Meta AI at your fingertips… Now, not coming soon!

Companies can change their names, but it doesn’t mean they change their stripes. This still appears to be true in a world of generative A.I. taking over the technology landscape. Alphabet Inc. (NASDAQ: GOOGL), the parent of Google (and the company most of still want to call Google), is the king of search. Meta Platforms Inc. (NASDAQ: META) is the parent of Facebook and absolute leader in social media, and most of us still want to call it by the Facebook name. Both stocks are leaders by far in their segments and both are dumping billions of dollars into multiple A.I. efforts.

So, which one is a better investment now that we are in the second half of 2024?

Loop Capital’s Rob Sanderson says Meta is the “Buy” and that investors should be patient when it comes to Alphabet. Not every analyst feels the same but this is a strict binary call regarding which company has the better A.I. strategy (or strategies) looking forward as of today. Meta AI with Llama 3 is favored of Gemini at this time. This report is definitely within the scope of a tactical bull report as it pits the upside of one company against the downside of another — and both stocks tend to have “bullish” analyst calls in the slew of daily upgrades and downgrades.

Loop Capital is increasingly optimistic about Meta’s A.I. position is more uncertain regarding Google’s A.I. efforts. Rob Sanderson has a Buy rating and $550 price target on Meta (versus a $509.50 current price). His rating on Alphabet is “Hold” with a $170 price target (versus $185.50 now). If Sanderson is right, that’s nearly 10% upside remaining in Facebook and nearly 10% downside in Alphabet.

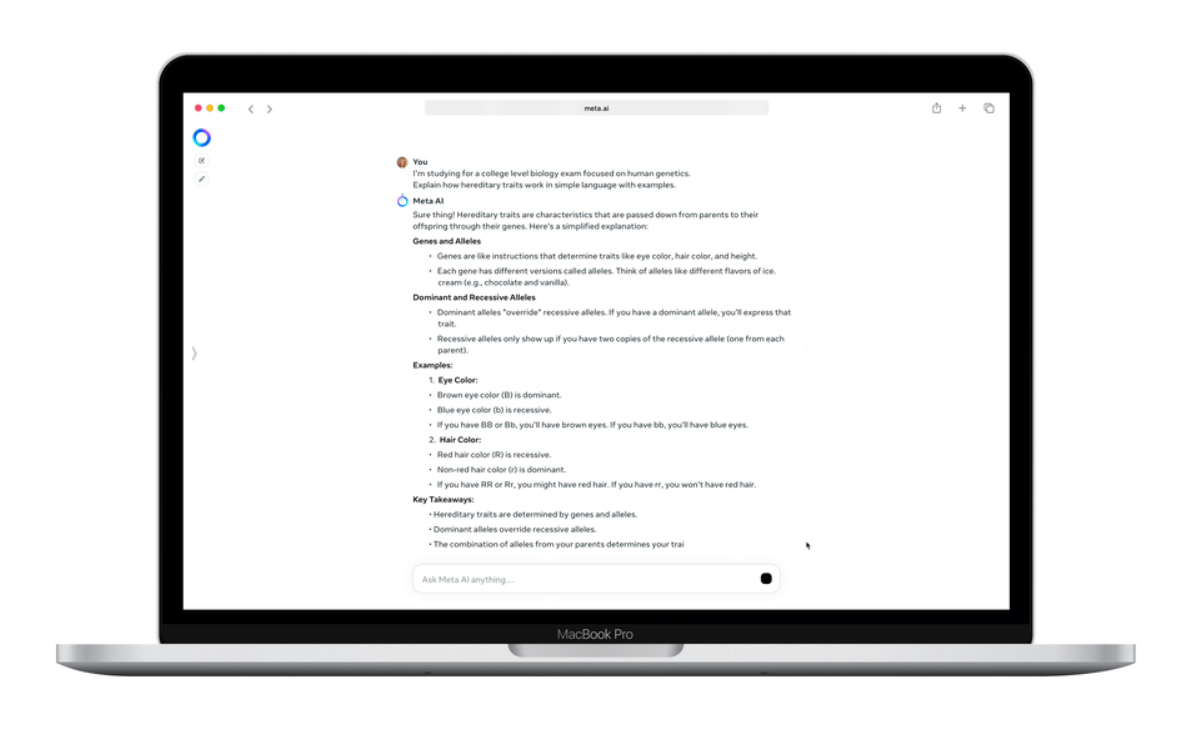

As Meta and Alphabet are two of the most talked about companies and stocks over A.I. spending, one concern brought up in the Loop Capital report is that Google’s hands are full trying to defend its search dominance as it is losing some share of traditional search queries as Bing and OpenAI (ChatGPT) from Microsoft Corporation (NASDAQ: MSFT) and other A.I. substitutes are popping up. Another fear for Alphabet’s stock is that Google is facing more challenges ahead from the likes of Apple Inc. (NASDAQ: AAPL) for Siri in the coming A.I. phones. Alexa’s upgrade from Amazon.com, Inc. (NASDAQ: AMZN) is also a threat, as is MetaAI within the Facebook architecture. Alphabet’s Gemini (formerly Bard) may not fend off that loss in market share of traditional search.

At the end of the day, three more key points were shown to be favoring Meta:

- innovator and effective fast follower;

- quickly correcting product development;

- and better built and battle-tested…

Keep in mind that this Meta vs. Alphabet call is just one firm’s view. Tactical Bulls would also remind its readers that no single analyst call should ever be the sole reason to buy or sell a stock. Meta also seems to be winning the game for investors so far in 2024. Meta was up 44% year-to-date versus a 32% gain for Alphabet. Imagine the day when a 32% gain is considered lackluster. And to compare this individual view to consensus analyst price targets, Alphabet’s consensus price target is about $9 higher (5%) than its current share price versus a $10 higher consensus target (2%) for Meta Platforms.

Categories: Investing