The name Facebook or Meta doesn’t matter to investors any longer. Meta Platforms, Inc. (NASDAQ: META) is part of the Magnificent 7 stocks powering the current bull market. Meta was supposed to post strong earnings and guidance in late-April, but that’s not what the stock’s earnings and guidance reaction showed. Just one problem — that initial sell-off appears to have been the wrong initial reaction entirely.

Before earnings, Meta Platforms’ stock had been up 14% year-to-date and up 140% in a year. At $493.50 before earnings was also down only about 3% from all-time-highs. Then the initial reaction took META shares down more than 14% at $421.50 in the immediate reaction.

Based on the recovery that has taken place since the first drop of $200 billion in market value, there has already been a huge recovery worth more than just a notation. Wall Street firms did not throw in the proverbial towel because they kept strong ratings, but many price targets were slashed. Now some of those targets may already need adjustments.

Meta’s excess spending is pointed at investments targeting the metaverse and in AI. Skipping over some of the details, the reality is that after cost cuts and layoffs, Meta is now targeting capital spending of $35 billion to $40 billion versus a prior forecast of $30 billion to $37 billion. CNBC initially dubbed Zuckerberg’s focus on the ways the company can bleed cash.

It looks like the Wall Street firms that defended the social media giant have won. At least so far. The analyst research reports were actually above and beyond a simple “tactical bullish” view. The opportunity for returns around AI, the Metaverse, headsets, and even plain ads from social media are just too large of a financial target for some of the firms to avoid. Did the capital returns via share buybacks and dividends already kick in?

WHO DIDN’T GIVE UP?

Morgan Stanley remained calm in its analyst report. The firm reiterated its Overweight rating and its base case remained unchanged at $550, saying it is a buyer on weakness and that it sees 32% upside from post-earnings trading levels. The firm noted that META’s revenue guide for Q2 implies 22% growth at the high-end, about 1% ahead of its own expectations, and the firm agrees with higher investment to come — as META continues to accelerate AI infrastructure investments for more durable engagement and revenue growth. Morgan Stanley also outlines how Meta shareholders should not forget about the TikTok ban “optionality” that exists here:

Through this tactical period of negative sentiment, we think it is also important to remain focused on the political developments around TikTok. This is because we think META is likely the largest beneficiary from any potential TikTok ban given an already large daily user base and Reels’ position in short-form video. Importantly, any positive impact here is not in our model and we estimate that even if 50% of time goes to META and that time monetizes at 50% of the rate of core it would add ~ $1 of EPS.

POSITIVE CALLS, BUT PRICE TARGETS CUT

Lots of positive calls but many price targets were cut:

- Wedbush maintained its Outperform rating but sharply cut its price target to $480 from $570.

- Oppenheimer maintained its Outperform rating but slashed its price target down to $500 from $585.

- Deutsche Bank maintained its Buy rating but cut its price target to $500 from $540.

- Wolfe Research maintained its Outperform rating while cutting its price target to $500 from $530.

- Jefferies maintained its Buy rating but cut its price target to $540 from $585.

- Goldman Sachs maintained its Buy rating but cut its price target to $500 from $555.

- Baird maintained its Outperform rating while trimming its price target to $500 from $525.

- Canaccord Genuity maintained its Buy rating while trimming its price target to $575 from $610.

MORE CUTS, BUT…

Some firms stayed very aggressive with only slight price cuts:

- Wells Fargo (Overweight) went to $593 from $600.

- Raymond James maintained its Strong Buy rating but went to $525 from $550.

- Truist (Buy) went to $535 from $550.

- Stifel (Buy) went to $550 from $588.

- RBC Capital (Outperform) went to $570 from $600.

AND A PRICE TARGET UPGRADE?

Rosenblatt reiterated its Buy rating after earnings and raised its price target to $562 from $520.

DARE SAY SELL?

At the start of May, BNP Paribas analyst Stefan Slowinksi issued an Underperform rating on Meta Platforms. His $360 target price also implied nearly 20% downside at that time. Its stock was closer to $439 at the time. It has rallied about 5% since that call.

TACTICAL BULL CONCLUSION

Meta’s shares were last seen trading at $467.75 and if that remains positive it will have marked the fifth straight days of gains. Its 52-week range is $230.72 to $$531.49.

The big initial drop in Meta Platforms wiped out $200 billion in market capitalization. So far, it has proven to be a tactical buying opportunity as the stock has recovered 10% from its lows. The analyst community is currently maintaining more of a “perma-bull” stance in their research calls rather than just a tactical bullish stance. They are still bullish with more dialed-down price targets.

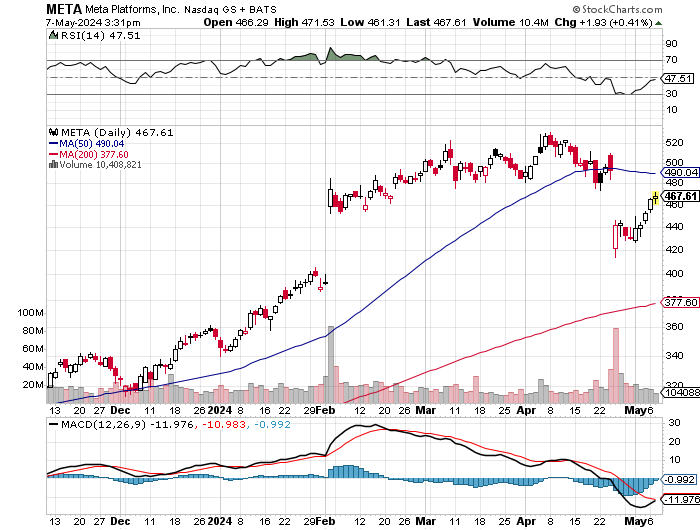

As of today, this looks like just another incidence where the Efficient Market Hypothesis is anything but efficient. Here is the chart from StockCharts.com showing how META shares have recovered.

Categories: Investing