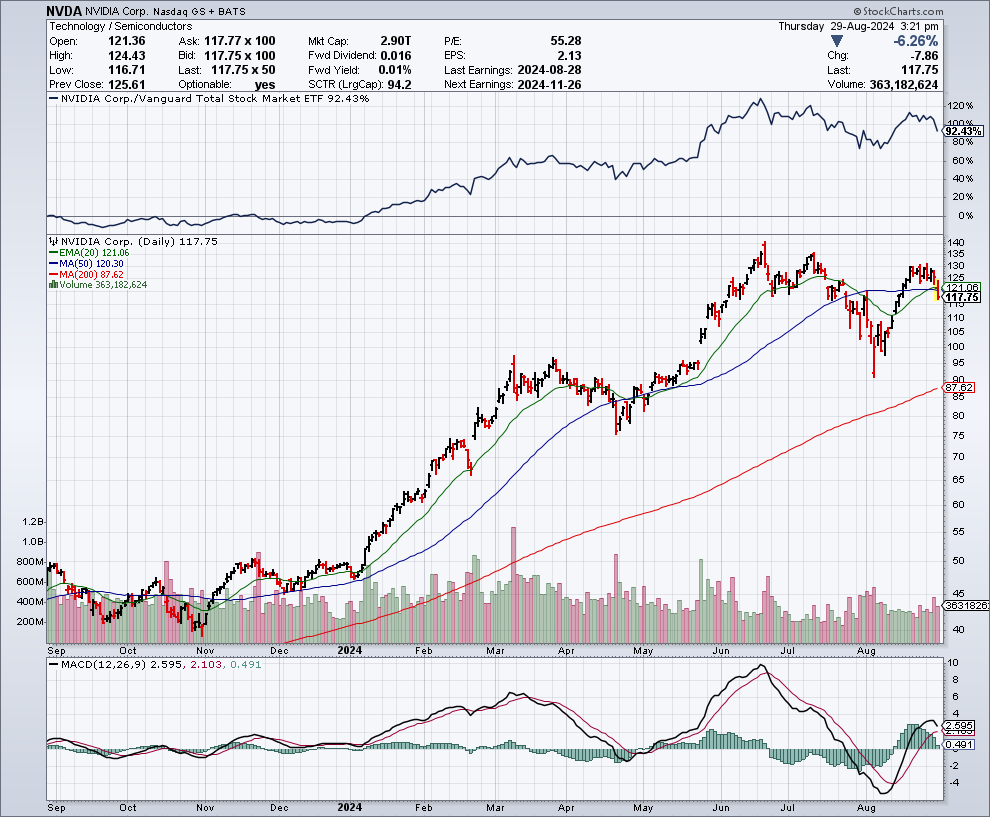

THE CHART — YOU DECIDE

The following chart has been provided by StocksCharts.com:

Courtesy of StockCharts.com

Categories: Investing