If you are completely complacent and happy with all your gains, don’t say you were not warned when the next major sell-off (or stock market crash) actually occurs. There will be a day when the stock market enters into a full-blown panic all over again. When it will happen is the only debate. And now may be the cheapest time in many years to crash-proof your stock market gains.

Generally speaking, catalysts for a major sell-off tend to be a surprise to most of the market. The S&P 500 as of June 28, 2024 has now gone more than 380 days without a daily 2% correction. This is the longest streak since the global financial crisis more than a decade ago.

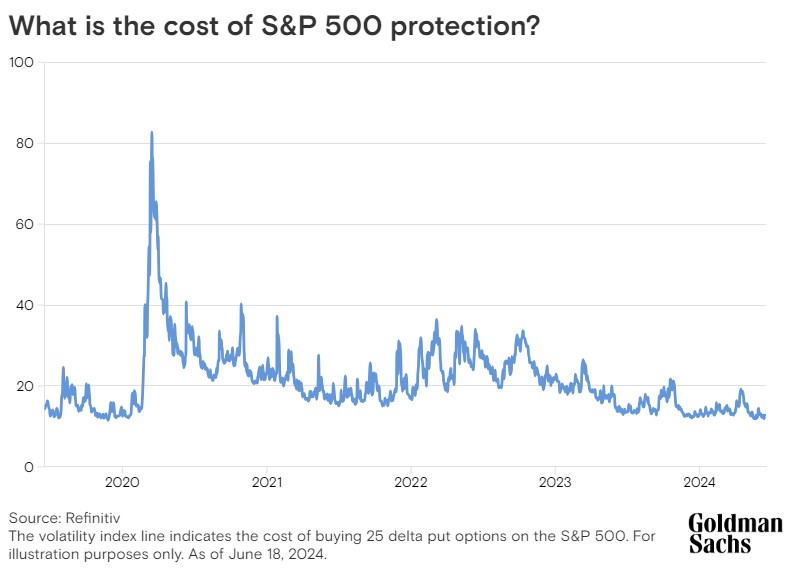

Goldman Sachs has shown that hedging against the S&P 500 Index is now at the cheapest level that has been seen in about the last five years. And why the opinion of Goldman Sachs matter so much is that the firm caters solely to institutions and wealthy individuals. Have you ever heard the nickname “Golden Slacks” before?

Should you prepare for a stock market crash? Or what about just a garden-variety sell-off? Either way, the good news is that it’s dirt cheap to buy downside protection right now.

The CBOE Volatility Index, or the “VIX,” also reflects this trend with its last reading at 12.25. As the so-called “fear index” rises, it usually means investors are more frantic. As the Vix falls those same investors are generally more complacent. When this rises to 20, it means investors have more to worry about. When the VIX rises

Where will the next stock market sell-off come from? Will it turn into the next crash? These are all questions worth asking, but inevitably a sell-off will come again. The market is currently only a day after the presidential debate. There are multiple wars and skirmishes. There are major political risks. China remains a risk. The consumer and the economy are both slowing down. And the Federal Reserve seems to be in a place where it cannot (or will not) lower interest rates.

What Goldman Sachs is really telling its clients is that the premium you have to pay for S&P put options is extremely cheap. This is after the S&P 500 and other indexes have repeatedly hit all-time high after all-time high in 2024. Investors are showing a strong appetite for risk.

Lindsay Matcham, who works in futures sales trading in the Goldman Sachs Global Banking & Markets unit, even said:

“The trend line of SPX protection this year has given us an indication of the potential complacency and potential overcrowdedness of markets.”

Investors can hedge against the S&P 500 in various ways. Some choose over-the-counter securities. Some choose listed markets. Some choose to hedge against an index or ETF. And some hedge against individual stocks.

So what is the flip-side of cheap hedging? If you wait to hedge when the investors’ appetite for risk is rising, then it’s too late. The VIX surged after the 9/11 attacks, heading into the global financial crisis, and during the COVID-19 economic shutdown. Then, after it’s too late, the cost protecting you stocks against a stock market drop rose to extreme levels and to multi-year highs while stocks tumbled and investors looked for ways to protect their assets.

Selling has so far been the way to play the “volatility.” Options sellers have made money and pocketed the premium so far in 2024 because there has been no volatility event nor a real sell-off for the market as a whole.

Goldman’s Matcham also has a warning for those investors who do not want to be caught off-guard or surprised when the next shoe drops:

“Even if you are not overly bearish, it makes sense to buy protection for your portfolio, given how cheap vol is. We don’t believe the market is sufficiently pricing the potential tail risks. These include the upcoming French elections, the US elections, potential escalations of conflict in the Middle East, and potential trade and tariff turmoil with China.”

The chart below is provided by Goldman Sachs.

Categories: Investing, Personal Finance