What’s coming soon to Netflix

The streaming component within the broader media sector has become quite crowded. The old “convergence” of media finally took place. And then some. In fact, the streaming media sector may now be so crowded and full of overlaps that both investors and the customers might need to seriously think about what the upside to any of the services really is. Being a cord-cutter is just not the bargain deal relative to a cable bundle like it used to be.

Tactical Bulls recently outlined how there might be a no-win scenario in streaming for investors. That may have overlooked one of the streaming leaders. Again, it may have if an outside report proves to be true. The independent research firm Argus sees Netflix Inc. (NASDAQ: NFLX) as a top winner ahead. Unlike other companies who have streaming services, Netflix is effectively a pure-play for streaming media.

Argus reiterated its Buy rating and raised its target price to $767 from $660. That would represent about 14% in implied upside if analyst Joseph Bonner’s higher price target price comes to fruition.

With Netflix shares at $673.61 ahead of the call, the stock is actually already ahead of its $658.90 consensus analyst price target. Keep in mind that this call is on top of Netflix shares having risen 53% over the last 12 months and with its stock up almost 39% so far in 2024 alone.

The first bullet notation from the Argus report after the target price was that Netflix is moving into live event sports programming in a bigger way with its NFL deal (noting further that the NFL holds the most value in the U.S. sports broadcast ecosystem). Argus sees the deal being quite attractive to advertisers on the new lower cost advertising subscription tier. Another boost ahead in the report is that Netflix is also expanding its experiential concepts, which is said to be mostly directed as subscriber addition/retention and with its eye on developing a new revenue stream.

ALSO READ: Two Top Tactical Buys for Rest of 2024

Bonner raised his earnings estimates as well — to $18.35 EPS (from $16.54) in 2024 and to $20.42 EPS (from $20.02) in 2025, with a long-term growth rate of 15% for EPS. Argus also noted that the price target hike is after Netflix shares blew through its prior $660 price target.

According to the report:

Netflix continues to reaccelerate revenue growth. The company, which has relied mainly on subscriber growth to drive revenue, has made major changes to reaccelerate subscriber additions. It launched a low-priced advertising-supported subscriber plan in November 2022, and is already making enhancements to increase its value proposition to customers. It started a crackdown on password sharing in May 2023, which has boosted subscriber additions.

Another boost to the Netflix target is from management’s continuation of stressing strategic continuity in its production of original buzzworthy content and also improving its content discovery process. And Argus does not seem to be that worried about price hikes or a strapped consumer here. The report says:

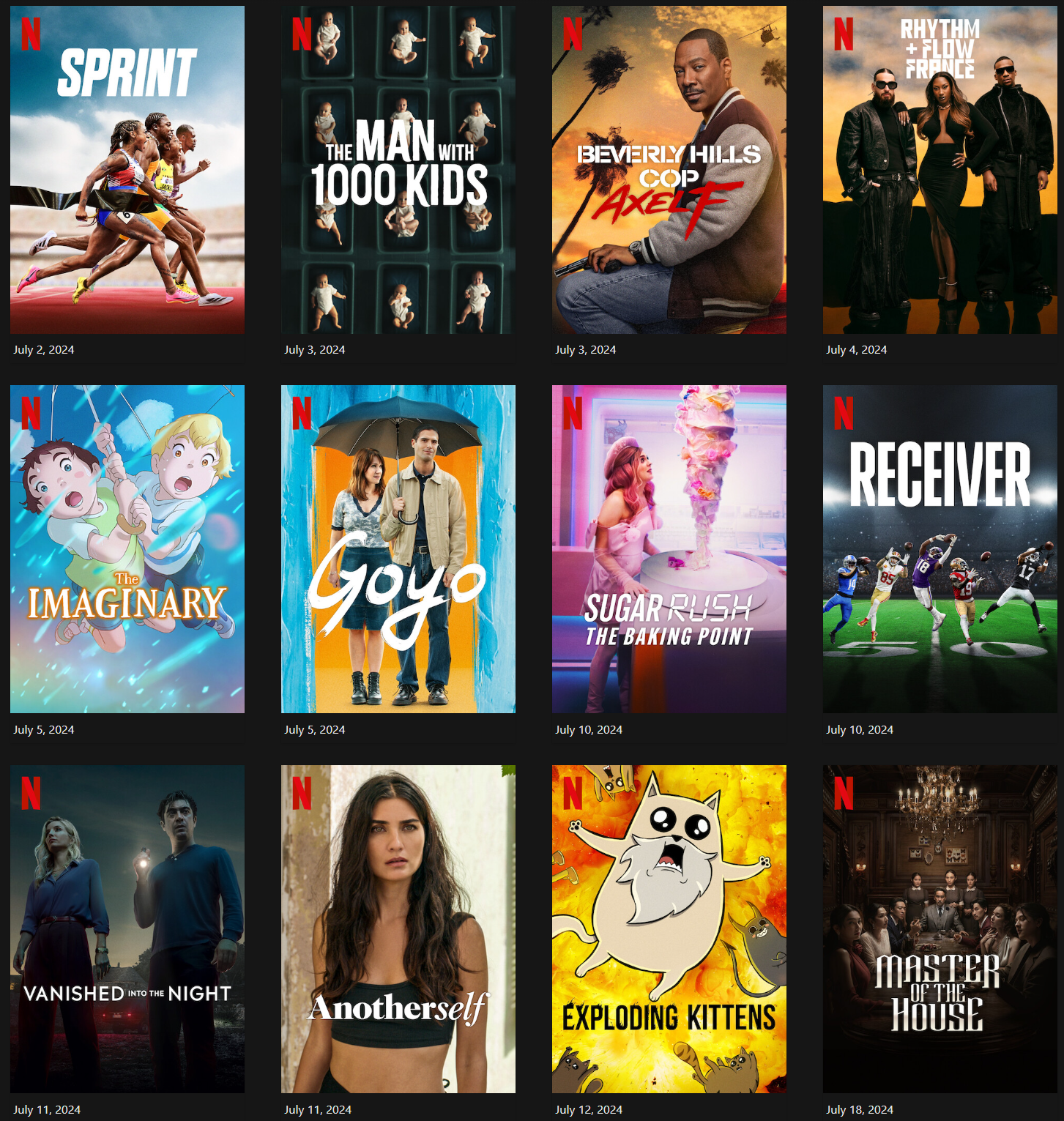

While Netflix is experiencing a difficult period amid intense competition and economic uncertainty, it (NFLX) remains the ‘anchor tenant’ for consumers in video streaming, with an attractive slate of projects on track for release.

Some analysts at sell-side firms have price targets above the current price as well. BofA is at $700, Evercore ISI is at $700, Loops Capital is at $750 and KeyBanc is at $707.

The reaction to the Argus report had Netflix shares up about 0.8% at $679.00 in Tuesday’s trading session. Its shares have a 52-week trading range of $344.73 to $689.88.

Categories: Investing