It seems hard to imagine that companies with stock market capitalizations of $1 trillion to $3 trillion can just keep growing in growing. Some of these companies are now larger than many nations’ total GDP. Still, many investors are continuing to bank on that that trend. The “why” is simple enough. That’s where all the growth is.

It seems hard to imagine that companies with stock market capitalizations of $1 trillion to $3 trillion can just keep growing in growing. Some of these companies are now larger than many nations’ total GDP. Still, many investors are continuing to bank on that that trend. The “why” is simple enough. That’s where all the growth is.

Tactical Bulls looks at many existing and past trends to help in determining where to be invested in the months (and years) ahead. This is not to be interpreted as investment advice as each investor should consult with their own financial advisor before deciding whether to buy, sell or hold any investment. And for that matter, it is impossible to ignore the current and next-year multiples being high on sales, earnings and cashflow metrics.

Long-term investors are more focused on what sales and earnings will translate to over the next two-year to five-year period. Or even longer. This is when earnings, sales and cashflow multiples start to look better compared to the lower growth portions of the S&P 500.

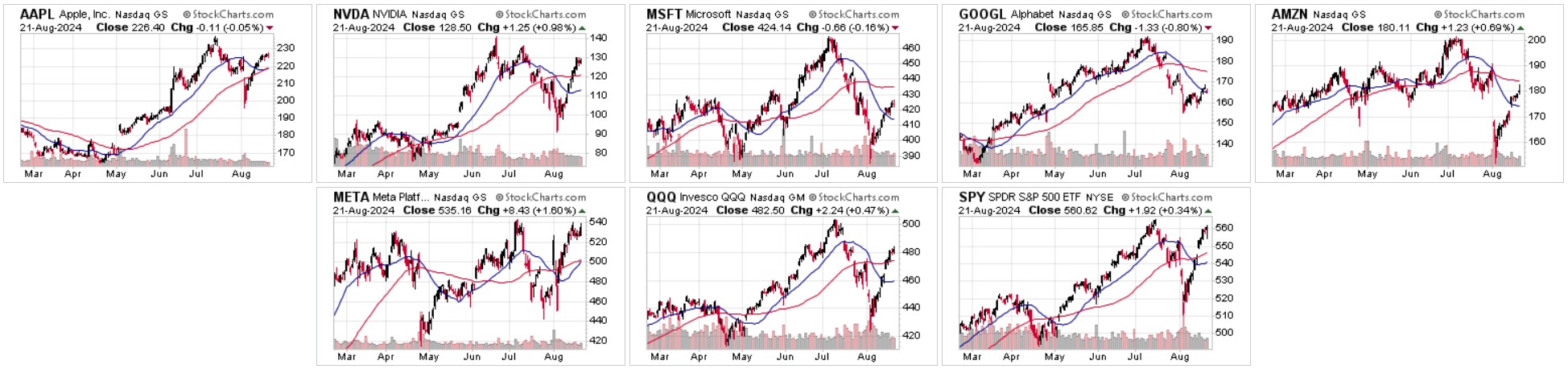

There are many outside views that support higher prices for the mega-cap tech stocks a year from now. Just do not overlook that very oversold conditions from late in July and early August may already be back into overbought conditions for some of the mega-cap tech stock charts (see below). The election results will be long gone by then. The verdict on lower interest rates and economic policies should be known by then. As should future taxation policies. And trends toward the cloud, artificial intelligence, memory and computing should remain deeply entrenched themes.

These are the market caps and year-to-date performances of the tech-related mega-caps so far in 2024:

Apple Inc. (NASDAQ: AAPL) $3.42 trillion (up 17% YTD)

NVIDIA Corporation (NASDAQ: NVDA) $3.14 trillion (up 158% YTD)

Microsoft Corporation (NASDAQ: MSFT) $3.14 trillion (up 13% YTD)

Alphabet Inc. (NASDAQ: GOOGL) $2.05 trillion (up 18% YTD)

Amazon.com, Inc. (NASDAQ: AMZN) $1.89 trillion (up 18% YTD)

Meta Platforms Inc. (NASDAQ: FB) $1.34 trillion (up 50% YTD)

GOLDMAN SACHS — “STAY THE COURSE!”

A bullish case from Goldman Sachs has been laid out for mega-cap tech stocks to keep performing. Peter Callahan, the firm’s TMT (Tech, media & comms) specialist did point out the uncanny drops that had been seen in July and the start August having reflected broader concerns about the economy, mixed earnings reports with weak guidance, and even a growing skepticism surrounding AI. Goldman Sachs had labeled many broader concerns about “the real AI benefits” being far less than most expected over the next decade.

Now the market is more focused on the costs surrounding AI investment and how long it will take to be both financially worth it and how impactful it will be for enterprises and consumers alike. Callahan’s view is that the mega-cap tech story is far from debunked. He even sees a “defensive” aspect with secular growth opportunities. And at the end of the day, he believes that the AI story remains “more ahead” than “behind.”

Goldman Sachs has the following ratings and targets on the tech mega-caps mentioned above:

- Apple (Buy, $275)

- NVIDIA (Buy, $135)

- Microsoft (Buy, $515)

- Alphabet (Buy, $195)

- Amazon (Buy, $250)

- Meta (Buy, $555)

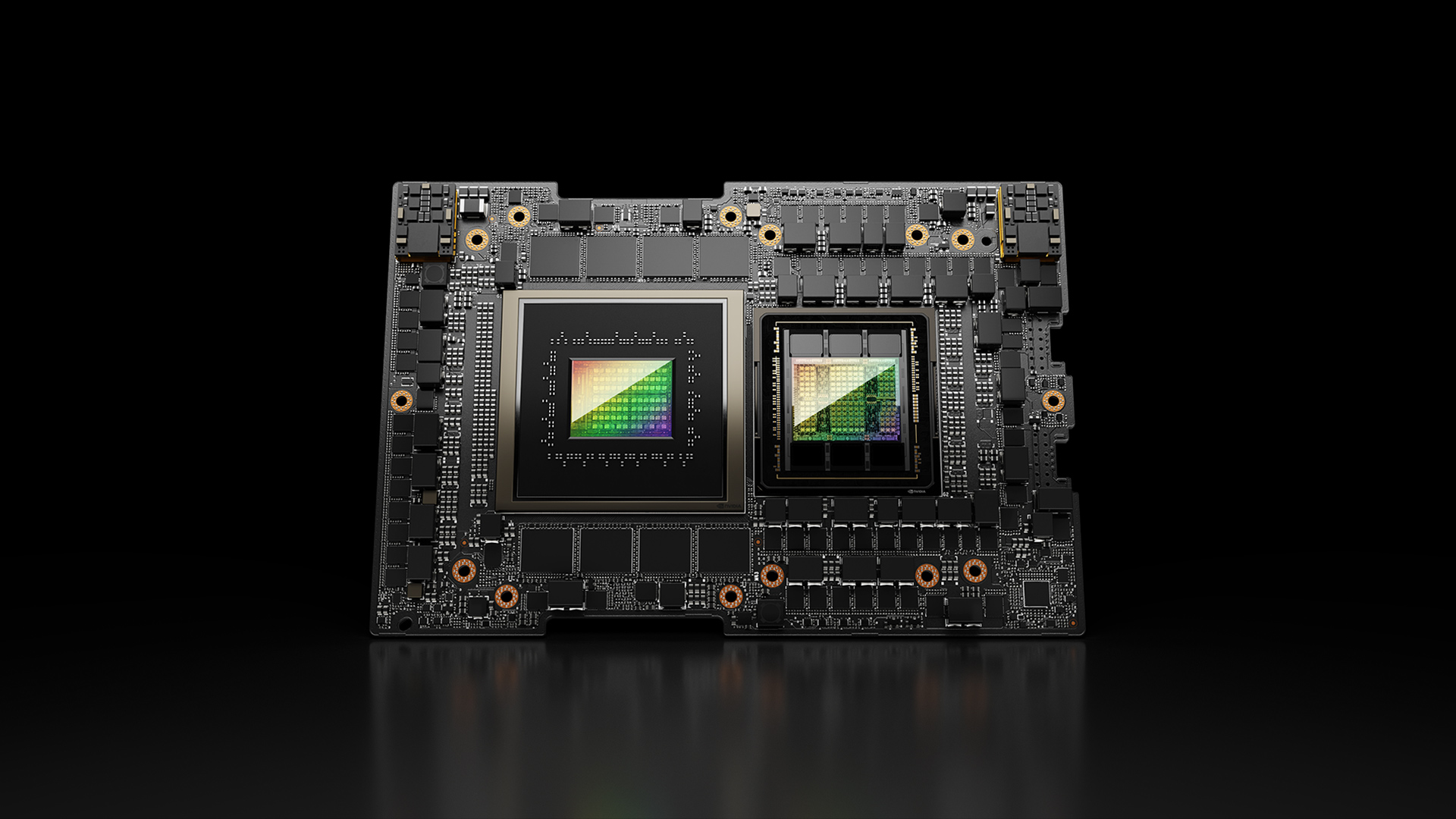

GOOGLE AND THE OLD GOOGLER TALKING UP NVIDIA

Google started the month of August out with news that Google is monopolist. The judgment came as paying billions of dollars to companies like Apple and Samsung to be the automatic search engine on consumer devices was preventing rivals from competing against it. This is arguably the strongest antitrust ruling since the government’s ruling against Microsoft more than 20 years ago. The ruling does not, as of yet, include any remedies, fines, penalties nor future changes on how Google will be able to operate as a company and with its units. But think about this — Alphabet could be worth even more in a sum-of-the-parts

When investors hear the name Eric Schmidt, they are most likely going to remember Schmidt as the “adult supervision” for Sergei and Larry at Google – now Alphabet Inc. (NASDAQ: GOOGL). Schmidt recently said in a recent talk at Stanford that NVIDIA has a large lead over tech peers in AI. He even went as far as saying the big companies are telling him they need $20 billion, $50 billion, and even $100 billion to spend in AI infrastructure. Schmidt also said he is a close friend with OpenAI CEO Sam Altman, but conceded that investors should know what to do if $300 billion is all going to NVIDIA.

MICROSOFT UNDER SATYA

A fresh investor update shown in an SEC filing from August 21 may cause some scares about changes in the outlook but these are shown as “mechanical updates only” versus the outlook that was given less than a month ago. Microsoft updated how it will change the reporting for cloud services and Azure with AI services. Productivity & Business Processes, Intelligent Cloud, and More Personal Computing were all adjusted — with revenues adjusted up about $7.5 billion from the last forecast Productivity & Business Processes and down by nearly the same combined amounts for Intelligent Cloud and More Personal Computing.

Microsoft has been able to do more with fewer people as a result of incorporating AI. This was confirmed by someone I met recently who was laid off from one of Microsoft’s partnership companies (not just tied to video games per the 1,900 employees) that felt this directly. He pointed out that he was no longer needed because the teams can be 2 or 3 people being assisted by AI rather than 10 team members all commanding high salaries.

With Microsoft shares back up to $424, down from a peak above $460 and up from the sub-$400 price in early August, some analysts still have much higher targets than its recent all-time high of $468.35. These are some analysts with strong ratings like Buy and Outperform that are still handily above Microsoft’s old high from July:

- Wedbush Securities ($550)

- Wells Fargo ($515)

- BofA Securities ($510)

- UBS ($510)

- Morgan Stanley ($505)

- RBC Capital Markets ($500)

- Citigroup ($500)

META STAYS FACEBOOK MORE THAN METAVERSE

It was not that long ago that Facebook as going all-in on the Metaverse. The company even changed its name. Then came the negative sentiment from Mark Zuckerberg insistingly invest billions upon billions on the metaverse despite all the lack of business and revenues being anywhere close to reality. That may take another decade, or will it? Facebook’s parent is one of the top AI infrastructure builders and that may benefit the metaverse efforts more than just the old static Facebook. Whether or not it can “make Facebook employees want to actually engage with it this time” remains to be seen.

While there is the endless effort to track Facebook engagement and improvement, the company still has WhatsApp, Oculus, Messenger, Instagram and other aspects that can drive its business. Oh, and when the antitrust cases come against the company, the sum-of-the-parts argument comes into play here too.

At $535 at the present time, here are some of the higher forecast analyst target prices above its all-time high of $542.81:

- Wells Fargo ($647)

- Tigress Financial ($645)

- Rosenblatt $643)

- UBS ($635)

- JPMorgan ($610)

- Guggenheim ($600)

- Jefferies ($600)

- Susquehanna ($600)

- Stifel ($590)

- Deutsche Bank ($585)

- KeyBanc Capital Markets ($560)

ELSEWHERE

It is hard to ignore some of the megatrends driving the mega-cap stocks. The next Apple iPhone will be including more aspects of AI and should constitute the largest upgrade cycle we have seen in years. Amazon’s AWS continues to grow and the core Amazon service is now a staple in almost every household in America.

Another question is which tech stock can most easily join the mega-cap club next. Broadcom Inc. (NASDAQ: AVGO) has a market cap of $771 billion with a $165 share price on last look after its stock split. Its shares are down about 10% from this year’s all-time high, and the consensus analyst price target is up closer to $195. Firms like JPMorgan, Cantor Fitzgerald, Rosenblatt and Barclays have analyst price targets of $200 or higher. If those targets come to fruition then Broadcom is basically in the mega-cap club too.

Again, investing decisions to buy, sell or hold are up to each individual investor and should be done with a financial advisor.

THE CHARTS

The 6-month charts below with 50-day and 200-day moving averages have been provided by StockCharts.com.

Mega-Cap Tech stocks from StockCharts.com

Categories: Investing