Imagine the day that the government tells you (but not anyone else) that you cannot buy certain goods or that your money (but only yours) is not worth as much as someone else’s money. Those issues and many other issues have been among the biggest fears of the crypto community regarding Central Bank Digital Currencies (CBDCs). It should be the fear of every community.

The fear of the United States launching its own Central Bank Digital Currency (CBDC) is now over. President Trump, with the signature of a pen, just killed the ability for the United States to launch its own CBDC.

Trump has signed the executive order named ‘Strengthening American Leadership in Digital Financial Technology.’ Dated January 23, 2025, this is “in order to promote United States leadership in digital assets and financial technology while protecting economic liberty…”

According to the order, the Trump administration is supporting the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy. This is an effort to fulfill the pledge to be a pro-crypto administration and here is the death of any would-be CBDC:

(V)taking measures to protect Americans from the risks of Central Bank Digital Currencies (CBDCs), which threaten the stability of the financial system, individual privacy, and the sovereignty of the United States, including by prohibiting the establishment, issuance, circulation, and use of a CBDC within the jurisdiction of the United States.

One issue which may be a disappointment to the biggest crypto-bulls who want immediate gratification is that Trump’s executive order stops short of immediately declaring or formally calling for a “Bitcoin Reserve” for crypto similar to what the Strategic Petroleum Reserve is for energy and national security. It also may imply that the United States is not about to go out and spend billions of dollars buying crypto tomorrow. Any formation of a stockpile is not going to happen immediately, but a framework has been laid out that could lead to a “Bitcoin Reserve” or something similar. A Working Group has been named to evaluate such an action — as follows:

The Working Group shall evaluate the potential creation and maintenance of a national digital asset stockpile and propose criteria for establishing such a stockpile, potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts… the Working Group shall hold public hearings and receive individual expertise from leaders in digital assets and digital markets.

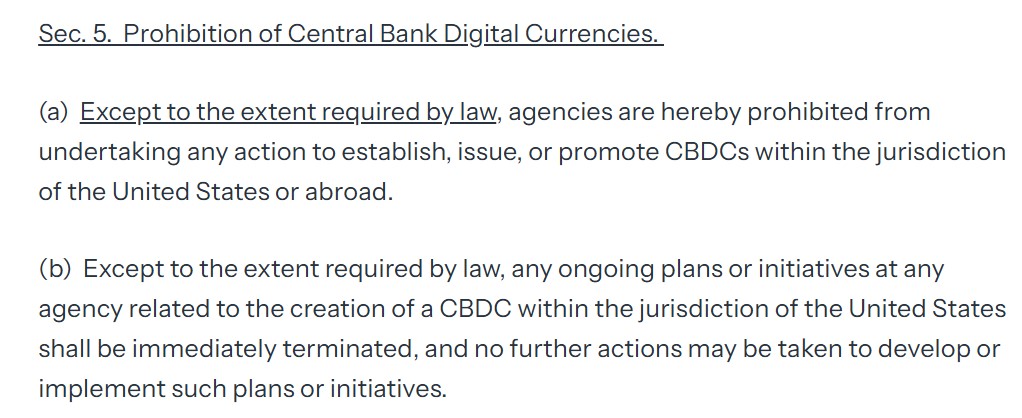

The image below expands upon the Executive Order in more detail to kill any efforts around creating a U.S. CBDC.

Tactical Bulls has covered how private banking will work toward integrating cryptocurrencies into the financial system. That too is still going to take some time.

Categories: Economy, Personal Finance