Tactical Bulls is featuring international markets which may potentially outperform the United States in 2025. Major stock market strategists are calling for another 8% to 10% gains for the S&P 500 in 2025, but some emerging and international markets may stand to significantly outperform the U.S. if the great investing and economic game plays out the way strategists are forecasting. India is certainly far from risk-free in 2025 but still finds itself in a strong position for 2025 and beyond. So, should tactical investors looking for outsized gains commit capital into investing in India?

First and foremost, the U.S. stock market is expensive by historical standards. U.S. stocks now account for well over 60% of the world’s total equity market valuations according to some reports. The world order is going to have to deal with a new regime and new rules after Donald Trump is sworn in as the 47th President of the U.S. And this new regime’s plans to cut government spending, keep taxes low, rekindle tariffs, and lower regulations will create some serious winners and some serious losers.

One of the most important things about investing is to remember that there are no guarantees at all that investors will be rewarded for their risk and for trying to outsmart the market. That said, India has a strong case for growth in 2025 and beyond even if it does have risks. Tactical investors are generally willing to invest anywhere and into any asset class where they feel their capital will be treated well. Now those same tactical investors have to decide if India will outpace China and its expected easing and stimulus set for 2025.

Two key ETFs are being featured before the data showing why India could be a great investor destination for 2025. The iShares MSCI India ETF (NYSEArca: INDA) has $10.5 billion in assets and its net asset value total return was last seen up 14% YTD. It has traded since 2012 and has risen about 200% from trough (about $20) to peak ($59.49) in that time. The iShares India 50 ETF (NYSEArca: INDY) has almost $1 billion in assets and its net asset value total return was up about 9% YTD on last look. INDY has traded since at least late-2009 and its trough (~$19) to peak (~$56) performance over time is roughly the same. Other funds and ADSs targeting India have been featured below.

Unlike China, India may skirt by a tad easier with targeted tariffs impacting U.S.-Indo trade and relations. Prime Minister Narendra Modi and Trump have already met previously, and two risks are there for 2025 and beyond — Trump has pointed to China and India and said “India charges a lot”… and Trump has thrown down the major tariff gauntlet about the BRIC nations (Brazil, Russia, India, China – plus partners) trying to form a basket that would replace the U.S. dollar as the global reserve currency for trade.

Let’s see what Wall Street and other global forecasters see in store for investors looking at India for 2025.

GOLDMAN SACHS IS VERY PRO-INDIA FOR 2025

Goldman Sachs Research sees India’s economy as relatively insulated against global shocks over the coming year, including on tariffs. The firm expects a GDP speed bump in 2025 with slower government spending and credit growth slowing but it sees India’s GDP rising strongly in the long term. India has favorable demographics compared to other large economic powerhouses and is considered to have stable governance at this time.

Our economists expect India’s economy to grow at an average of 6.5% between 2025 and 2030. Their 6.3% forecast for 2025 is 40 basis points below a consensus of economists surveyed by Bloomberg. The decelerated growth rate is, in part, due to fiscal consolidation and slower credit growth.

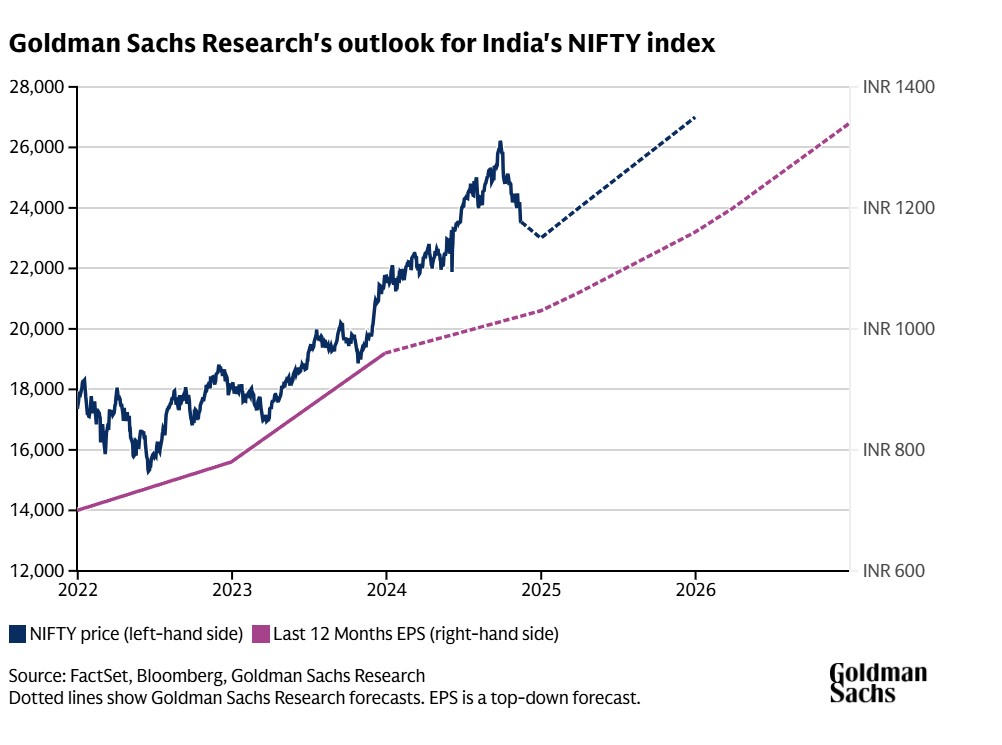

Indian equity markets are likely to keep performing strongly in the medium term, according to a separate report from Goldman Sachs Research. In the near term, though, slowing economic growth, high starting valuations, and weak earnings-per-share revisions could keep markets rangebound.

Our equity strategists expect the benchmark NIFTY index to reach 27,000 by the end of 2025 (versus ~24,500 on last look). They also forecast MSCI India earnings growth at 12% and 13% respectively for the calendar years 2024 and 2025 — lower than consensus expectations of 13% and 16%.

Below is a chart that Goldman Sachs published for its 2025 and longer-term equity market forecasts.

MORGAN STANLEY IS ALSO PRO-INDIA FOR 2025

Morgan Stanley has a note out calling for India to outperform its emerging market peers over 2025. The firm sees a structural rise in equity holdings on household balance sheets (more investors locally) and sees a higher global allocation to India (by the way, that’s the “tactical” nature of the call) as India’s index weighting rises.

While slower government spending can act as a drag, it is also expected to counter the localized inflation that should in-turn make growth better predictable and help raise valuations in its stock market. And any slowdown in the bull market in India would be considered a transient opportunity (also code for “tactical” opportunity).

A more detailed view of Morgan Stanley’s views also pointed out that the Nifty 50 has risen nearly 245% from its Covid-19 lows — and mid-cap and small-cap gains were more like 430% and 540%, respectively. Morgan Stanley also noted that previous bull markets have ended with higher market valuations (earnings multiple). That leaves substantial return on equity upside and a longer earnings growth cycle on the table.

BOFA SECURITIES SEES INDIA RISING TOO, BUT…

BofA’s equity strategists had a funny looking 6,666 target for the S&P 500 in 2025. They also set the target for the Nifty 50 Index at 26,500 by year-end. While that is a forecast gain of 9% or so in its 2025 target, BofA is more muted on investor inflow of funds and noted expensive valuation metrics in India.

With earnings growth expected to remain weak, BofA sees soft commodities, lower capital spending and a lagging credit growth weighing on the markets. Other U.S. policies on trade, immigration, fiscal spending and the good old-fashioned geopolitics influencing volatility in Indian stocks. It’s a higher forecast versus where the markets are in 2024, but it sounds bumpier and less robust than Goldman Sachs and Morgan Stanley.

THE GREAT MARK MOBIUS

Mark Mobius, who is considered by many (certainly by yours truly) as the “Father of Emerging Markets Investing.” He publishes his own views and his last focal point for India was published in late October-2024. His view at that time said:

Overall, I see long-term growth and exceptional potential in India, particularly in technology. I believe the country is well-positioned to become a global leader — if not the leader — in semiconductor production. For one, the demand here is enormous — India is one of the world’s largest markets. Besides, its relatively open economy means India can harness technology from key players worldwide. Also, India’s status as the world’s largest exporter of software has made it a base for numerous global semiconductor companies’ software divisions, which means it has a talent pool ready to support large-scale semiconductor manufacturing and development.

PM Modi also recently praised Mobius’ suggestion that global funds should invest at least 50% of their assets in the Indian stock market. And Mobius, since the U.S. election, has heavily favored investing into India versus China. And Mobius has also gone on record saying that Trump’s economic strategies could have a big impact on emerging markets — with India standing out as a winner — and that a second Trump presidency could create new growth opportunities for countries willing to adapt.

INDIA’s OVERALL BIG PICTURE

The CIA World Factbook is an incredible source of information for the present and future growth metrics of the world’s nations. India is now above 1.4 billion people, with well over a dozen major languages (Hindis is largest at 43.6%). Its two top religions are Hindu (79.8%) and Muslim (14.2%). Only 6.8% of the nation is age 65 and over — with 68.7% between 15 and 65 years old and 24.5% counted as 14 and under, and a median age of just 29.8 years. India’s Real GDP estimate for 2023 was $13.104 trillion, ranked third in the world; and GDP per capita’s estimated $9,200 for 2023 was ranked as #150 in the world.

It’s not just a story of peaches and roses. India has a very high poverty rate and high income inequality. The nation has also struggled perpetually with how to provide adequate infrastructure, proper health care and sanitation, and a historic difficulty to rise from one class to another. And for a weak infrastructure, India is very difficult to navigate logistically — crammed roads, packed trains, and a lack of affordable air transport for the masses. India is also heavily dependent on foreign nations (some quite unfriendly to the U.S.) to supply its oil and gas consumption which exponentially outweighs its own combined oil and gas production. India even imports more coal than it produces, and fossil fuels still made up 76.1% of total installed electricity generation capacity as of 2022.

The International Monetary Fund (IMF) is another strong source for global expectations and forecasts. Their view was for 2024 Projected Real GDP growth of 7.0%, and a recently adjusted outlook for 7% GDP growth in 2025.

The World Bank’s competing forecasts also had 2024 and 2025 pegged for 7% annual Real GDP growth. Its tables have not been adjusted since before November, but the World Bank also has GDP forecasts of 6.7% foe 2026 and for 2027. Inflation is also expected to keep cooling down, from 6.7% in 2023 to 5.4% in 2024 and 4.5% in 2025. By 2027, the World Bank expects just 4% inflation.

OTHER WAYS TO INVEST IN INDIA

Another ETF for India is the WisdomTree India Earnings Fund (NYSEArca: EPI) that focuses profitable companies in all ranges of market caps which are considered value investments also. It is small but has risen over 15% YTD.

India Fund Inc. (NYSE: IFN) is a closed-end fund worth more than $600 million and the fund’s performance has been negative with a -5% return YTD. This closed-end fund has been around since 1994, long before the arrival and proliferation of ETFs. Its performance is harder to calculate because it has paid out over $50 in dividends and capital returns over the last 20-year period or so.

India’s vast IT-services market… Infosys Limited (NYSE: INFY) is a $95 billion IT-services outfit from India with well over $18 billion in annualized revenues at this time. Wipro Ltd. (NYSE: WIT) is not that far behind with a $77 billion market cap. And then there is Cognizant Technology Solutions Corp. (NASDAQ: CTSH) worth about $40 billion that is U.S.-based but has very deep ties in India as most of its employees are in India. India has long been an IT-spending destination for U.S. companies and Western nations for cheaper IT-related services. How that all plays out in a world where the growth of AI can get out of control remains to be seen.

India’s big banks have ADSs too… ICICI Bank Ltd. (NYSE: IBN) has a $109 billion market cap and its performance was last seen at about 30% YTD. HDFC Bank Ltd. (NYSE: HDB) has a $167 billion market cap but its ADS in dollar-terms were negative at -2.2% YTD returns.

Finviz tracks 11 Indian ADSs that trade in the U.S. markets and these have a full snapshot and charts on each.

DISCLAIMER, WARNING & COMMON SENSE

As with all investment classes, investing in stocks in any country comes with risk and there are absolutely no assurances that the investments will be profitable. There could even be a substantial loss of capital. India has been a rapidly growing nation for decades and its economic history and political history have not always worked out well for international investors looking to profit on one of the world’s top growth centers for the future.

All figures and datapoints have been obtained from sources which are deemed reliable (direct sources and indirect sources), but there are no assurances that the figures used will remain accurate or relevant beyond the date of this report. Tactical Bulls has also not verified the figures presented by these outside sources.

Tactical Bulls does not have any formal ratings nor does it have any formal price targets on any of the stocks and ETFs mentioned in this report. All of the data and facts provided are for informational purposes only. This is in no way intended to be investment advice nor is it a recommendation to buy or sell any of the ETFs and stocks mentioned.

Categories: Investing