Sometimes you see news reports driving stocks higher that sound almost too good to be true issued by companies that have long been forgotten by investors. Lumen Technologies, Inc. (NYSE: LUMN) is one of those companies. Its shares had remained actively traded over time but its stock price had recently declined to $1.00. Now the stock is trading up over $6.00 in a very short period of time. New and existing investors will want to know what it all boils down to looking forward.

Tactical Bulls wants to review whether or not new tactical investors looking for upside should consider committing new capital to Lumen Technologies. As its shares surged, its market cap surged to $6 billion in this latest recovery. There may be more to the gains, but this may be a longer outlook than what has been seen already in a short period of time.

Lumen was one of the old beneficiaries of the dot-com bubble when shares exploded higher from 1998 to 2000. During that time the shares exploded from close to $10 to nearly $50. Then, after coming back down to earth, the shares recovered again to almost $50 in 2007 and again in 2010. It has been a long slow decline since that time. Many investors, including yours truly, have even almost entirely forgotten all about Lumen prior to the most recent news flow and price action.

Lumen’s products and services are in dark fiber, edge cloud services, internet protocol, managed security, wide area networks, secure access, unified communications systems, optical services, ethernet and VPN data networks. The key driving force for Lumen’s stock surge in recent days is that the company has announced major partnerships, one with Microsoft Corporation (NASDAQ: MSFT) and one with Corning Inc. (NYSE: GLW). The company now shows that the total pacts with artificial intelligence leaders are to the tune of $5 billion. And now Lumen is calling this the largest expansion of the internet in generations.

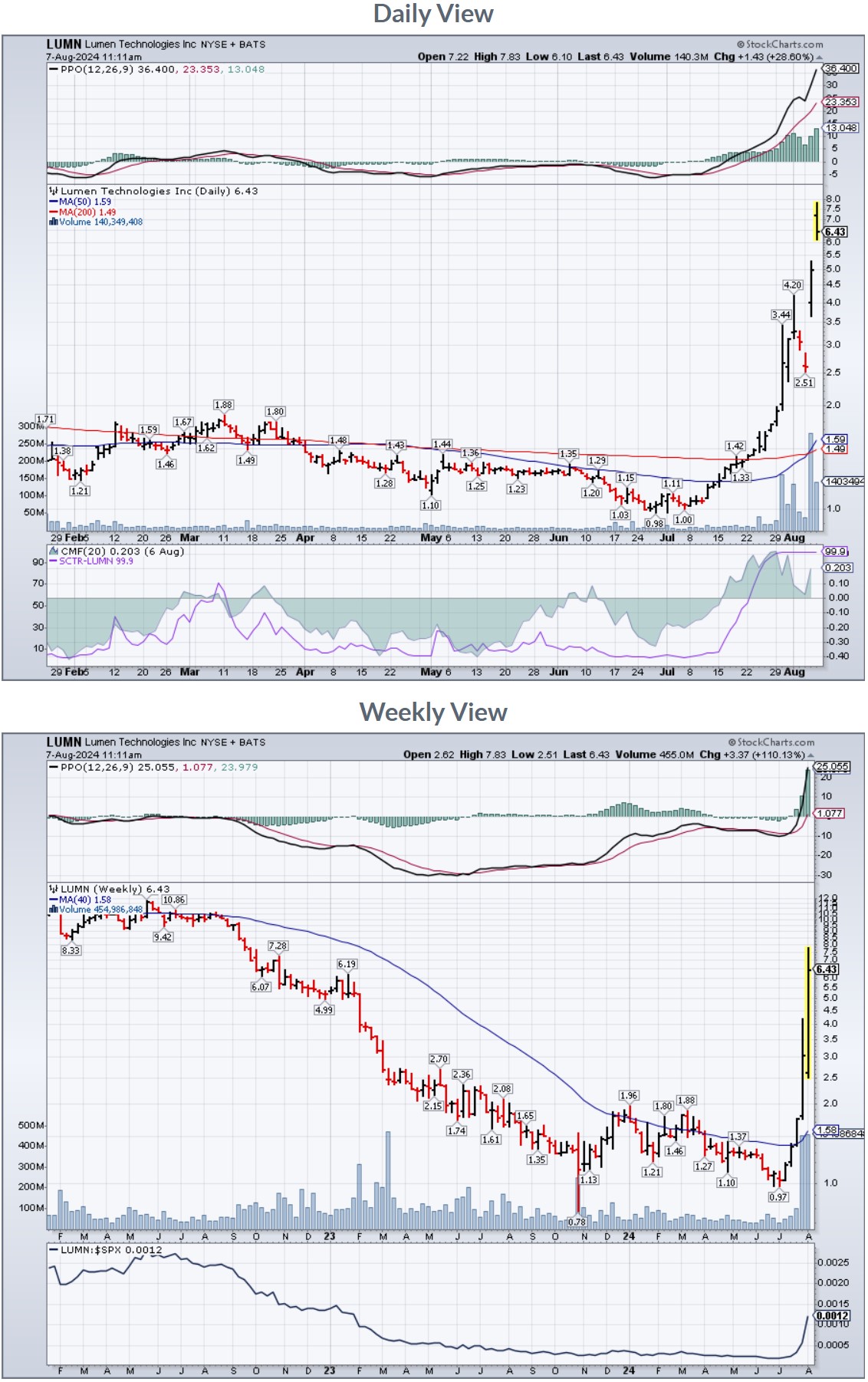

Tactical Bulls is looking at many issues here on Lumen Technologies. The first long-term chart from E*TRADE and Morgan Stanley shows how Lumen has surged in recent days AND how low the stock had gone down from its former glory days. This report considers volume surges, price surges, analyst reports, stock charts, actual news reports, an earnings review, the company’s own guidance, short sellers, profit taking and more.

THE VOLUME SPIKE SURGE

Seeing trading volume explode from 10 million to 20 million shares a day on a $1.00+ stock up to 100 million shares might be expected when big news occurs. After all, it doesn’t take billions of investor capital when it’s a small-cap stock and when shares are priced so low.

Now this stock has surged to over $6.00 and the prior day’s trading volume was 306 million shares with a $5.00 close that was nearly a double from the prior day. And the post-earnings report has shares up another 25% with more than 120 million shares having traded in the first hour of the day.

WALL STREET MISSED THIS SURGE

Wall Street itself admittedly missed the boat here if you look at the analyst calls. There was no great “upcoming news” notation ahead of time. And in the days since the news broke, there have been upgrades and target hikes. There just have been no “screaming buy” upgrades seen in those calls. Most analysts still remain timid on Lumen’s stock despite the exponential share price gains. Here are some of the calls in recent days:

8/7 – Lumen was raised to Neutral from Sell at Goldman Sachs, but its target was raised to $4 from $1.

8/7 – Lumen was maintained as Neutral at UBS, even though the firm raised its target to $5 from $1.

8/7 – Lumen was raised to Neutral from Underweight at JPMorgan.

8/7 – Lumen was maintained as Sell but its target was raised to $3 from $1 at MoffettNathanson.

8/6 – Lumen was raised to Neutral from Sell and its target was raised to $3.15 from $1.25 at Citigroup.

Prior to this, the analyst coverage was also weak — Underweight at Morgan Stanley and Sector Perform at RBC, although these prior ratings may not reflect live coverage at this time.

THE NEWS FLOW STOCK SURGE

As you can tell, very little was going on here before the stock exploded higher. Then the news breaks began appearing in the last two weeks:

July 24 – Microsoft partnered with Lumen Technologies to “power the future of AI and enable digital transformation to benefit hundreds of millions of customers.” The stock rose to $1.64 from $1.52 the next day, with 40 million shares traded one day and 19 million shares the next day.

July 30 – USA News Group announced that major tech firms are lead a Trillion-dollar surge in Gen-AI spending. Lumen’s stock rose to $2.67 from $1.94, on 161 million shares.

August 1 – Corning reached a supply agreement with Lumen for next-gen fiber-optic cable to support the buildout of data centers’ AI demands. The shares were at $3.15 the prior day and closed up at $3.32, on 133 million shares.

August 5 – Lumen announced that it has secured deals worth a total of $5 billion on AI-driven demand for connectivity. Shares were at $2.59 that day but rose to $5.00 on 306 million shares the following day.

IS THE EARNINGS RELEASE MORE GROUNDED?

The earnings release from August 6 showed that total revenue was $3.268 billion for the second quarter 2024, down from $3.661 billion for the second quarter 2023. Free Cash Flow (ex-special items) was -$156 million for the quarter, versus -$896 million a year earlier. And as of June 30, 2024, Lumen had cash and cash equivalents of $1.495 billion.

While Lumen Technologies highlighted continued success in North American large and mid-market enterprise sales, those new logo sales increased year over year and its net total contract value for all channels was also up year over year. That said, the company’s revenue breakdown showed that Q2-2024 total Business Segment Revenue of $2.577 billion was down from $2.908 billion a year earlier.

Lumen also showed that the company delivered better customer satisfaction across customer channels — “which should manifest in lower churn, higher gross sales, and improved overall revenue growth over time.”

Lumen also addressed its recently-announced partnership with Microsoft with its “unique position to further capitalize on the demand for customized, private, and secure networks” and called it “a tailwind generated by the need for high-bandwidth infrastructure to support AI ventures.”

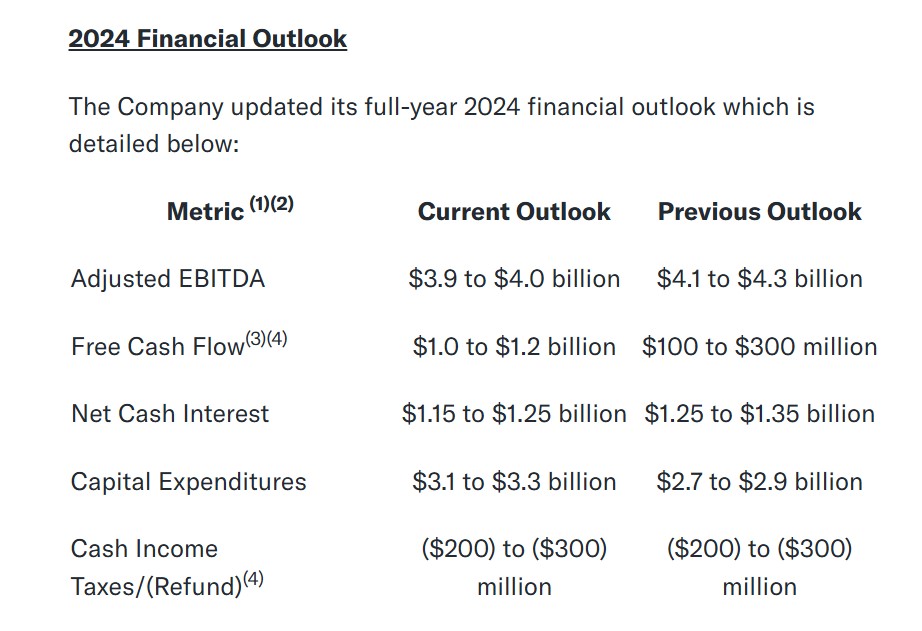

The image below is Lumen’s 2024 updated guidance:

WHAT TO CONSIDER NOW

What investors might want to consider here at this point is that the current indications are a much larger footprint ahead, but the guidance for 2024 does not indicate an explosion of business immediately. Buildouts of this magnitude can take years to complete. Manufacturing the cable takes time. Installing it also takes time. Getting customers to get the installations ready takes time.

When stocks have been lower for extended periods, exponential stock surges are often followed by profit-taking as so many investors can finally get their money out. Investors should also consider that Lumen Technologies was a heavily “shorted” stock as 137 million shares were short as of July 2024 representing 13.88% of its float and 13.2 days to cover. Did short sellers run for the hills or did they decide to get more aggressive? We will not know that answer for another couple of weeks.

Having $1.5 billion in cash and cash equivalents should be strong, but Lumen also carried more than $19 billion in total debt at the end of March. Will Lumen use the recent strength to conduct a capital raise? It would be hard for investors to blame management if they chose to take advantage of such a strong surge while the company’s interest is hot again.

So, should new chase or pass…?

THE TACTICAL BULLS VIEW AHEAD

Tactical Bulls is not issuing any price targets or formal recommendations on Lumen Technologies stock. The views herein are not to be interpreted as investment advice. Any financial decision to buy or sell stocks is up to each investor and their financial advisors. The writer of this report has no ownership position (neither long nor short) in Lumen Technologies.

It is not surprising that Lumen’s stock exploded in the recent news. And the company should be commended for the deals it has secured. Then again, it’s hard to get over the notion that the analysts covering Lumen have either maintained caution or “raised targets with still-cautious ratings” in the daily upgrades and downgrades. One consideration about analysts in situations like this is that sometimes they have such a longstanding history that they simply cannot adapt when positive changes finally occur. And there are times when stocks have exponential moves that even prevent analysts from being able to issue updated formal price targets.

Lumen has just been given a great new base to work from. Whether that stock base is $3.00 or $6.00 remains to be seen. And while anything is possible, expecting the shares to repeat the past week’s exponential explosion higher would be asking a lot. Probably too much. And yes, this report comes with extreme remorse and envy for having missed game-changing news from a company that used to dominate the capital spending side of the internet. Sometimes all investors can do is worry about what they should do for the days and weeks ahead rather than worry about what they missed in the days before.

The dual daily and weekly charts below are from StockCharts.com:

Categories: Investing