When new societal trends and technologies begin to explode it creates massive opportunities for the companies who are setting the trend or who have the most to benefit. NVIDIA Corporation (NASDAQ: NVDA) is currently the absolute leader in making the artificial intelligence technology. Demand is through the roof and NVIDIA has been able to continually expand its market opportunities. Gone are the days that NVIDIA is a graphics chipset maker for computers and video game systems.

It seems safe to assume, that even with a market capitalization of $2.3 trillion today, there remains huge upside if the company delivers half of what A.I. can offer the world in the decades ahead. There are of course absolutely no assurances that any of the upside comes to fruition. Wall Street history and the history on Main Street are littered with massive disappointments.

Wall Street analysts are continuing the age-old pattern of chasing the hottest company up and away with endless Buy recommendations. These come with higher earnings and revenue estimates, as well as higher and even aggressive analyst price targets than seemed possible a few months earlier. With NVIDIA’s earnings just two days away, many of these analysts have already raised their price targets ahead of the news. It’s time to make certain assumptions about what a much higher stock price, higher market cap and even higher analyst price targets will mean if the trends of the last year carry forward through 2024 and into 2025.

NVIDIA has become the poster child of a what can happen when a company is perfectly positioned as the leader of a trend while the stock market is in a raging bull market. With NVIDIA at nearly $950.00, its 52-week range is $298.06 to $974.00. So, in short, if you were lucky enough to buy within 5% of the lowest price over the last year you are up well over 200%.

WHAT UPSIDE AHEAD LOOKS LIKE?

For NVIDIA’s market cap of $2.33 trillion to rise to $3 trillion it implies a share price of about $1,223. Several Wall Street analyst price targets are already there or higher. Many are close. And if NVIDIA has another “beat and raise” and if it announces an expected stock split, then the imagination can only fathom how high Wall Street price targets will go.

What does a $2,000 share price imply? It may seem hard to fathom a $950 stock price rising to $2,000 if it has already risen 200% in the last year to a $2.33 trillion market cap. This is certainly not meant as a prediction that NVIDIA will rise to $2,000 soon or ever. The market will decide that. But one thing that is not hard to imagine in the early innings of A.I. changing the world NVIDIA shares may still have another 100% upside if things continue as they have.

A theoretical $2,000 share price is about 110% higher than the current $950 share price. If NVIDIA does get to $2,000 and if the share count remains the same (without effects of a split) then NVIDIA’s market capitalization would be a whopping $4.89 trillion.

THAT PESKY DISCLAIMER…

Please be advised that any price targets issued herein are all from outside sources. Tactical Bulls does not issue Buy or Sell recommendations and does not issue price targets on stocks. Analyst ratings and targets can change any day, particularly ahead of and after key earnings reports. It is also possible that some of the analyst price targets mentioned herein have already changed and are no longer accurate.

The investment community’s reaction to NVIDIA earnings has not yet been seen despite all the positive analyst reports. There is no reason that NVIDIA shares have to rise. NVIDIA’s stock could easily fall. Some investors would even welcome and expect profit taking. Other investors just want a straight-line up in their stock prices. If NVIDIA has disappointing news on earnings, guidance or technology delays, the stock price reaction to earnings could be sharply lower. After all, even without much change in recent weeks, it’s up 200% from a year ago.

All decisions to buy and sell any investment are the sole responsibility of each investor and reader individually. It would be wise to consult the advice of your investment advisor before making any decisions to buy or sell (even if they work for the firms below you know what they are likely to say).

MASSIVE PRICE TARGET HIKES

Below is a snapshot of some analyst price target changes since April 1, and investors should take note that many of the former price targets were already at or above the current $950 share price. In fact, some of those price targets were already above $1,000 without NVIDIA’s stock ever getting there.

- Barclays (Overweight) to $1,100 from $850 on May 20.

- Susquehanna (Positive) to $1,100 from $1,050 on May 20.

- Stifel (buy) to $1,085 from $910 on May 20.

- Robert W. Baird (Outperform) to $1,200 from $1,050 on May 20.

- Wells Fargo (Overweight) to $1,150 from $970 on May 14.

- HSBC (Buy) to $1,350 from $1,050 on May 10.

- Goldman Sachs (Buy) to $1,100 from $1,000 on May 7.

- UBS (Buy) to $1,150 from $1,000 on April 30.

- Raymond James (Strong Buy) to $1,100 from $850 on April 11.

- KeyBanc (Overweight) to $1,200 from $1,100 on April 8.

NEW & ASSUMED COVERAGE

There have been some coverage assumptions and changes at some firms as well. These are two of the more positive new coverage analyst calls:

- Jefferies was assumed in new/renewed coverage with a Buy rating and the old $780 target was reassigned at $1,200 on May 13.

- Evercore ISI started NVIDIA at Outperform on April 16 and assigned a $1,160 price target.

AND ALREADY-HIGH PRICE TARGETS…

NVIDIA has other price targets that remain firmly higher as well without any fresh changes since NVIDIA’s last round of dominating the news cycle:

- $1,400 at Rosenblatt.

- Oppenheimer at $1,100.

- BofA Securities at $1,100.

- Wedbush Securities at $1,000.

- Morgan Stanley at $1,000.

- Argus at $1,188.

- CFRA at $1,000.

THE STOCK CHART

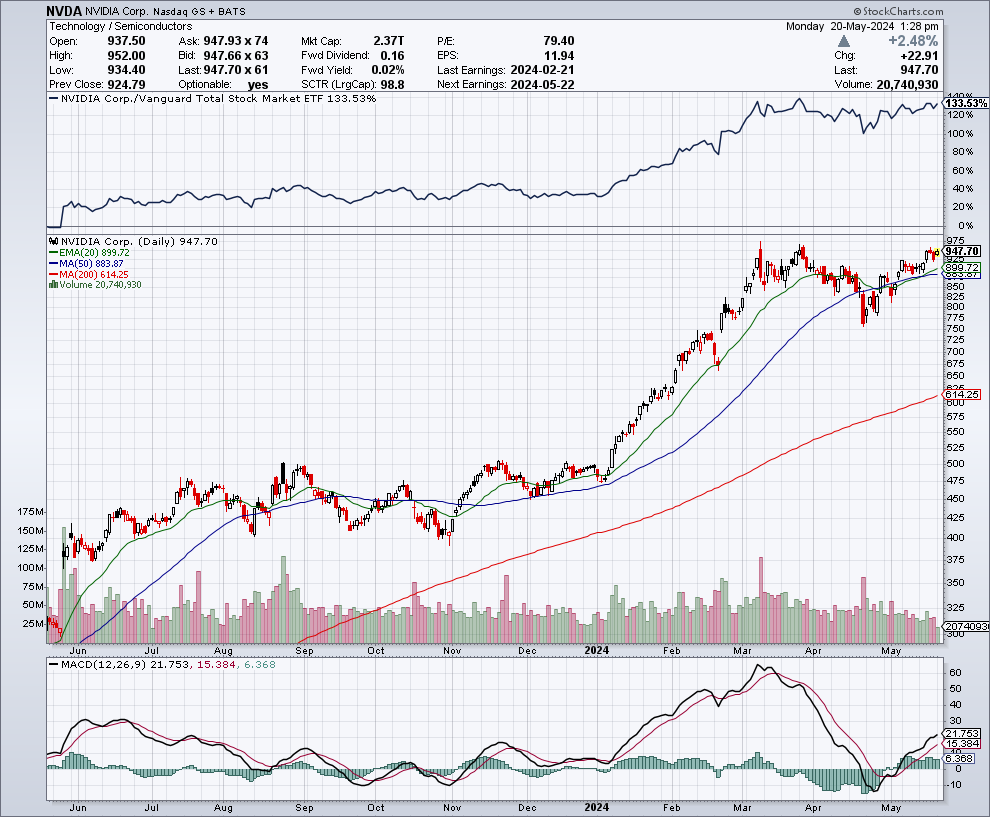

NVIDIA’s stock chart has not followed the “endlessly higher” trends in the weeks ahead of earnings, but a look at the one-year move should show just how dramatic the gains have been. This stock chart is courtesy of StockCharts.com for investors.

Again, all analyst ratings and price targets were issued by firms on Wall Street. Tactical Bulls does not issue price targets nor any official ratings. It is up to each investor to make their own decisions and to conduct their own research due diligence on any investment decisions.

Categories: Investing