NVIDIA Corporation (NASDAQ: NVDA) had traded higher and traded lower after its earnings report was greeted with a mostly positive reception. The problem so far is that, despite much stronger Blackwell sales than expected, the upside and long-term ambitions are being digested into NVIDIA’s current valuations. That is a common theme that is being seen because most analysts already have positive ratings and already have higher price target expectations over the coming year (see below).

Tactical Bulls has compiled how each of the major firms’ analyst reports are covering NVIDIA’s post-earnings views. The opinions and price targets mentioned by each firm are from each of the firms named.

The question now is that most analysts have a clearer view of NVIDIA’s year ahead views. This may make the sock less than exciting for tactical investors who may have enjoyed the post-earnings moves from 2023 into 2024 versus the more recent reactions seen since its peaking in late-2024. And we have seen a significant rotation out of the Magnificent 7 stocks of late.

Please Note: Tactical Bulls does not have any formal rating nor does it maintain any formal price target on NVIDIA.

WHAT WALL STREET SAYS…

Bernstein reiterated its Outperform rating and raised its price target to $185 from $175. The firm believes that NVIDIA is now likely through the worst of its ramp issues as all Blackwell configurations are now in full production.

BofA Securities reiterated its Buy rating and raised its price objective to $200 from $190. BofA noted that the quarter included close to $11 billion worth of Blackwell sales, versus the $4 billion to $7 billion expected. The firm also keeps NVDA as a Top Pick based on it keeping its leadership in the AI market.

Citi reiterated its Buy rating and $163 price target as the $11 billion-ish in Blackwell sales exceeded estimates and with Blackwell production in full swing. While Nvidia’s gross margin outlook is under the estimates on initial Blackwell sales, Citi sees margins in the mid-70-points later this year. Still, Citi sees a rangebound stock near-term while it digests overhangs from potential new China restrictions, tariffs and gross margin pressure.

D.A. Davidson believes that NVIDIA will continue to see strong demand for its chips in the near-term, but the firm did warn that it seems an inevitability that customers will ultimately pull back when they start scrutinizing the returns on their AI computing investments. The firm’s rating remains at Neutral.

JPMorgan reiterated an Overweight rating and its $170 price target as the guidance for 9% quarterly revenue growth is above consensus estimates. As Nvidia also continues to move from an aggressive slate of new product launches and segmentation, JPMorgan believes that demand will continue to be greater than the supply.

Morgan Stanley reiterated its Overweight rating and raised NVDA’s target price to $162 from $152. The firm also kept its Top Pick status for NVDA noting that it looks like everything will improve from this point — noting the caveat that export controls will remain an idiosyncratic risk to NVDA (and others).

ALSO READ: WHAT IF MICROSTRATEGY LOSES ACCESS TO CAPITAL TO BUY MORE BITCOIN?

MORE (OR LESS) FROM WALL STREET…

These are some of the other firms seen so far with ratings and targets on NVIDIA:

- Benchmark reiterated its Buy rating and $190 target.

- Deutsche Bank reiterated its Buy rating with a $160 target.

- KeyBanc reiterated its Overweight rating with a $190 target.

- Loop Capital reiterated its Buy rating with a $175 target.

- Needham reiterated its Buy rating and $160 target.

- Rosenblatt reiterated its Outperform rating and $220 target.

- Stifel reiterated its Buy rating and $180 target.

- Susquehanna reiterated its Positive rating with a $180 target.

- Truist reiterated its Buy rating and raised its target to $205 from $204.

- UBS reiterated its Buy rating with a $185 price target.

- Wedbush reiterated its Outperform rating with a $175 target.

AND ONE CUT…

Another call has been seen, but no details were available. Summit Insights has downgraded NVIDIA to Hold from Buy after the report.

NVIDIA closed at $131.28 ahead of earnings, but after a positive open its shares were last seen down almost 2% in the early trading session after Thursday’s opening bell. Finviz showed its consensus analyst price target as roughly $176 for the stock.

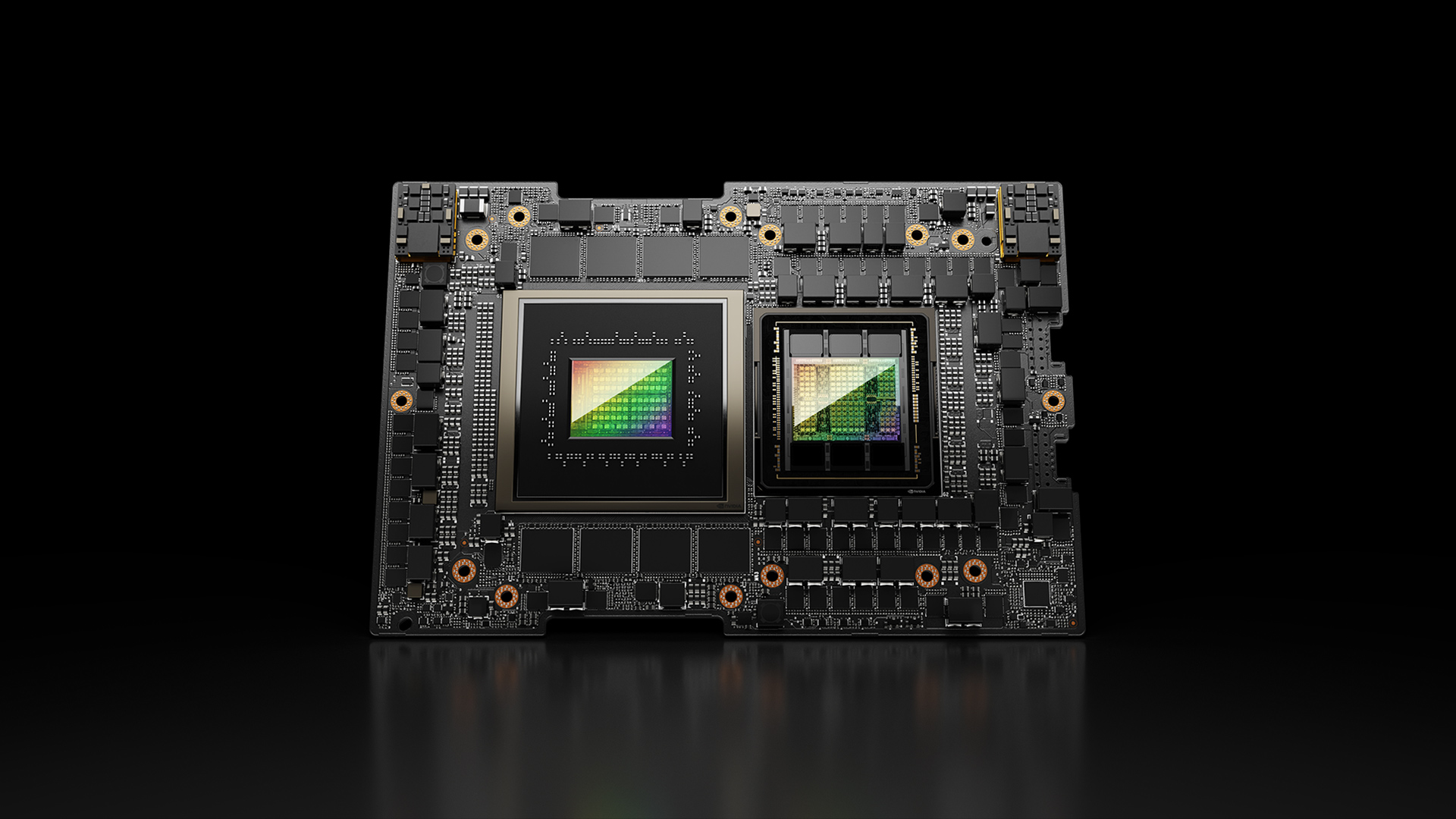

NVIDIA image of Quantum Cloud

Categories: Investing