Stocks that sell off massively in a single trading session often find that it’s not a one-day event and then it’s over instantly. That whole Efficient Market Hypothesis just doesn’t work all that well. Companies with negative earnings reactions and adverse guidance surprises can end up in an investor tug of war for weeks or months after the bad news breaks. But what happens when the same stock that gets crushed one day comes roaring back just a day later?

This is when bullish investors have to decide whether they want to remain a long-term bull or just be a tactical bull. This week’s post-earnings reaction in Salesforce, Inc. (NYSE: CRM) could prove to be a win for tactical bulls and long-term bulls alike. The initial reaction was atrocious. Then the immediate recovery the following day took place on major volume and was so impressive that the long-term bull thesis doesn’t seem dead at all. That’s even acknowledging that there is an AI-vortex sucking up IT budgets.

SALESFORCE STOCK HISTORY

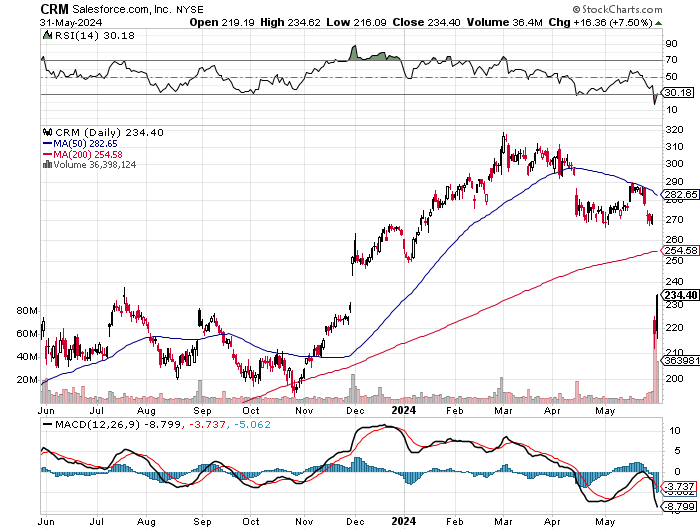

Salesforce’s stock had peaked above $318 at the start of March and had slid down to $271.62 before the earnings and guidance concerns. It appeared to be the case that $270 was strong support on multiple trading sessions ahead of earnings. Thursday’s reaction created a volume explosion of 66.8 million shares to drop nearly 20% all the way down to $218.01. That closing price was also about halfway through the same day trading range of $212.00 to $225.09.

Disaster! Right? No! Not for tactical bulls. Not for long-term bulls.

By closing in the middle of the daily range this gave no indication that the massive drop in a single day was going to be erased. That single day drop was a loss of well over $40 billion in market capitalization. But a recovery of 7.5% and a close at the highs of the day on Friday recaptured almost 40% of the total relative losses seen after the news.

Salesforce was on the way to being disgraced. It found itself becoming The Tactical Bull of The Week!

THE PACK OF LOSERS FOR THE WEEK

Salesforce closed down 16% for the last week. The reason this is being named the Tactical Bull of the Week is that Salesforce’s recovery was better than all other cloud and applications players as far as the proportion of losses recovered in a day. Here are the other large losers from this last week:

- MongoDB (MDB) -35.6%

- Nutanix (NTNX) -22.6%

- Workday Inc. (WDAY) -18.9%

- Dayforce Inc. (DAY) -18.6%

- Paycom Software (PAYC) -16.6%

- Paylocity (PCTY) -13.4%

- ServiceNow (NOW) -13.3%

- Snowflake (SNOW) -11.9%

Using two trading days to create near-term and long-term price movements is not the goal here. It is very possible, or even likely based on the technical chart damage, that CRM shares trade in a period of daily swings up and down as the summer trading months kick off here. Still, the longer-term stock chart for Salesforce looks to have significant support levels just above the $200 level. That kind of set up allows longer-term bulls and tactical bulls alike some confidence to either build or add to a position without taking crazy downside risk.

ANALYSTS TRIM TARGETS BUT STAY HIGHER

Wall Street analysts were quick to cut their price targets on May 30 after the Salesforce earnings news hit. Tactical Bulls tracked at least 15 analyst price target cuts on that day alone. Here is just a partial list of those price target cuts:

- Citi (Neutral) to $260 from $323

- Deutsche Bank (Buy) to $300 from $350

- JPMorgan (Overweight) to $300 from $310

- Morgan Stanley (Overweight) to $320 from $350

- Oppenheimer (Outperform) to $280 from $325

- Stifel (Buy) to $300 from $350

- TD Cowen ((Hold) to $285 from $330

- UBS (Neutral) to $250 from $310

- Wedbush (Outperform) to $315 from $325

It turns out that 10% revenue growth and a 3% bookings growth just aren’t good enough metrics for Salesforce investors after a large run from a year ago. Contracted revenue that is unrecognized was also up less than 10%.

The reversal of fortune on Friday could not have come at a more opportune time for tactical bulls and long-term bulls alike in Salesforce shares. Thursday’s 19.8% drop was the worst single-day drop in nearly 20 years. And nearly 40% of the one-day loss was recaptured in a single trading session.

THE NEW THREATS

Salesforce’s management team is facing multiple issues. The focus on other AI-alternatives in software and a portfolio of countless services is hard to keep up with when businesses are suddenly becoming more reserved on their IT budgets. These are some metrics that came into play:

- sales are taking longer to close

- some sales are being postponed

- sales end up being smaller than originally expected

- outside AI spending is crowding out other IT contracts

And we can all remember Salesforce calling out that new-hires working remotely just were not productive like seasoned workers away from the office.

Then came Friday’s gain of 7.5% back up to $234.44. Again, that is almost an instant 40% recovery of the greatest one-day loss in two decades. The S&P 500 gained just 0.9% and the Dow gained 1.6% on Friday. Sure, the lack of new inflation and Friday’s bullish move helped — but the Salesforce 7.5% surge was the largest percentage gain of all 30 Dow stocks by nearly 5 percentage points.

VOLUME & INFLOWS OF CAPITAL

With nearly another 36 million shares trading hands on Friday alone, this was a day where long-term bulls decided to add to their position and where tactical bulls looking for a bounce decided to get in for a ride. To prove that the bulls stuck with the stock and added to positions, the low of the day was $216.09 around 11:00 AM on Friday and the shares just marched steadily higher from there almost the entire day. It does take actual buying to drive share higher during the trading day. Closing at $234.44 was more than a $15.00 per share intraday gainer for investors who decided on Friday morning that Thursday’s massive sell-off was just too much.

A serious caveat exists here though. Salesforce shares are never considered dirt cheap to peers, and many of the macro headwinds starting to surface in recent weeks are unlikely to suddenly vanish. If a company is not spending a significant amount of time, effort and their IT-budget around artificial intelligence then the company’s senior technology officers are likely going to need new jobs working in non-profits or for the government. That may start to abate and return to the mean in time, but it’s unlikely entire departments are going to vote that AI-related spending has to be for the birds just around the corner.

THE CHART’s TEA LEAVES & CHICKEN BONES

The chart below is from StockCharts.com and it shows that CRM shares sharply violated the 200-day moving average. Technicians would say this is bad, but the reaction of the stock speaks louder than most chartists can make their case. Last October was the last time the 200-day moving average was violated to the downside, but that only lasted less than two weeks. Even with the stock recovering to $234.40 by Friday’s close, the 200-day moving average was still much higher at $254.58. This might leave some technical traders to believe that much more “selling to get anywhere close to even” is a likely scenario here.

Salesforce chart courtesy of StockCharts.com

Categories: Investing