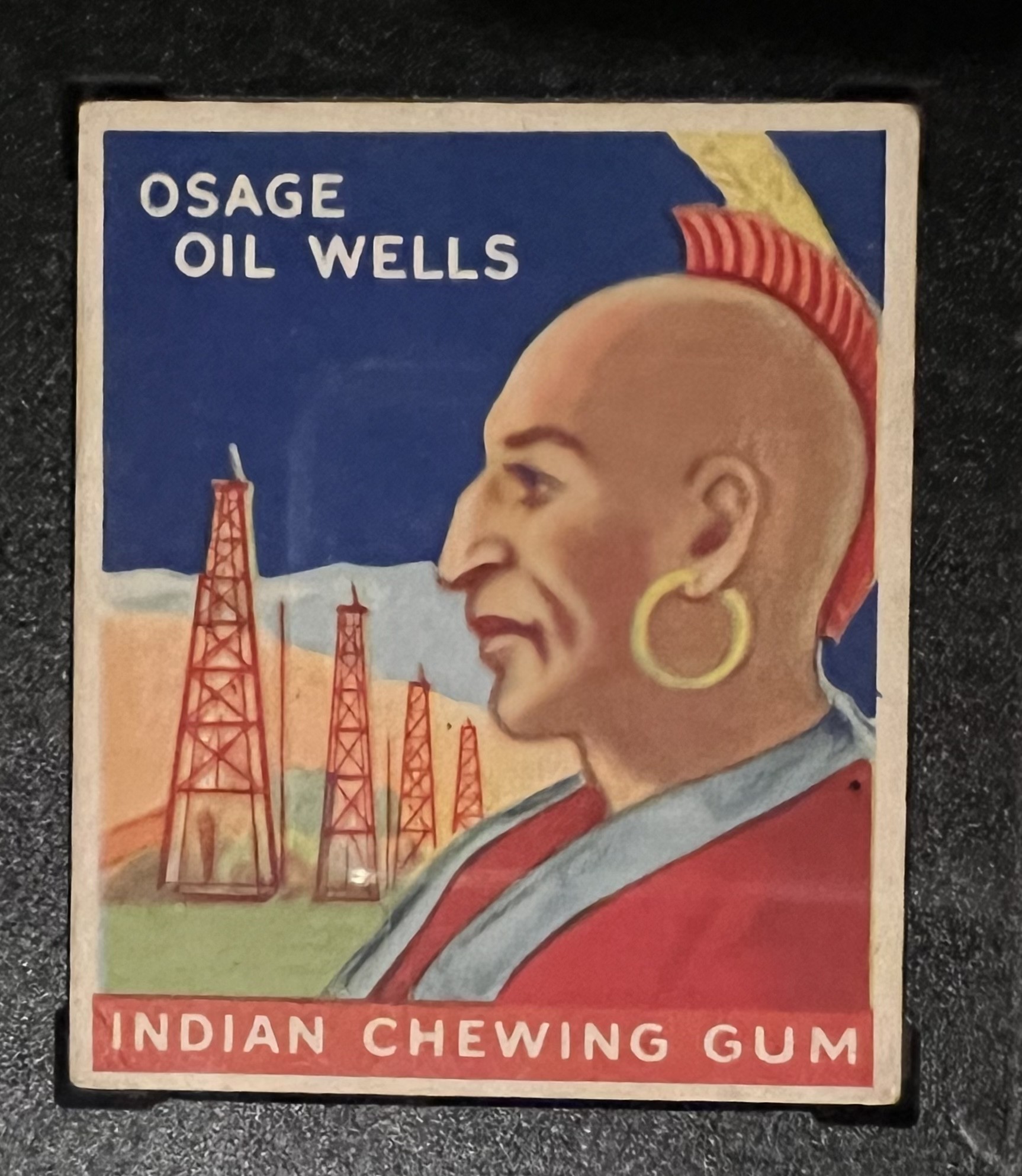

The Osage Oil Wells card from 1933 Goudey Indian Gum set

The term “peak oil” has been spoken about for many years. This is simply when the world’s oil demand will peak, and then followed by how demand should likely begin to contract. Now there is a slower adoption of electric vehicles, and other alternative energy sources are still years away from release and adoption. “Peak Oil” has not yet occurred. It may not even peak over the next 10 years.

According to Goldman Sachs Intelligence, oil demand is still expected to rise over the next 10-year period. And the arrival of “Peak Oil” could even arrive years later.

Global oil demand was just under 90 million barrels per day back in 2012. Then demand was right at 100 million barrels per day in 2019, the year before the pandemic. That number is now about 104.5 million barrels per day in 2024. And “peak oil” still hasn’t even happened yet. Goldman Sachs Research’s base case for the peak global oil demand currently stands at 110 million barrels per day by 2034. Another scenario, one with slower EV adoption, predicts that global oil demand could keep increasing beyond 2034 towards 113 million barrels per day by 2040.

Goldman Sachs pointed out that other prominent forecasters are predicting peak oil by 2030. The firm now believes using its own research that the use of oil and demand for oil will increase through 2034. The firm also predicts that China will see growing oil demand until the late-2020s.

Where the research gets even more interesting for long-term energy forecasters is that it is not expecting a sharp decline in oil demand even after peak oil is reached. A key driving force, no pun intended, is that demand from rising incomes around the globe will boost the appetite for energy supplies. That energy demand is expected to be primarily met by using more fossil fuels.

Tactical Bulls would remind readers that Goldman Sachs may publish public reports that are not just for its clients. That said, the firm’s financial client base is the world’s top institutional clients and very wealthy individuals. This is one of the world’s top investment banking giants and it does not take on clients who do not have millions of dollars in assets.

Demand for diesel fuel is forecast here to rise beyond this decade and will not likely peak until 2034. Goldman Sachs points out that medium- and heavy-duty trucks are simply more difficult to electrify than traditional cars and SUVs. The reasons — batteries are too big, too heavy, and too expensive to justify fleet conversions. That said, the report highlights that hydrogen may begin competing with diesel for large fleet vehicles by the late-2030s.

ALSO READ: HERE’S WHAT YOUR A.I.-LAYOFF WILL LOOK LIKE

Growth is growth, but this doesn’t mean that hundreds of new refineries have to be built and are going to pop up next to your neighborhood. After averaging more than 2% demand growth since the 2020 Covid-economy, global oil demand is forecast to grow 1.3% in 2025 and then less than 1% annually to 2034. The report says:

“We think peak demand is another decade away, and more importantly, after the decade it takes to peak, it plateaus, rather than sharply declines, for another few years.”

The “plateau” is calling for global oil demand to drop a mere 0.1% to 0.3% from 2035 to 2039, followed by a 0.5% decline in 2040. Goldman Sachs sees gasoline demand for cars’ internal combustion engines peaking around 2028, but petrochemical demand growth for specialized refined products (like jet fuel) may more than offset the decline in gasoline demand through 2040.

There is a somewhat significant warning here for the price of fossil fuels, at least if you believe that supply influences prices in the supply-demand equation. Goldman Sachs warns that as capital spending for oil production slows, that may lead to supply shortages. The warning doesn’t mention prices directly, but it said:

“While peak oil demand is still a decade away, capital is slowing for the production of crude oil and oil products, contributing to constrained supply in the medium term.”

How you choose to view this report entirely up to you. For a disclosure from Goldman Sachs, the report is shown to be “for educational purposes only” and that it “does not constitute a recommendation” nor is it to be taken as “any financial, economic, legal, investment, accounting, or tax advice…”

Making forecasts out for a decade or even longer may seem difficult and somewhat arbitrary in a country where the four-year election cycle seems to dominate every ounce of focus. It is this sort of planning that energy companies have to consider in their own long-term plans and forecasts. That’s not just oil and gas companies. Gas-powered car makers and EV-makers have to take energy demand into consideration. Energy companies focused solar, wind, nuclear, hydro and other energy sources have to model how their costs will stack up against fossil fuels.

Economists have to factor in how energy demand (and pricing) will factor into spending habits for years into the future. The United Nations has just issued a forecast for how the global population will peak at more than 10 billion people by 2084 — and will then start to contract all in the same century.

For investors, knowing when peak oil will occur and knowing what it will look like is where long-term investing plans this decade can shine.

Categories: Economy