2024 is now history and 2025 has begun. The S&P 500 rose by 23.3% and closed out at 5,881.63 in 2024. Investors are now looking to see what’s in store for 2025. With a new regime in Washington D.C., it turns out that businesses, analysts and strategists are almost universally more positive for 2025. The average strategist on Wall Street is calling for the S&P 500 to rise more than 12% in 2025.

Tactical Bulls has already looked over the worst performing large cap stocks of 2024. The goal there was to see if there are any hidden gems that may be great buying opportunities for value investors. That verdict remains to be seen. But…

There is something interesting about the top 20 winners of 2024 in the S&P 500 as 2025 kicks off. These stocks gained 75% to 300% in 2024 alone. What is so interesting looking ahead is that analysts on average are actually looking for gains on most of the top-winners again in 2025. And while those calls for upside are not anywhere close to calling for a repeat of the 2024 gains, many of the stock prices and 52-week highs are still handily under the consensus analyst price targets. So…

Tactical Bulls always advises against just looking at one analyst call as the sole reason to buy or sell a stock. Using the consensus analyst price target is often a better tool for determining how much implied upside might be in a stock. That said, even the consensus analyst price targets can greatly miss the mark. There are simply no guarantees nor assured outcomes in the stock market.

One issue to keep in mind is that none of the stocks mentioned in the top 20 winners of the S&P 500 were predicted to rise anywhere as much as they did in 2024. That is not unusual at all. Could you imagine an analyst at a reputable firm predicting 75% to 300% upside in S&P 500 and Dow stocks? And in just a year?

Some common features are seen in the big winners of 2024 looking into 2025. These generally have significant tailwinds and are showing growth over value. Some of these pay little or dividends. And some of the stocks are trading above their average analyst price target and some are trading close to their 52-week high. But…

Most of these top 20 S&P 500 stocks from 2024 are entering 2025 with stock prices which are still handily under their consensus analyst target prices. And some of the consensus price targets are also above the 52-week highs seen in 2024. And most of these stocks also sold off in December as that “Santa Rally” failed to materialize.

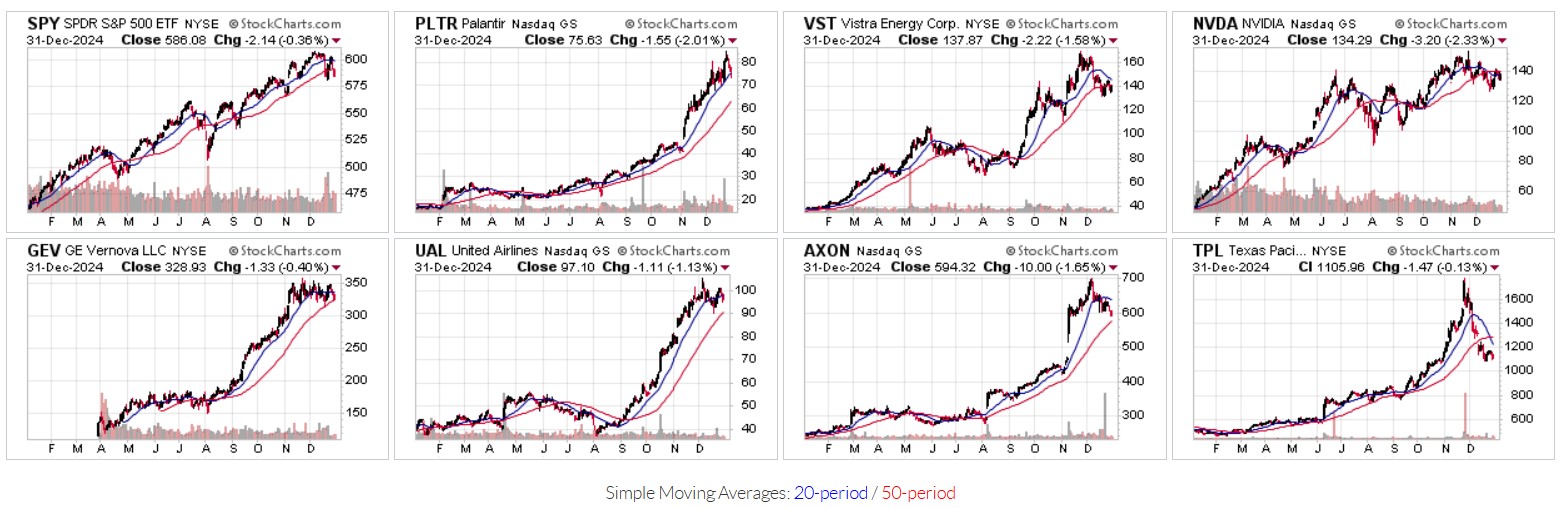

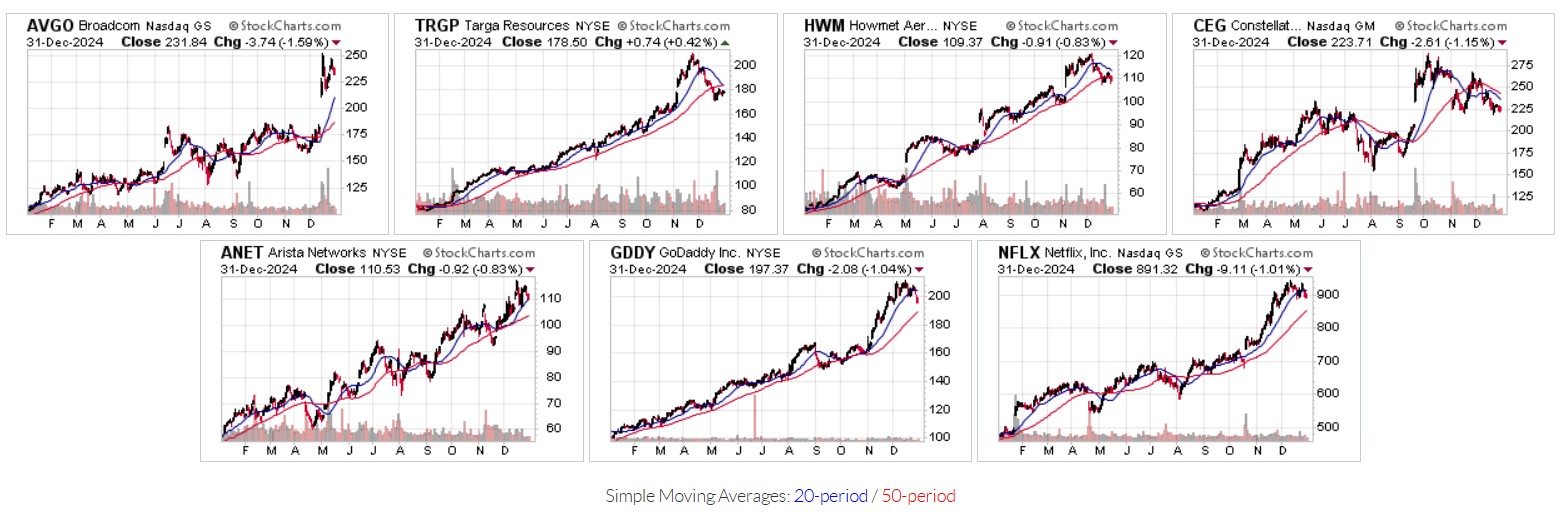

These top 20 stocks of the S&P 500 from 2024 have been shown with percentage gains in 2024 and the consensus (average) analyst price target from a Finviz screen of the S&P 500 using year-end prices. Also included is the current market cap and the 52-week high so investors could see if the stock closed the year out strong or not. And a “CandleGlance” one-year chart from StockCharts.com has been shown for each stock at the end of the review. And please read the disclaimer below so you don’t get tricked into thinking these are recommendations.

TOP 20 STOCKS OF THE S&P 500 IN 2024

The top 20 stocks have been posted below and without commentary. Please see the review of the charts at the end and the disclaimer.

Palantir Technologies Inc. (NYSE: PLTR) up 340% in 2024

Market Cap: $172 Billion

2024 Closing Price: $75.63

Avg. Target Price: $44.87

52-Week High: $84.80

Vistra Corporation (NYSE: VST) up 256% in 2024

Market Cap: $47 Billion

2024 Closing Price: $137.87

Avg. Target Price: $169.90

52-Week High: $168.87

NVIDIA Corporation (NASDAQ: NVDA) up 171% in 2024

Market Cap: $3.3 Trillion

2024 Closing Price: $134.29

Avg. Target Price: $173.18

52-Week High: $152.89

GE Vernova Inc. (NYSE: GEV) up 150% in 2024

Market Cap: $91 Billion

2024 Closing Price: $328.93

Avg. Target Price: $370.04

52-Week High: $357.09

United Airlines Holdings Inc. (NYSE: UAL) up 135% in 2024

Market Cap: $32 Billion

2024 Closing Price: $97.10

Avg. Target Price: $117.50

52-Week High: $105.09

Axon Enterprise Inc. (NASDAQ: AXON) up 130% in 2024

Market Cap: $45 Billion

2024 Closing Price: $594.32

Avg. Target Price: $610.77

52-Week High: $698.67

Texas Pacific Land Corp. (NYSE: TPL) up 114% in 2024

Market Cap: $25.4 Billion

2024 Closing Price: $1105.96

Avg. Target Price: $565.13

52-Week High: $1,769.14

Broadcom Inc. (NASDAQ: AVGO) up 108% in 2024

Market Cap: $1.08 Trillion

2024 Closing Price: $231.84

Avg. Target Price: $245.83

52-Week High: $251.88

Targa Resources Corp. (NYSE: TRGP) up 105% in 2024

Market Cap: $39 Billion

2024 Closing Price: $178.50

Avg. Target Price: $206.71

52-Week High: $209.87

Howmet Aerospace Inc. (NYSE: HWM) up 102% in 2024

Market Cap: $44 Billion

2024 Closing Price: $109.37

Avg. Target Price: $127.57

52-Week High: $120.71

Constellation Energy Corp. (NYSE: CEG) up 91% in 2024

Market Cap: $70 Billion

2024 Closing Price: $223.71

Avg. Target Price: $277.04

52-Week High: $288.76

Arista Networks Inc. (NYSE: ANET) up 88% in 2024

Market Cap: $139 Billion

2024 Closing Price: $110.53

Avg. Target Price: $114.46

52-Week High: $116.94

GoDaddy Inc. (NYSE: GDDY) up 86% in 2024

Market Cap: $28 Billion

2024 Closing Price: $197.37

Avg. Target Price: $202.87

52-Week High: $211.11

Netflix Inc. (NASDAQ: NFLX) up 83% in 2024

Market Cap: $381 Billion

2024 Closing Price: $891.32

Avg. Target Price: $846.44

52-Week High: $941.75

Deckers Outdoor Corp. (NYSE: DECK) up 82% in 2024

Market Cap: $31 Billion

2024 Closing Price: $203.09

Avg. Target Price: $203.90

52-Week High: $214.70

KKR & Co., Inc. (NYSE: KKR) up 78% in 2024

Market Cap: $131 Billion

2024 Closing Price: $147.91

Avg. Target Price: $169.33

52-Week High: $163.68

Royal Caribbean Group (NYSE: RCL) up 78% in 2024

Market Cap: $62 Billion

2024 Closing Price: $230.69

Avg. Target Price: $254.95

52-Week High: $258.70

Tapestry Inc. (NYSE: TPR) up 77% in 2024

Market Cap: $15.2 Billion

2024 Closing Price: $65.33

Avg. Target Price: $66.29

52-Week High: $66.47

Apollo Global Management Inc. (NYSE: APO) APO) up 77% in 2024

Market Cap: $93 Billion

2024 Closing Price: $165.16

Avg. Target Price: $182.94

52-Week High: $189.49

NRG Energy Inc. (NYSE: NRG) up 75% in 2024

Market Cap: $18.3 Billion

2024 Closing Price: $90.22

Avg. Target Price: $105.25

52-Week High: $103.14

DISCLAIMER

Tactical Bulls has already reminded its readers that no single analyst report or strategist report should ever be the sole basis to buy or sell a stock. And you have been warned that even consensus analyst price targets can greatly miss the mark. Any decision to buy or sell (or hold or short sell) is up to each investor and that decision should be made with a financial advisor. And just because a stock rose the year before, there are zero assurances that they will keep rising.

Tactical Bulls does not maintain any in-house price targets, nor does it maintain any formal ratings of its own for the stocks in this report. All price target data is from Finviz. The ratings and price targets of other firms may not be viewed in the same light by Tactical Bulls.

ONE-YEAR STOCK CHARTS

The following “CandleGlance” Charts are courtesy of StockCharts.com. They show a one-year move as of the end of 2025 and they include the 20-day and 50-day moving averages. A chart was also included for the SPDR S&P 500 ETF Trust (NYSEArca: SPY) for a comparison.

Categories: Investing