Apple Inc. (NASDAQ: AAPL) is one of the greatest American growth stories in the history of business. Its $3.3 trillion market cap should pretty much tell you all you need to hear. Or does it?

Wall Street has seemingly been in love with Apple almost year after year. Tactical Bulls has tracked multiple analyst calls which are starting to show some serious concerns ahead of its January earnings report. Whether this means Apple is not delivering remains to be seen. Either way, investors are looking spooked ahead of the reports.

Apple’s stock rose by nearly 30.7% after including dividends in 2024, but the problem for the stock is that Apple is no longer growing that much. Its gains were fueled by “multiple expansion” rather than by its own growth. Apple has not posted any growth to speak of since 2022 — and now there are questions rising as to whether or not Apple can turn in the 5%-plus growth expected for Fiscal Year 2025.

The problems are twofold. China has been weak for Apple. The iPhone 16 that has been hyped in commercials for its AI features has also been a slow rollout for the Pro version of the phone (and AI on phones has been slow to be released and adopted). And lastly, Apple’s stock chart is showing big strain after the stock has pulled back by about 15% in less than a month. Please read the disclaimer below.

So, how many brokerage firm analysts are really throwing up the warning signal?

DOWNGRADES & PRICE TARGET CUTS

J.P. Morgan’s Samik Chatterjee pointed to a nervous outlook for 2025. The firm’s rating is Overweight and with a $260 price target that had been lowered from $265 based on a weaker outlook rather than based on the past quarterly earnings due soon. The market share loss in China was one issue, but also the slow adoption and demand for AI-phones was another more direct risk to flattening unit sales ahead.

Barclays has also reiterated its Underweight rating on Apple, a rare “Sell” equivalent rating on Wall Street. The firm trimmed its price target to $183 from $184 in a symbol price target cut. The firm sees the actual earnings in-line to a tad softer, but it warned that the March quarter outlook could be lower due to iPhone concerns and adverse currency impacts as the dollar strength has made the iPhone more expensive in other markets.

DBS downgraded Apple to Hold from Buy with a $210 price target.

Jefferies downgraded Apple to Underperform from Hold as well, another “Sell” equivalent rating. The price target at Jefferies went down to $200.75 from $211.84.

Loop Capital recently downgraded Apple to Hold from Buy, and the firm has a $265 price target. The concern here is iPhone demand reduction for now, before amplifying in mid-to-late 2025.

Needham maintained its Buy rating on Apple, with no real change to its $260 price target.

Earlier in January, a firm named MoffettNathanson downgraded Apple to Sell from Neutral and taking its price target down to $188 from $202, and its target had been as high as $211 in mid-November.

START OF 2025 OOPTIMISM

To start 2023 out, BofA Securities reiterated its Buy rating and its $256 price objective. One area of strength to BofA is that it believes the higher margin Pro unit costs are down about 5% from the prior Pro model

Bernstein joined BofA on the same day (Jan. 3) by reiterating its Outperform rating and raising its target price to $260 from $240.

And over 2024, Warren Buffett and Berkshire Hathaway Inc. (NYSE: BRK-B) sold out of far more than half of the corporate giant’s Apple shares.

THE PERMA-BULL STUCK BY APPLE

The one analyst who has stuck by Apple through thick and thin so far has been Dan Ives of Wedbush Securities. Right before Christmas, Ives not only reiterated his Outperform rating on Apple — he raised his target to $325 from an already above-consensus target of $300.

On top of a multi-year AI growth renaissance, Ives pointed out an impressive estimated figure that some 300 million iPhones sold to consumers have not been upgraded in more than 4 years. He even opined that Apple might sell as many as 240 million iPhone units in Fiscal Year 2025 for the highest sales in the company’s history. Ives also valued Apple’s services business as high as $2 trillion!

APPLE STOCK CHART WORRIES

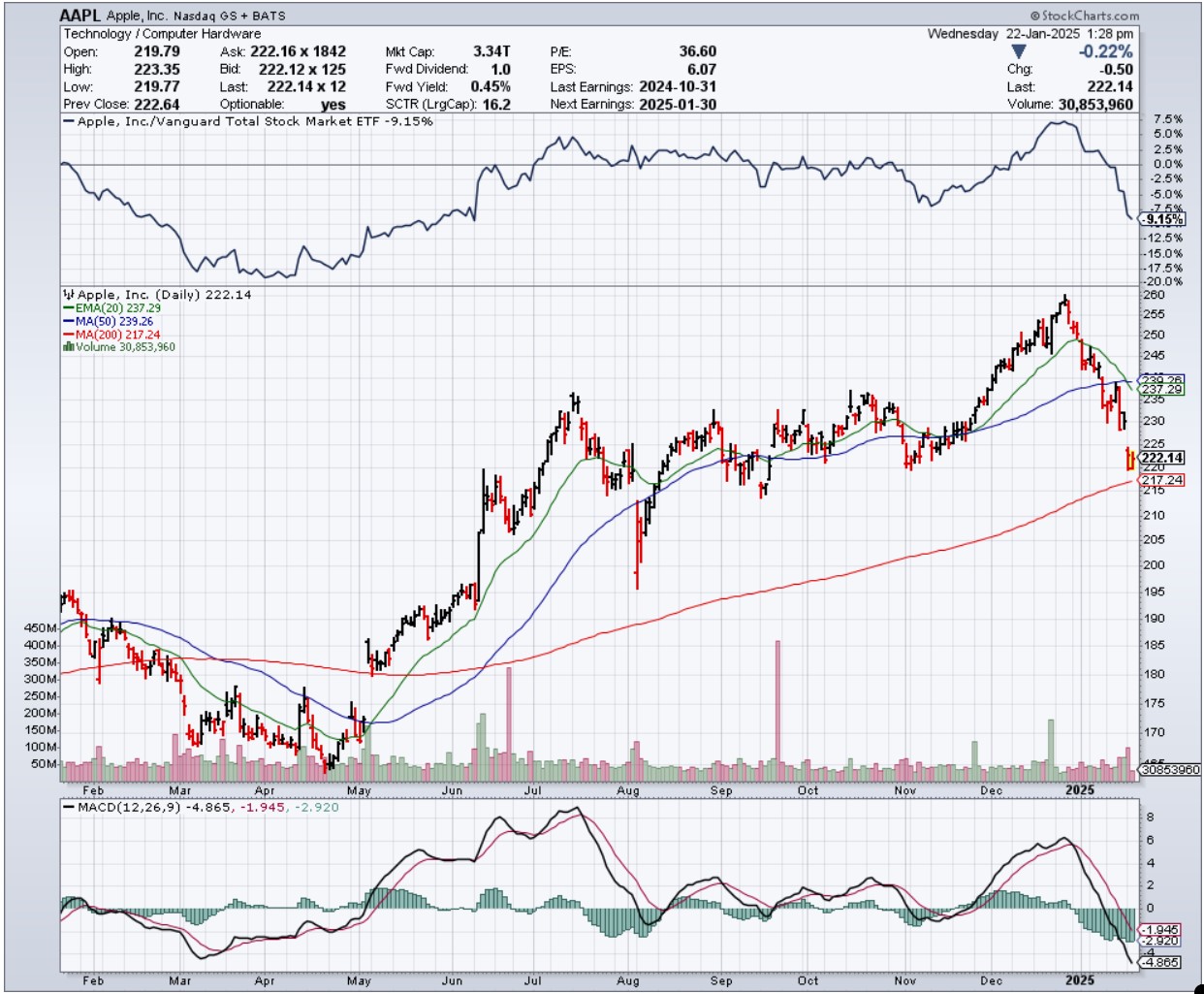

While analysts are one thing, technical traders only care about the stock charts. This is an area that should be showing just how much concern there really is about a bullish readout for tactical investors. Apple’s stock peaked at $260 in late-December and it looked like a perfect setup to become the first $4 trillion company. As more woes have been seen in China and with the iPhone demand, now its stock is down 15% and at $222 it has only about $5.00 more in support before taking out the 200-day moving average (at $217.24 today).

If that 200-day violation would occur, then the last areas of support were seen at $213/214 in September and $197/200 at the start of August. The chart below from StockCharts.com will show the one-year trading history.

Courtesy of StockCharts.com

DISCLAIMER

Tactical Bulls does not maintain any formal ratings or price target of its own on Apple. All ratings and price targets have been credited to the firms which issued those ratings and targets. This is not intended to be investment advice nor is it a recommendation to buy or sell any securities mentioned here or related to Apple. All investment decisions are the responsibility of each investor individually and those decisions should be made along with a financial advisor.

Categories: Investing