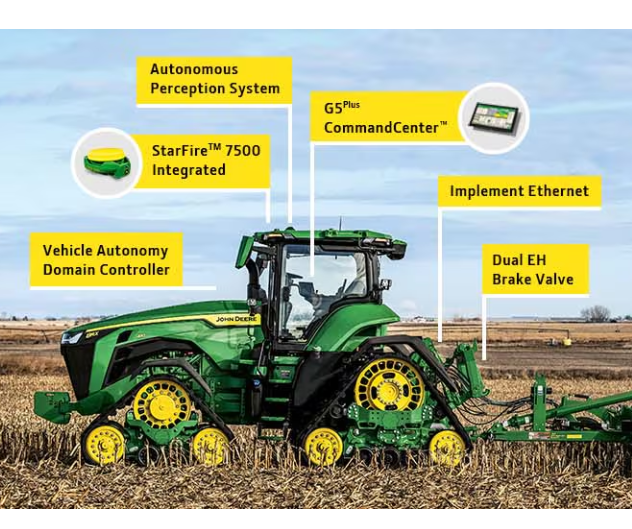

Deere’s autonomous tractor, image courtesy of Deere.

Investors love finding undervalued stocks. It is often the case that “undervalued stocks” are hidden or largely unknown companies to investors. Then again, sometimes the “undervalued stocks” are right under every investor’s nose.

Deere & Co. (NYSE: DE) could have about 45% upside ahead over the next couple of years. That is the take of one very aggressive analyst upgrade, even after Deere’s stock has risen 22% year-to-date in 2025.

A firm named Melius Research upgraded Deere’s stock to Buy from Hold. Analyst Rob Wertheimer at the firm also set a street-high price target of $750 for the stock. Before blindly jumping into the stock just because of the analyst call, keep in mind this is not just an aggressive analyst call to take the street-high position — it is about $200 higher than the consensus analyst price target, and it’s also about $230 higher than the current share price.

Tactical Bulls always reminds is readers that no single analyst report should ever be the sole basis to buy or sell a stock. This is particularly true for aggressive “Buy” ratings that are the street-high analyst price targets. Research analysts can get their thesis wrong just like the rest of us.

Most analysts issue 12-month price targets. This particular call from Melius Research is a 2-year price target. Several key issues were highlighted here for such an aggressive two-year target:

- Deere is considered to have one of the best competitive moats at the present time, something underappreciated by investors.

- Deere’s equipment and precision-agriculture technology (i.e. self-driving tractors, planting/spraying techniques) are expected to deliver transformational value to farmers. This is expected to help add to the bottom-line for farmers with cost-savings.

- Melius sees upgrades on equipment software creating a recurring revenue stream for the company. Deere’s target is 10% for recurring revenue (versus about 2% at present) by the end of this decade.

- Those higher recurring sales and the wide moat above are expected to dive higher valuations as well. Its average of about 17-times expected earnings is versus about 20-times for the broader S&P 500.

- Deere’s downward revenue trend is likely to end. After $45 billion in 2024 sales, Deere’s expected $38 billion in 2025 sales are projected to rise back above $40 billion in 2026 and nearly $46 billion in 2027.

- The decline in farming income is also expected to help drive that sales growth for 2026 and 2027.

Melius calls itself an independent research firm, data analytics and investment firm. The firm’s “about” message shows how and why it would be able to come up with a much more aggressive long-term price target:

Artificial intelligence has emerged as one of the key themes of the century, making a siloed view of the software, semiconductor, internet and hardware sectors obsolete. Furthermore, the powerful thematic of sustainability is driving a secular shift in investment never seen before, creating unique opportunities and a new generation of leaders.

Less than half of the analysts covering Deere have the equivalent of “Buy/Outperform” ratings. While Deere is up over 22% YTD, its stock is up 40% from this time a year ago.

After closing at $519.92 on Friday, Deere’s market cap is almost $141 billion and its 52-week trading range is $340.20 to $533.78.

Categories: Investing