Regulated Utilities are supposed to be safe for investors during times of uncertainty. They have decades of operating history and wide moats that are nearly impossible for competition to come in. Regulated utilities are also supposed to represent a hedge against stock market volatility for investors looking for safety and income. There is a serious caveat here — utilities need for interest rates to remain stable, and lower rates are better than stable rates. It is quite rare for analysts to issue the equivalent of a “Sell” rating due to long-term performance and expectations that these businesses can stand up to almost any adverse business climate.

Eversource Energy (NYSE: ES) was initiated with an Underperform rating at Jefferies, and that is definitely the same as a “Sell: rating elsewhere. The firm’s $52 price target on Eversource was about 18% under the prior $63.67 closing price. And Eversource’s stock price didn’t like the rating either — its shares closed down 3.7% at $61.30 after this new rating.

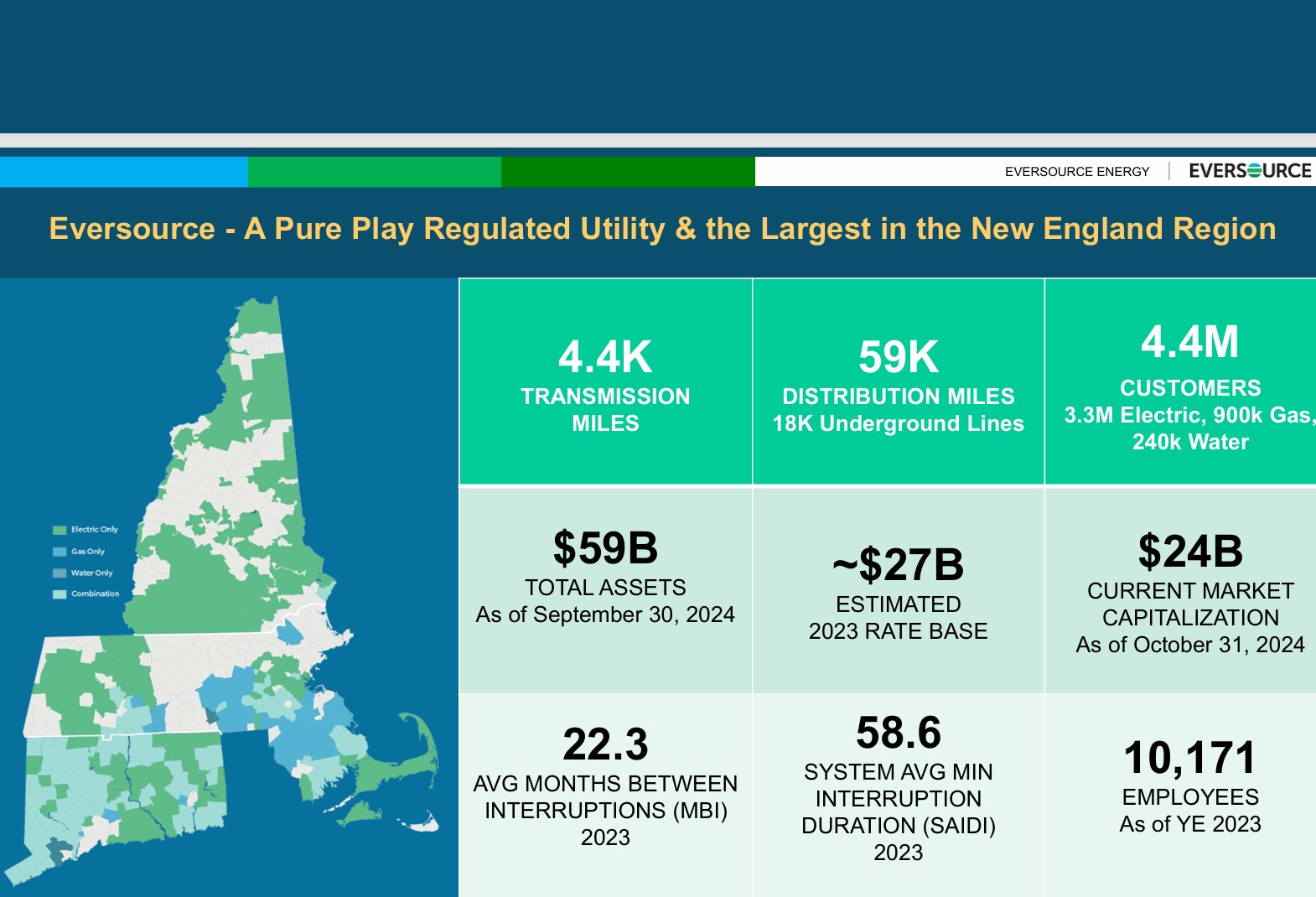

Eversource Energy (NYSE: ES) is not the highest yield of utilities in the S&P 500, but it is certainly a high dividend with above a 4.4% yield. Its earnings have suffered because of ongoing charges after completing the sale of its offshore wind and it is back at a core of being “a pure-play regulated pipes and wires utility.” Its operations are also in the New England area, and the state of Connecticut is not very friendly to requests for rate hikes.

Its consensus analyst price target was $73.29 in late-October — and that is now down to about $72 without the effects of a $52 price target in the mix. It has not even seemed to matter that Eversource has divested money-losing operations around offshore wind (or has it?) and it has not mattered that it has a 24-year consecutive streak of dividend hikes.

THE JEFFERIES “SELL” RATING

Again, it is unusual to see the equivalent of a “Sell” rating in regulated utilities. Then again, this situation is more unique than representative of the broader utilities sector in stocks because of diversification into water, gas and electric services.

Jefferies analyst Paul Zimbardo cited rate request risks and a credit rating risk (currently investment-grade) with a 4% to 5% base case for annual dilution. It also noted that it has no critical data center thesis like other utilities, and this also is shown to still have some lingering offshore wind construction risks that most investors thought was over.

Add it all up — that 24-year dividend hike string could be a risk down the road due to a much higher payout ratio ahead (to 73% from 63%). This also has current valuation concerns coming into play on top of a gas case that is going to act as an overhang for most of 2025.

It is also no secret that being a utility in Connecticut is one of the most challenging states to operate when it comes to asking for rate increases — and some Connecticut operations have to endure pressure for rate decreases and higher capital spending on projects despite a non-deflationary operating environment.

THE VALUATION

Eversource is a top New England utility player with about 4 million customers in electric, gas and water services. While it is diversified its operations and regulatory environments are not exactly the cheapest in the utility sector at all. It has varying coverage in Connecticut (149 towns), Massachusetts (140 towns) and New Hampshire 211 towns). Its stock is still down 30% from its 2022 levels and it pays out about 60% to 65% of non-GAAP earnings in dividends.

Eversource is valued at about a 20% discount in peer utility book values and is valued at about 14-times normalized expected earnings (non-GAAP EPS). Now we all know why — those future metrics might not be anywhere as cheap as they are today. Eversource has also been spending a larger percentage of its operating income on interest expenses along with a rising share count from equity issuance that has been an ongoing overhang.

PRIOR COVERAGE

Tactical Bulls featured Eversource among dividend stocks that were expected to win in 2025 with 4% to 8% dividend yields. Unfortunately, that was before the election and the expectation that interest rates would remain higher. These were the prior price targets issued elsewhere, all of which may be under review after these analysts see that a $52 price target has been issued:

- Mizuho ($73);

- Barclays ($72);

- BofA ($66);

- Scotiabank ($66);

- Evercore ISI ($69);

- BofA ($66);

- CFRA ($73);

- Morgan Stanley ($75);

- and Wells Fargo ($79).

CHARTS AS TEA LEAVES

Looking at the stock charts can be like trying to read tea leaves or chicken bones for many investors. That said, Eversource has been seeing higher lows for the last 15-month period — but longer-term the trend had been lower highs on rallies. Its peak was closer to $95 back in the 2019 to 2022 years. Then, after the Fed’s interest rate cycle began its shares went down and traded under $55 before its recovery this year. Trading down to $52 would represent a technical breakdown after it failed to reach $70 in the 2024 recovery. And interest rates are no longer predicted to be significantly lower in 2025. The chart can be found at StockCharts.com directly.

DISCLAIMER

All price targets and ratings in this report are from the firms named. Tactical Bulls does not have formal price targets or formal ratings on Eversource. Those opinions may also not represent the opinions held by Tactical Bulls.

This is not intended to be investment advice nor is it a recommendation to buy or sell securities. All investing decisions come with risk of financial losses and those decisions should be made along with the assistance of a financial advisor.

Categories: Investing