The massive run higher in NVIDIA Corporation (NASDAQ: NVDA) has seen its first real break in some time. Whether or not this is the start of a significant move lower due to massively overbought technical conditions remains up for debate. NVIDIA was getting all the stock allocation inflows and shares of stocks like Amazon.com Inc. (NASDAQ: AMZN) were largely ignored on a relative basis. If a sell-off in NVIDIA turns into a serious capital rotation it could significantly help Amazon.com and other stocks that weren’t getting the same love.

Tactical Bulls recently featured the 9 DJIA stocks with the most implied upside for the rest of 2024 and heading into 2025. Amazon.com was featured prominently in this review. Despite having no dividend at the present time to help juice future returns, Amazon’s stock gain of 22% so far in 2024 was just not anywhere as exciting as the gain in NVIDIA.

ALLOCATION/ROTATION

If a true asset rotation does finally take place, it would be hard to imagine that it might even help out the other 400 to 450 “other stocks” in the S&P 500. Rational investors know that it actually takes real net capital inflows to drive a stock price higher. And for a stock to stay higher, it requires new incoming capital after existing investors will inevitably want to lock in some of their gains.

GIANT TO SUPERNOVA SIZE

Amazon’s last stock price of $188.00 generates a market capitalization of $1.96 trillion. This is a massive figure of course, but it’s well under the $3 trillion in market caps of NVIDIA, Microsoft Corp. (NASDAQ: MSFT) and Apple Inc. (NASDAQ: AAPL). Microsoft and Amazon are frequently the most similar companies when it comes to analyzing cloud and hosting — but then both companies have wildly different businesses outside of Azure vs. AWS. Microsoft is now also within 10% of its consensus analyst price target.

Apple is above its consensus analyst price target. Where this story on Apple gets more interesting is that Apple hasn’t even seen the real benefit from its coming A.I.-enhanced iPhones yet to get back to revenue growth. That leaves it in a “show-me” state after its shares surged in June after the WWDC conference.

HOW MUCH UPSIDE?

So now this just leaves Amazon.com as the target of the major DJIA stocks for upside. That $188 recent price and a consensus analyst price target of $221.78 indicates an implied upside of about 17.5%. And despite its 22% gain YTD, Amazon shares have been trading sideways in a $175 to $190 channel most trading days since this February.

OUTSIDE OF AMZN

Amazon is among the most recent additions to the Dow after its huge stock split. The issue to consider in the A.I.-focused world is that its recent investment in Anthropic for A.I. (Claude) hasn’t garnered some of the same attention as has been seen around NVIDIA, or even around Microsoft and OpenAI (ChatGPT).

HOW TO ANALYZE?

Maybe it’s a fair question to ask if Amazon is now just becoming another a hulking conglomerate that is now hard to pivot in a post-Bezos world? The flip-side question is whether Amazon has migrated it a seeping stock that is ready to recapture investor interest if the capital rotation really does come into play.

ANALYST LOVE

Most analysts issue new price targets immediately after earnings reports. That doesn’t mean that there have not been analyst price target adjustments in the weeks after April’s earning report. Here are some of the known recent calls since the start of May:

- Robert W. Baird (Outperform) target to $213 from $210

- Tigress Financial (Buy) target to $245 from $210.00

- Loop Capital (Buy) target to $225 from $215

- Telsey Advisory (Outperform) target to $215 from $200

- Monnes Crespi & Hardt (Buy) target to $225 from $215

And on as recently as June 7, Barron’s published how Amazon could join the $3 trillion market cap club. That would require a stock price of nearly $288 and that would be more than 60-times expected 2024 earnings estimates. Is this just another massive valuation hope that is too high for a company that is now more than 25 years in operation? Barron’s highlighted a June 7 call from TD Cowen (with a Buy rating and $225 target) calling Amazon’s investments in generative-AI within its web services as a boost to long-term revenue growth.

AMAZON CAN FLOP TOO!

There are of course many issues which can prevent Amazon’s stock from rising outside of just a significant sell-off or a lack of performance in the stock market ahead. Amazon faces ongoing labor problems, and now it is facing its first formal unions. Investments into A.I. may take years and years to pan out. AWS competition from Microsoft, Alphabet and a host of other companies often offer better value for companies looking to lower costs. Consumers are tapped and wanting services over goods right now and this could hurt Amazon’s core consumer business. The U.S. streaming market is now saturated. And Amazon is involved in so many other operations that they could take away some of management’s focus.

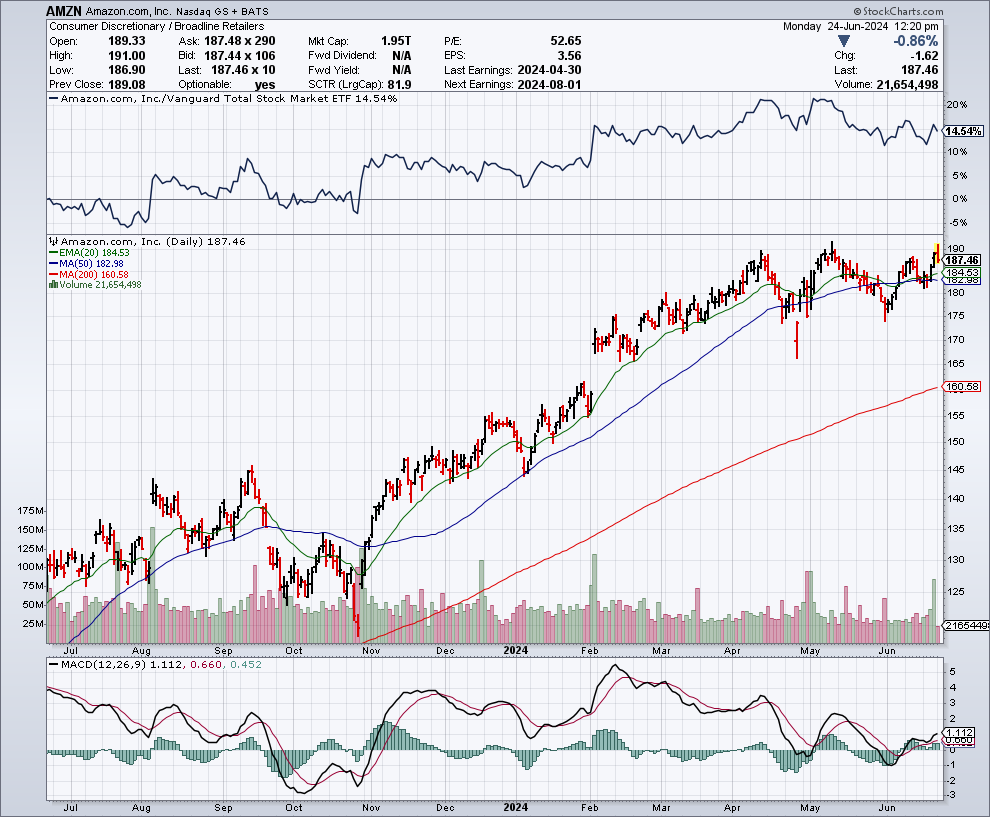

HISTORY & CHART

The $188.00 after a dip on Monday morning compares to Amazon’s 52-week range of $118.35 to $191.70. Will this be enough to drive Amazon’s stock up toward that $220 mark? We will all find out together in time.

A one-year chart from StockCharts.com has been provided below.

Categories: Investing